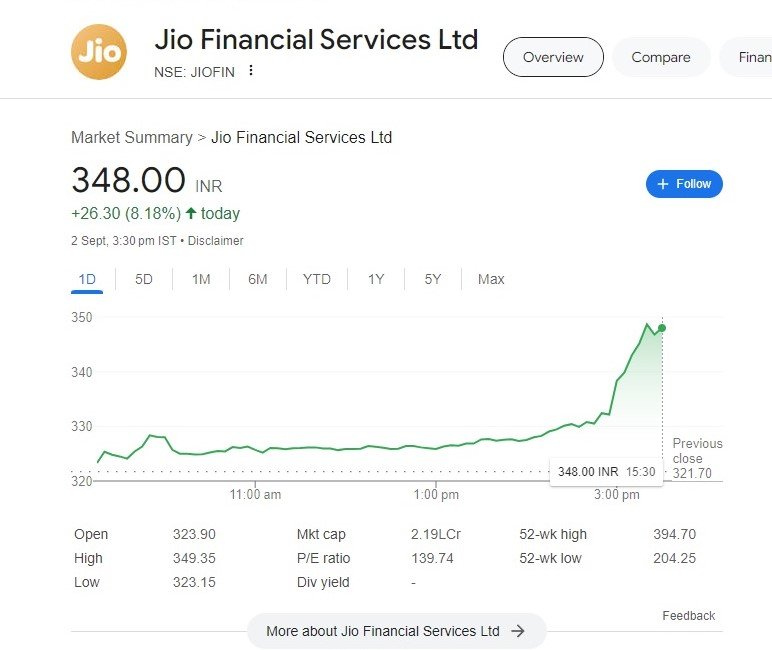

Jio Finance Share Price Soars 9%: Will Jio Financial Services Break the Consolidation Zone?

Mumbai, September 2, 2024 – Jio Financial Services (JFS) made headlines today as its shares surged by an impressive 9%, reflecting renewed investor confidence in the financial arm of the Reliance Group. This uptick comes amidst a broader consolidation phase, raising questions about whether the stock is poised to break out of its current zone and establish a new upward trajectory.

A Closer Look at Jio Finance Share

As of today’s close on the Bombay Stock Exchange (BSE), JFS exhibits a price-to-equity (P/E) ratio of 662.06. This high P/E ratio, significantly above the industry average, indicates that investors are betting heavily on the company’s future growth prospects. However, it also suggests that the stock may be overvalued at its current level, a factor that could contribute to the ongoing consolidation.

The stock’s price-to-book (P/B) value stands at 8.37, further highlighting the premium at which it is trading compared to its book value. This premium can be attributed to the market’s expectation of Jio Financial leveraging its parent company’s vast ecosystem to drive future growth.

Earnings per share (EPS) for JFS are reported at 0.49, which is modest considering the stock’s valuation. This metric indicates that while the company is profitable, its current earnings are not yet substantial enough to justify its high valuation, making the stock’s performance heavily reliant on future growth expectations.

The return on equity (RoE) stands at 1.26%, a figure that reflects the company’s ability to generate profit from its shareholders’ equity. While this is a positive sign, it also indicates that JFS is still in the early stages of capitalizing on its market opportunities.

Market Sentiment and Investor Expectations

The 9% surge in Jio Finance Share can be attributed to a combination of factors, including positive market sentiment, anticipation of strategic announcements, and speculative buying. Investors are closely watching the company’s next moves, particularly in expanding its financial services offerings and leveraging the Reliance Group’s extensive customer base.

However, the stock’s high valuation metrics suggest that it is currently trading in a speculative zone. For Jio Finance Share to break out of its consolidation phase and sustain a rally, it will need to deliver consistent earnings growth and demonstrate a clear path to higher profitability.

Market analysts are divided on the stock’s near-term prospects. Some believe that Jio Finance Share is on the verge of a breakthrough, driven by upcoming strategic initiatives that could unlock significant value. Others caution that the stock’s high valuation and modest earnings may limit its upside potential in the near term, leading to continued consolidation.

Can Jio Finance Share Break the Consolidation Zone?

The key question on every investor’s mind is whether Jio Finance Share can break out of its current consolidation zone. For this to happen, the company will need to demonstrate strong execution of its business plan, particularly in areas such as digital lending, insurance, and wealth management.

Additionally, any strategic partnerships or acquisitions that enhance JFS’s market position could serve as catalysts for a breakout. The company’s ability to leverage technology and data from its parent company, Reliance Industries, will be crucial in driving future growth.

In conclusion, while today’s 9% surge is a positive sign, Jio Finance Share remains in a critical phase where it must balance high investor expectations with tangible business results. Investors should keep a close eye on upcoming earnings reports and strategic announcements, as these will provide clearer signals on whether JFS can break out of its consolidation phase and deliver sustained growth.

More Articles

Dalal Street Week Ahead: Key Factors to Watch as PMI Data and Global Trends Shape Market Outlook

NBCC News: Stock Price Soars 18% Amid Excitement Over Bonus Issue Plans

Anil Ambani Reliance Infrastructure Leads Sharp Decline in Group Stocks on August 26, 2024

Zydus Share Price Tumbles After Controversial Sterling Biotech Acquisition

Nvidia and OpenAI Hit with Lawsuit Over Alleged Unauthorized Use of YouTube Videos for AI Training

Reliance Power Share Price Soars: Anil Ambani-Owned Stock Hits Upper Circuit, What’s Next?

Elon Musk to Join Trump’s Cabinet? A Bold Move That Could Transform Tech and Policy!

Technical Glitches Mar Trump Musk Interview, Sparking Meme Frenzy and Online Debate

Sena Leader’s Drunk Son Allegedly Driving BMW in Fatal Mumbai Accident: Sources

Rahul Gandhi: The Controversial Political Leader

Linguistic Diversity Shines: MPs Take Oath in Sanskrit, Hindi, and Other Languages

Om Birla Re-Elected as Lok Sabha Speaker: A Milestone of Bipartisan Unity

Asaduddin Owaisi’s Controversial Oath Sparks Debate on His Integrity in Parliament

Bhartruhari Mahtab Appointed as Pro-Tem Speaker for the 18th Lok Sabha: A Key Leadership Role

Hajj Deaths Toll Mounts as Hajj Pilgrims Suffer Amidst Extreme Heat and Poor Conditions

Discover more from

Subscribe to get the latest posts sent to your email.

3 COMMENTS