Anil Ambani Reliance Infrastructure Leads Sharp Decline in Group Stocks on August 26, 2024

Anil Ambani Reliance Infrastructure Leads Sharp Decline in Group Stocks on August 26, 2024

Mumbai, August 26, 2024 – Stocks of the Anil Dhirubhai Ambani Group (ADAG) experienced a significant decline today, with Reliance Power, Reliance Infrastructure, and Reliance Home Finance hitting their lower circuit limits. This sharp downturn follows a series of regulatory actions and market reactions that have shaken investor confidence in these companies.

Reasons Behind the Decline of Anil Ambani Reliance Infrastructure Group

The primary catalyst for the decline was the Securities and Exchange Board of India (SEBI) imposing a five-year market ban on Anil Ambani and 24 other entities, including former key officials of Reliance Home Finance Ltd (RHFL). This action stems from an investigation into alleged fund diversion at RHFL. SEBI’s order, issued on August 22, 2024, also included a ₹25 crore fine on Ambani and total penalties exceeding ₹625 crore on all involved entities.

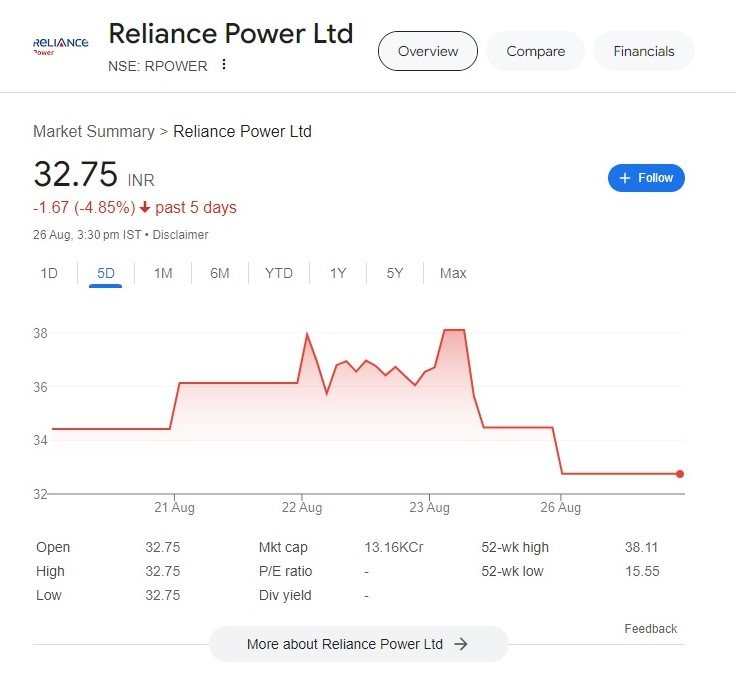

Real-Time Updates on Anil Ambani Reliance Infrastructure Group Share Prices and Trading Volumes

As of 10:35 AM IST, the share prices of the affected companies were as follows:

- Reliance Power: Fell 4.99% to ₹32.73.

- Reliance Home Finance: Dropped 4.93% to ₹4.24.

- Reliance Communications: Declined 4.92% to ₹2.32.

- Reliance Naval and Engineering: Decreased 4.62% to ₹2.27.

- Reliance Capital: Fell 4.46% to ₹11.79.

Trading volumes were significantly higher than average, indicating a rush of sell orders as investors reacted to the regulatory news.

Statements and Actions by Companies and Regulators

In response to the SEBI order, Reliance Power and Anil Ambani Reliance Infrastructure Group issued statements clarifying that the SEBI order has no direct impact on their operations, as they were not parties to the proceedings and that Anil Ambani had resigned from the board of directors. However, these reassurances did little to calm the market.

Market Sentiment and Broader Implications

The broader market sentiment surrounding Anil Ambani Reliance Infrastructure Group companies has been severely impacted. Financial experts suggest that the regulatory actions have eroded investor confidence, not just in the affected companies but in the group’s overall governance and financial practices. The allegations of fund diversion and the subsequent penalties have raised concerns about the stability and transparency of the group’s financial operations.

Expert Analysis and Implications for Investors

Financial analysts warn that the immediate outlook for Anil Ambani Reliance Infrastructure Group stocks remains bleak. The regulatory actions have created a cloud of uncertainty that is likely to persist in the near term. Investors are advised to exercise caution and closely monitor any further developments. The penalties and bans could lead to liquidity issues and further declines in stock prices.

Potential Recovery Strategies and Risks

Recovery strategies for Anil Ambani Reliance Infrastructure Group companies may include restructuring efforts, asset sales, and attempts to improve corporate governance. However, these measures will take time to implement and may not immediately restore investor confidence. The group also faces the risk of further regulatory scrutiny and legal challenges, which could exacerbate its financial woes.

Predictions for Future Performance

Based on current trends, the stocks of Anil Ambani Reliance Infrastructure Group- Reliance Power, Reliance Infrastructure, and Reliance Home Finance are expected to remain under pressure. The market will likely continue to react negatively to any news related to regulatory actions or financial instability within the group. Analysts predict that unless there are significant positive developments, such as successful restructuring or favourable legal outcomes, the downward trend may persist in the coming days.

This article provides a comprehensive overview of the significant decline in Anil Ambani Group stocks on August 26, 2024, highlighting the reasons behind the decline, real-time updates on share prices, market sentiment, expert analysis, and potential recovery strategies. Investors are advised to stay informed and cautious as the situation evolves.

More Articles

Zydus Share Price Tumbles After Controversial Sterling Biotech Acquisition

Nvidia and OpenAI Hit with Lawsuit Over Alleged Unauthorized Use of YouTube Videos for AI Training

Reliance Power Share Price Soars: Anil Ambani-Owned Stock Hits Upper Circuit, What’s Next?

Elon Musk to Join Trump’s Cabinet? A Bold Move That Could Transform Tech and Policy!

Technical Glitches Mar Trump Musk Interview, Sparking Meme Frenzy and Online Debate

Sena Leader’s Drunk Son Allegedly Driving BMW in Fatal Mumbai Accident: Sources

Rahul Gandhi: The Controversial Political Leader

Linguistic Diversity Shines: MPs Take Oath in Sanskrit, Hindi, and Other Languages

Om Birla Re-Elected as Lok Sabha Speaker: A Milestone of Bipartisan Unity

Asaduddin Owaisi’s Controversial Oath Sparks Debate on His Integrity in Parliament

Bhartruhari Mahtab Appointed as Pro-Tem Speaker for the 18th Lok Sabha: A Key Leadership Role

Hajj Deaths Toll Mounts as Hajj Pilgrims Suffer Amidst Extreme Heat and Poor Conditions

PM Modi Celebrates International Yoga Day in Srinagar

Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround – News 24 Media

Raymond Group Stocks Jump Over 8.5% to Set New High:

Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Discover more from

Subscribe to get the latest posts sent to your email.

5 COMMENTS