The Rise of Gold Prices Amidst Geopolitical Turmoil: An Extensive Analysis

Authored by News 24 Media’s Business Analyst

Introduction

In the ever-evolving realm of global dynamics, gold has emerged as a symbol of stability and assurance for investors. As tensions escalate in regions such as the Middle East and amidst the Russia-Ukraine conflict, the appeal of this precious metal has soared. This article aims to delve into the underlying reasons propelling the surge in gold prices, examining historical trends, and offering strategic guidance for investors.

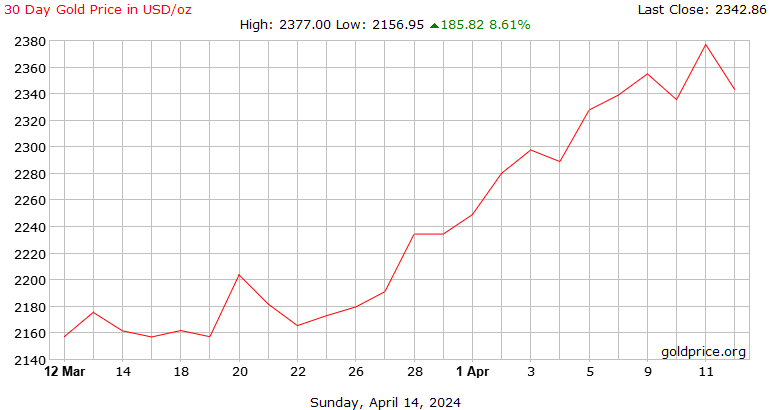

Gold Prices

The Perfect Storm: Factors Driving Gold Prices Upward

- Geopolitical Uncertainty

The ongoing turmoil in the Middle East and the escalating Russia-Ukraine crisis have created an atmosphere of instability. Investors, wary of geopolitical risks, are turning to gold as a safe haven. The metal’s intrinsic value and historical resilience make it an attractive choice during periods of upheaval. - Anticipation of Interest Rate Reductions

The United States is poised for interest rate adjustments, with some experts predicting multiple cuts within the year. Lower interest rates tend to enhance the appeal of non-yielding assets like gold. Investors are seeking refuge in gold as an alternative to traditional interest-bearing investments. - Persistent Inflation

Inflation erodes the purchasing power of fiat currency. As central banks grapple with rising inflation, gold becomes an attractive store of value. Its tangible nature provides financial security when paper currency faces challenges.

Historical Trajectory of Gold Prices

A Detailed Examination of Gold Price History

- GoldPrice.org

GoldPrice.org offers a comprehensive collection of historical gold price data. Some key highlights include:

Spot Gold Prices in U.S. Dollars (USD):

Over the past 40 years, gold has experienced significant fluctuations. As of the most recent data, the price stands at $2,395.16 per ounce. The chart below illustrates this journey.

Inflation-Adjusted Gold Price:

Adjusting for inflation, gold’s value remains a crucial benchmark. The chart below shows the inflation-adjusted gold price using the 1980 Consumer Price Index (CPI) formula.

- MacroTrends

MacroTrends provides an interactive chart showcasing real (inflation-adjusted) gold prices per ounce dating back to 1915. The series is deflated using the headline Consumer Price Index (CPI). - World Gold Council

The World Gold Council offers comprehensive data on gold prices across various timeframes (daily, weekly, monthly, and annually) since 1978. Prices can be explored in different currencies, including trading, producer, and consumer currencies. - Investing.com

For those interested in futures data, Investing.com provides historical information on Gold Futures, including closing prices, open, high, low, and percentage changes for various date ranges.

Gold Price Movement: Recent Trends

Over the past few weeks, gold prices have shown a consistent upward trend, as illustrated in the table below:

| Date | Pure Gold (24K) | Standard Gold (22K) |

|---|---|---|

| 4 April, 2024 | INR 6,142 | INR 5,630 |

| 3 April, 2024 | INR 6,164 | INR 5,650 |

| 2 April, 2024 | INR 6,109 | INR 5,600 |

| 1 April, 2024 | INR 6,033 | INR 5,530 |

Investment Strategies: Buy, Hold, or Sell? Strategic Approaches for Investors

- Buy and Diversify

Consider investing in gold ETFs and Sovereign Gold Bonds, which offer exposure to gold without the need for physical purchase and storage. - Hold as a Hedge

Investing in gold mining stocks can be profitable as the prices of these stocks tend to increase with rising gold prices. However, these stocks are typically more volatile than the metal itself. - Strategic Selling

Gold mutual funds, which hold shares of mining company stocks and physical metal, can be considered. Evaluate your risk tolerance and consider selling when prices reach their peak.

Conclusion

Amidst global uncertainties, gold continues to be a reliable asset for investors. Whether you decide to buy, hold, or sell, it’s important to remember that timing the market perfectly is challenging. Stay informed, diversify your portfolio, and let gold serve as a stable anchor in turbulent times.

The Surge of Gold Prices Amidst Geopolitical Turmoil: A Strategic

Disclaimer: The opinions expressed in this article are solely those of the author and do not constitute financial advice. Always consult with a professional financial advisor before making investment decisions.

More Articles

The Strategic Petroleum Buffer: India’s Prudent Approach Amidst Middle East Tensions

India Calls for Immediate De-escalation of Iran Israel War After Iran’s Missile Attack

Countdown to Conflict: Iran Israel War in 48 Hours – Can India Forge Peace?

Investigating the Legal Battle: Patanjali’s Apology and the Allopathy Perspective

Unmasking the Shadow of Racism: The Surge of Anti-Indian Racism in Canada

Bade Miyan Chote Miyan: A Whirlwind of Action, Humor, and Bromance

“Pushpa 2: The Rule” Teaser Ignites Frenzy: Allu Arjun’s Electrifying Avatar Takes Center Stage

Pioneers of Progress: A Chronicle of the University of Calcutta’s Intellectual Legacy

Chaitra Navaratri: Celebrating the Divine Feminine and Seeking Blessings from Devi Durga

Digital Havoc: Unraveling the School Email Bomb Threat in Kolkata and West Bengal

Bandhan Bank Share Price Plummet After CEO Chandra Shekhar Ghosh’s Resignation

Hafiz Saeed Poisoned: India’s Most Wanted Terrorist Hospitalized

Gudi Padwa 2024 or Ugadi: Date, Time, Rituals, History, and Significance

Discover more from

Subscribe to get the latest posts sent to your email.

7 COMMENTS