SEBI Launches Aggressive Crackdown on F&O Mess: 7 Crucial Measures to Shield Retail Traders

SEBI Cracks Down on F&O Market Mess: 7 Bold Measures to Safeguard Retail Traders

Introduction

To restore order and protect retail traders, the Securities and Exchange Board of India (SEBI) has taken decisive action against the chaos prevailing in the F&O market. With 92.5 lakh retail traders and proprietorship firms suffering trading losses amounting to a staggering Rs 51,689 crore in FY24, SEBI has released a consultation paper proposing crucial measures. These measures aim not only to enhance investor protection but also to promote overall market stability.

Background

The F&O market, known for its complexity and volatility, has witnessed irregularities and speculative frenzy. Recent incidents have underscored the need for regulatory intervention. Youngsters, drawn by the allure of high returns, have increasingly engaged in derivative trading, sometimes risking their household savings. SEBI’s move comes at a critical juncture, addressing issues that have plagued the market.

SEBI’s Crackdown

So, what exactly is SEBI doing to clean up the F&O mess? Let’s dive into the specifics:

- Rationalization of Options Strikes:

- SEBI proposes to rationalize existing strike price introduction methodology. Strike intervals will be uniform near the prevailing index price (around 4% around the prevailing price) and will widen as strikes move away from that price (approximately 4% to 8%).

- Upfront Collection of Options Premium:

- To prevent undue intraday leverage and discourage risky practices, SEBI suggests mandating upfront collection of options premiums from buyers.

- Removal of Calendar Spread Benefit on Expiry Day:

- Given the skew in volumes on expiry days and associated liquidity risks, SEBI will no longer provide margin benefits for calendar spread positions involving contracts expiring on the same day.

- Intraday Monitoring of Position Limits:

- SEBI will monitor position limits for index derivative contracts intraday in response to evolving market dynamics. This ensures timely adjustments and aligns with technological advancements.

- Minimum Contract Size:

- The minimum value of derivatives contracts will increase from the current Rs 5-10 lakh to Rs 15-20 lakh in the first phase and Rs 20-30 lakh in the second phase.

- Rationalization of Weekly Options:

- SEBI aims to streamline weekly options contracts, ensuring they adhere to a single benchmark.

Expert Opinions

Market experts and analysts have weighed in on SEBI’s actions. While some applaud the move as necessary for market integrity, others raise concerns about potential liquidity impacts and the need for careful implementation. The debate continues, but one thing is clear: SEBI’s measures are a significant step toward restoring order.

Impact on Retail Traders

Retail traders stand to benefit significantly from these measures. Enhanced stability, reduced speculative excesses, and better risk management will create a safer trading environment. As SEBI tightens the reins, retail participants can expect a more level playing field.

Future Outlook

SEBI’s crackdown sets the tone for the future. It signals a commitment to fairness, transparency, and investor protection. Traders should stay informed about further regulatory changes and adapt their strategies accordingly.

Conclusion

In summary, SEBI’s intervention is not just about rules and regulations; it’s about safeguarding retail traders’ dreams and hard-earned money. As the F&O market evolves, these measures will shape its trajectory, ensuring a more resilient and equitable landscape.

Call to Action

Stay informed!

More Interesting Articles

SEBI Unveils the Truth About Intraday Trading: Hidden Risks, New Regulations, and Investor Impact

Ola Electric IPO: Retail Subscription Opens August 2, Valuation Soars to $4.4 Billion

KPIT Share Price Soars: In-Depth Analysis of Recent Surge and Promising Investment Potential

Nifty & Sensex Plunge on Budget Announcements, Rebound Strongly: Key Insights for Investors

Union Budget 2024: Nirmala Sitharaman Unveils Bold Vision for India’s Future

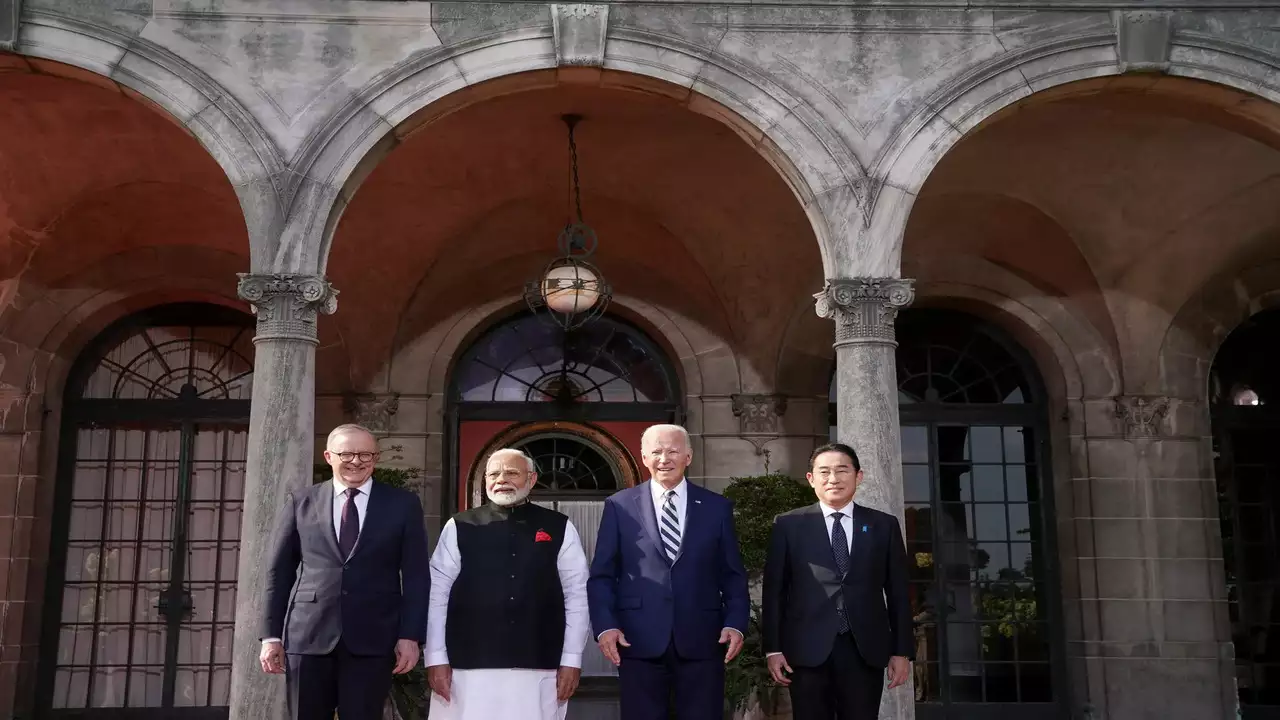

PM Modi Urges Urgent Unity and Constructive Debate Ahead of Crucial Budget Session

Bangladesh’s Shoot-on-Sight Order Amid Mounting Student Protests: A Deepening Crisis

Aishwarya Rai Bachchan and Abhishek Bachchan: Addressing Rumors of Rift and Separation

Hardik Pandya Divorce: Cricketer and Natasa Stankovic Announce Split After Four Years of Marriage

Tragic Loss: Travel Influencer Aanvi Kamdar Falls to Her Death in Gorge Accident

Supreme Court Upholds Maintenance Rights for Divorced Muslim Women Under Section 125 CrPC

Sena Leader’s Drunk Son Allegedly Driving BMW in Fatal Mumbai Accident: Sources

Rahul Gandhi: The Controversial Political Leader

Linguistic Diversity Shines: MPs Take Oath in Sanskrit, Hindi, and Other Languages

Om Birla Re-Elected as Lok Sabha Speaker: A Milestone of Bipartisan Unity

Asaduddin Owaisi’s Controversial Oath Sparks Debate on His Integrity in Parliament

Bhartruhari Mahtab Appointed as Pro-Tem Speaker for the 18th Lok Sabha: A Key Leadership Role

Hajj Deaths Toll Mounts as Hajj Pilgrims Suffer Amidst Extreme Heat and Poor Conditions

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS