Trent Ltd Stock Review: After a Wild Ride to ₹8,345, Is the Tata Retail Giant Ready to Rebound?

Explore the latest insights on Trent Ltd (NSE: TRENT) as it consolidates after a sharp fall from its 52-week high. Technical levels, investment outlook, and risk factors explained for 2025 investors.

Will TRENT Ltd regain its ₹8K+ glory? Dive into the full technical analysis and price trend now before making your next move.

📊 Overview:

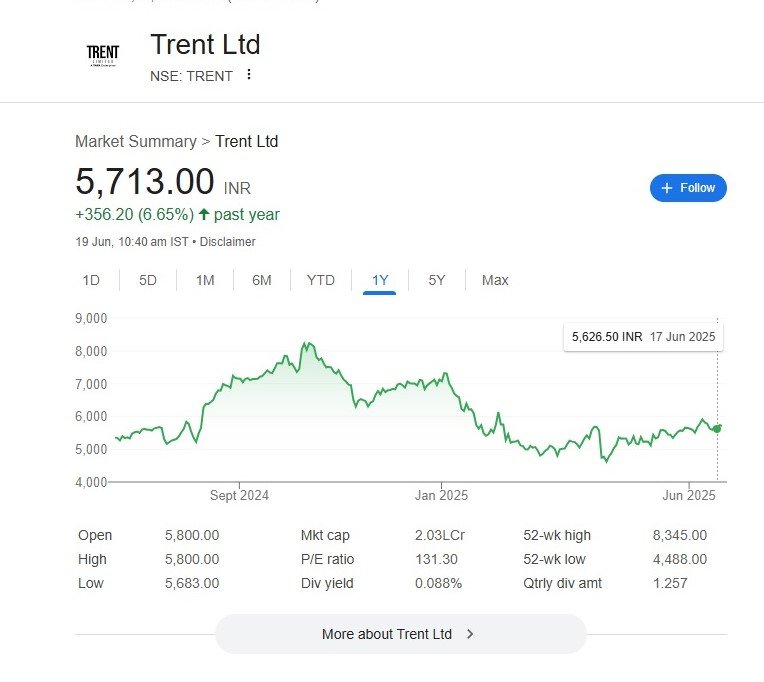

- Current Price (as of 19 June 2025): ₹5,713.00

- 1-Year Performance: +6.65% gain — modest growth with notable volatility.

- 52-Week Range: ₹4,488.00 – ₹8,345.00

- Market Cap: ₹2.03 Lakh Cr

- P/E Ratio: 131.30 — very high, suggests strong future growth expectations.

- Dividend Yield: 0.088% — minimal, growth-focused company.

📈 TRENT Ltd Chart & Price Action Analysis:

📌 Trend Summary:

- Peak: Around ₹8,345 in Sept 2024.

- Correction Phase: Sharp fall from peak to around ₹5,000 in early 2025.

- Recent Stability: Price appears to be consolidating between ₹5,500–₹5,800 since March 2025.

🔍 Support Levels:

- ₹5,000–₹5,100: Strong psychological and historical support (tested multiple times, Jan–April 2025).

- ₹4,488: 52-week low; critical long-term support.

📍 Resistance Levels:

- ₹6,000–₹6,200: Immediate resistance zone — price has struggled to break above it post-correction.

- ₹7,500–₹8,000: Heavy resistance from past highs, possible future target only if fundamentals support.

🧠 Interpretation & Recommendation:

✅ Positives:

- Backed by the Tata Group, giving strong credibility and investor confidence.

- Retail and fashion sector leader (owns Westside, Zudio) — benefits from consumer spending cycles.

- Post-correction consolidation indicates that investors are accumulating around current levels.

⚠️ Concerns:

- High Valuation (P/E > 130) — leaves little margin for error; future earnings must meet lofty expectations.

- Weak Dividend Yield — suitable for growth investors, not for income-focused portfolios.

- Volatility — Recent price history exhibits sharp fluctuations, indicating a high beta stock.

🛒 Investor Outlook:

| Type of Investor | Suggestion |

|---|---|

| Short-Term Traders | Accumulate in a staggered manner if bullish on the retail sector + Tata Group. Buy between ₹5,300–₹5,600 with a long horizon. Set stop-loss at ₹4,800. |

| Long-Term Investors | Wait for correction or a lower P/E entry point. Stock is is currently priced for perfection. |

| Value Investors | Wait for correction or a lower P/E entry point. Stock is currently priced for perfection. |

📌 Conclusion:

Trent Ltd (NSE: TRENT) shows promise with its strong retail footprint and brand backing, but its current high valuation and past volatility suggest caution. It is best approached with a long-term strategy and only after assessing sector performance and upcoming earnings.

Trent Ltd share price, TRENT stock analysis 2025, Tata retail stock, TRENT technical chart, TRENT support resistance, should I buy Trent stock, retail sector stocks India, Tata stocks 2025, NSE TRENT forecast, #TRENT #TrentLtd #TataStocks #RetailStocks #StockMarketIndia #InvestSmart

Recent Posts

- SEBI Tightens IPO Norms: Demat Mandate for Top Brass, Startup ESOP Relief, PSU Delisting Reforms & More

- “I May Do It, I May Not”: On Iran Strike Trump’s Cryptic Warning Fuels Global Uncertainty

- Mazagon Dock Share Analysis: Soaring 58% in a Year — Is This Defence Giant Ready for Its Next Breakout

- Mazagon Dock, BDL Lead Defence Stock Surge as Israel-Iran War Deepens Global Security Woes

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS