Sun Pharmaceutical Industries Ltd: A Comprehensive and Promising Investor Analysis with Exciting Opportunities

Sun Pharmaceutical Industries Ltd: A Comprehensive Analysis for Investors

Introduction

Sun Pharmaceutical Industries, a leading Indian multinational pharmaceutical company, has played a pivotal role in researching, producing, and distributing Covid-related therapies and vaccines. While the industry has emerged stronger due to its pandemic response, it now faces a crossroads of challenges and opportunities. In this article, we delve into Sun Pharma’s stock prospects, financial health, historical performance, and price targets, while also highlighting key risks for investors.

Sun Pharmaceutical Industries Ltd Stock Prospects

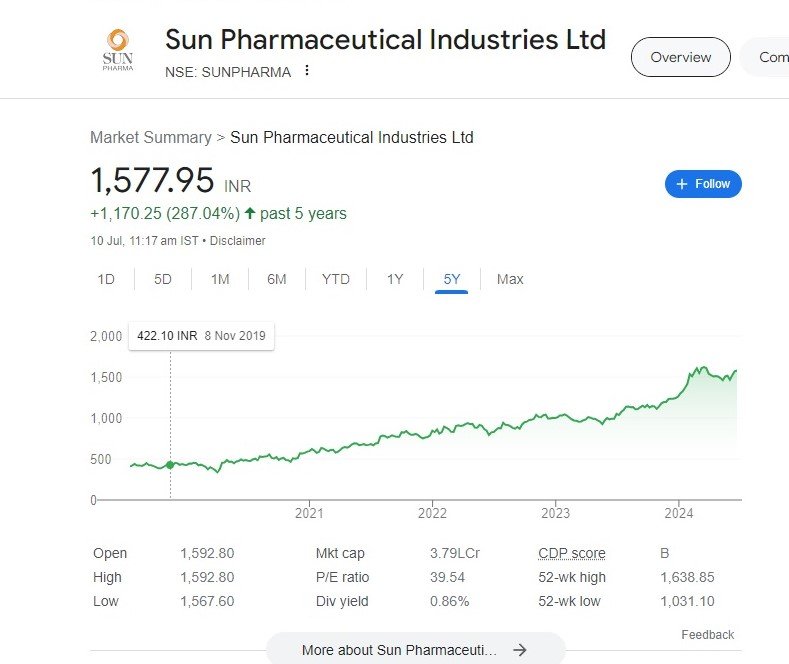

Sun Pharma’s stock performance has been noteworthy over the past years. Let’s explore some key metrics:

- Recent Stock Performance:

- As of the latest data, Sun Pharmaceutical Industries Ltd’s stock closed at ₹1,568.4, with a 6-month beta of 0.9173, indicating lower volatility compared to the market average.

- Over the past month, the stock showed a positive trend, with a 1-month return of 4.08%.

- However, the 3-month return was -2.52%, reflecting recent fluctuations.

- Financial Health:

- Sun Pharmaceutical Industries Ltd’s financials reveal a strong position. Its market capitalization stands at ₹3,73,792 crore.

- The price-to-earnings ratio (PE) is 39.03, and earnings per share (EPS) is ₹39.91.

- The company’s net profit margin is 22.15%, and EBITDA is ₹30.80 billion.

Short-Term and Long-Term Price Targets

- Short-Term (achieved)

- Analysts project a target price of around ₹1,567.78, representing an upside of 3.09% from the current price.

- Sun Pharmaceutical Industries Ltd’s focus on mergers, acquisitions, and new therapies may drive short-term growth.

- Long-Term (2026-2030):

- Considering the industry’s growth potential, Sun Pharmaceutical Industries Ltd’s stock price prognosis for 2029 is ₹2,693.31.

- Investments in cell and gene therapies, along with strategic partnerships, could contribute to long-term gains.

Risks and Caution

Investors must be aware of the following risks:

- Patent Cliff: Sun Pharmaceutical Industries Ltd faces the impending patent cliff, risking market exclusivity for top-selling drugs. Losses estimated at $200 billion may impact branded drug sales.

- Regulatory Challenges: Legal liability, product liability, and compliance risks are inherent in the pharmaceutical industry.

- Technological Innovations: Keeping pace with innovations is crucial for sustained growth.

- Business Model Shifts: Companies are reevaluating portfolios, leading to spin-offs and divestitures.

Conclusion

Sun Pharma’s stock prospects remain promising, but investors should exercise caution. Diversification, thorough research, and risk management are essential for successful investment decisions. As the industry evolves, Sun Pharma’s strategic moves will shape its future trajectory.

Remember, investing involves risks and professional advice is recommended. Always stay informed and adapt to changing market dynamics.

Disclaimer: This article provides information and analysis based on available data as of the publication date. Investors should conduct their research and consult financial advisors before making investment decisions.

More Articles

Flipkart-Backed Truck Aggregator BlackBuck Excitingly Files for IPO, Targeting ₹550 Crore

Tata Power Company Limited: A High-Voltage Rising Star in the Stock Market

Yes Bank Limited Stock: A Comprehensive Analysis of Exciting Prospects and Ambitious Price Targets

Sena Leader’s Drunk Son Allegedly Driving BMW in Fatal Mumbai Accident: Sources

Rahul Gandhi: The Controversial Political Leader

Linguistic Diversity Shines: MPs Take Oath in Sanskrit, Hindi, and Other Languages

Om Birla Re-Elected as Lok Sabha Speaker: A Milestone of Bipartisan Unity

Asaduddin Owaisi’s Controversial Oath Sparks Debate on His Integrity in Parliament

Bhartruhari Mahtab Appointed as Pro-Tem Speaker for the 18th Lok Sabha: A Key Leadership Role

Hajj Deaths Toll Mounts as Hajj Pilgrims Suffer Amidst Extreme Heat and Poor Conditions

PM Modi Celebrates International Yoga Day in Srinagar

Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround – News 24 Media

Raymond Group Stocks Jump Over 8.5% to Set New High:

Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS