Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Let’s dive into the details of the Ixigo IPO. As an investor, it’s essential to understand the company’s background, financials, and potential risks. Here’s a comprehensive overview:

Ixigo IPO Details:

- Company: Le Travenues Technology Ltd (operates Ixigo)

- IPO Size: ₹740.10 crores

- Issue Type: Book Built Issue

- Price Band: ₹88 to ₹93 per share

- Issue Dates: June 10, 2024, to June 12, 2024

- Listing Date: Tentatively set for June 18, 2024

- Lot Size: 161 shares (minimum application)

- Total Issue Size: 79,580,900 shares

Ixigo Company Overview:

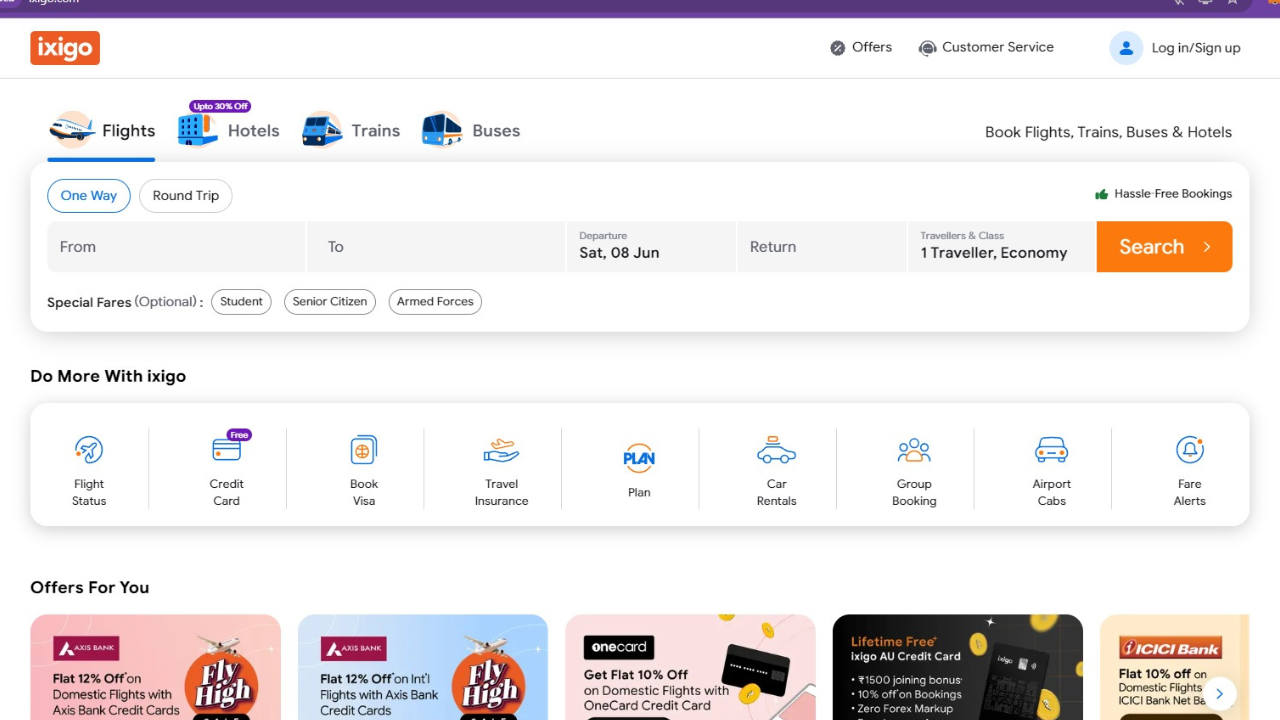

- Ixigo is an online travel agency (OTA) that enables travellers to book flights, trains, buses, and hotels.

- It boasts 83 million monthly active users across its apps and has been a fast-growing OTA in terms of app downloads.

Financial Performance of Ixigo:

- Net profit for fiscal 2023: ₹234 million ($2.9 million)

- Revenue from operations (fiscal 2023): ₹5 billion ($60 million)

- Net profit (9 months ending Dec 2024): ₹657 million ($7.9 million)

- Revenue (9 months ending Dec 2024): ₹4.9 billion ($59 million)

Pros:

- Profitability: Ixigo is a rare profitable tech startup in the Indian market.

- Resilience: Despite the pandemic, it has shown strong growth.

- Large User Base: High app usage and downloads.

- Diverse Services: Covers various modes of transportation and accommodation.

Cons:

- Competition: The OTA industry is competitive.

- Dependency on IRCTC: Relies heavily on Indian Railways bookings.

- Tech Vulnerabilities: Risks related to technology and data security.

Use of IPO Proceeds:

- Working capital, investment in technology, data science, and inorganic growth.

Remember, always conduct thorough due diligence before investing. Consult a financial advisor and assess your risk tolerance

More Articles

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Lucrative PSU Stocks: Public Sector Undertakings in India Reap Rewards from Government Policies

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Ride into the Future with Royal Enfield’s Electrifying 2024 Lineup

Top 10 Inverter Air Conditioners in India: Unmatched Cooling and Energy Savings

Vladimir Putin AI Deepfake Film Makes Waves at Cannes, Sells Big

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Paytm News- in Turmoil: COO Bhavesh Gupta’s Resignation Adds to the Storm – Latest Updates

REC Share Price Skyrockets: Q4 FY’24 Net Profit Soars to New Heights!

Arvind Krishna: Architecting IBM’s Future and Leading Industry Transformation

Discover more from

Subscribe to get the latest posts sent to your email.

23 COMMENTS