Yes Bank Limited Stock: A Comprehensive Analysis of Exciting Prospects and Ambitious Price Targets

Yes Bank Limited Stock: A Deep Dive into Prospects and Price Targets

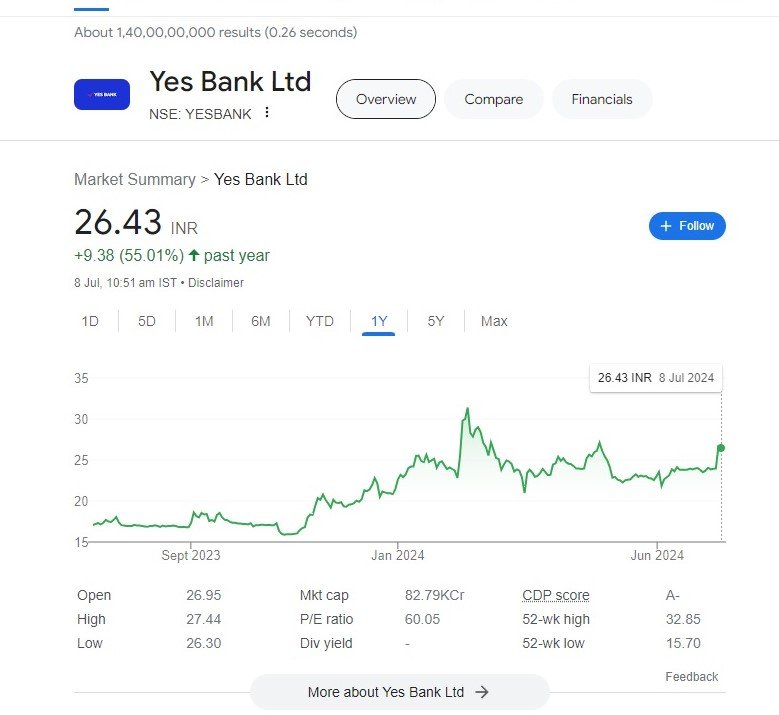

Published on July 8, 2024

Introduction

Yes Bank Limited, a prominent private sector lender in India, has recently caught the attention of investors with an impressive 11% jump in its share price following strong Q1 results for the fiscal year 2024. In this research-based article, we’ll delve into the factors driving Yes Bank’s performance, analyze its prospects, and discuss mid-term and long-term price targets.

Why the Surge in Yes Bank Limited?

- Robust Asset Quality:

- Yes Bank Limited’s asset quality has shown remarkable improvement. The bank’s gross non-performing asset (GNPA) ratio fell to 2%, indicating healthier loan portfolios.

- This reduction in bad loans has boosted investor confidence and contributed to the recent stock rally.

- Low Credit Costs:

- Yes Bank Limited’s credit costs have remained under control. Lower provisioning for bad loans has positively impacted its profitability.

- Investors appreciate the bank’s prudent risk management practices.

- Loan Book Growth:

- Yes Bank’s loan book, especially in the MSME (Micro, Small, and Medium Enterprises) and corporate segments, has expanded.

- A growing lending business is a positive sign for the bank’s future revenue.

Short-Term Outlook of Yes Bank Limited

- Yes Bank’s share price currently hovers around ₹27.04 apiece. Experts suggest that it may touch ₹32 ahead of the Q1 results for 2024.

- Yes Bank Limited’s profitability is expected to remain steady, and its asset quality remains healthy.

- Investors who already hold Yes Bank shares are advised to continue holding, anticipating potential gains.

Long-Term Price Targets

- Technical Analysis Perspective:

- Technical analyst Prakash Gaba believes that if one holds Yes Bank shares for a five-year horizon, stellar profits are possible.

- The stock needs to close above ₹30 on a monthly timeframe for a breakout.

- Once that happens, the stock could potentially reach ₹100, although this may take five years.

- Other Analysts’ Views:

- Various forecasts provide different price targets:

Potential Risk analysis for investment in Yes Bank Limited

- Asset Quality Concerns:

- Yes Bank Limited has faced challenges related to its asset quality in the past. Non-performing assets (NPAs) and bad loans can impact the bank’s profitability and stability.

- Persistent concerns over asset quality may affect investor confidence.

- Governance Issues:

- The bank has grappled with governance issues, which have eroded investor confidence and tarnished its reputation.

- Transparency and effective management are crucial for any financial institution, and Yes Bank’s history raises questions in this regard.

- Regulatory Uncertainties:

- Regulatory changes or interventions can significantly impact a bank’s operations and financial health.

- Investors should closely monitor regulatory developments and their potential effects on Yes Bank.

- Perpetual Bonds Risk:

- Yes Bank Limited issued perpetual bonds, which are a form of debt with no fixed maturity date.

- When the issuer faces financial difficulties (as Yes Bank did during its crisis), redeeming these bonds becomes unlikely, and finding buyers in the secondary market becomes challenging.

- Financial Performance and Cash Flow:

- Yes Bank Limited’s financial performance, including net interest income (NII) and profitability, has fluctuated.

- Investors should assess the bank’s ability to generate consistent earnings and manage liquidity.

- Valuation and Risk-Reward Ratio:

- Yes Bank’s valuation may imply a poor free cash flow yield, which could be a concern for potential investors.

- Consider the risk-reward ratio before making investment decisions.

Conclusion

Yes Bank Limited’s recent performance reflects positive trends, but investors should consider both short-term gains and long-term potential. While the technical outlook is optimistic, it’s essential to monitor the bank’s financial health, business growth, and external factors. As always, prudent investment decisions require thorough research and a clear understanding of risk factors.

More Articles

Sena Leader’s Drunk Son Allegedly Driving BMW in Fatal Mumbai Accident: Sources

Rahul Gandhi: The Controversial Political Leader

Linguistic Diversity Shines: MPs Take Oath in Sanskrit, Hindi, and Other Languages

Om Birla Re-Elected as Lok Sabha Speaker: A Milestone of Bipartisan Unity

Asaduddin Owaisi’s Controversial Oath Sparks Debate on His Integrity in Parliament

Bhartruhari Mahtab Appointed as Pro-Tem Speaker for the 18th Lok Sabha: A Key Leadership Role

Hajj Deaths Toll Mounts as Hajj Pilgrims Suffer Amidst Extreme Heat and Poor Conditions

PM Modi Celebrates International Yoga Day in Srinagar

Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround – News 24 Media

Raymond Group Stocks Jump Over 8.5% to Set New High:

Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Lucrative PSU Stocks: Public Sector Undertakings in India Reap Rewards from Government Policies

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Discover more from

Subscribe to get the latest posts sent to your email.

3 COMMENTS