Tata Power Company Limited: A Rising Star in the Stock Market

Introduction

Tata Power Company Limited (NSE: TATAPOWER) has been making waves in the stock market, with its share price soaring to new heights. As an Indian electric utility and electricity generation company, Tata Power is part of the esteemed Tata Group. Let’s delve into the details of its remarkable performance, fundamentals, and potential risks.

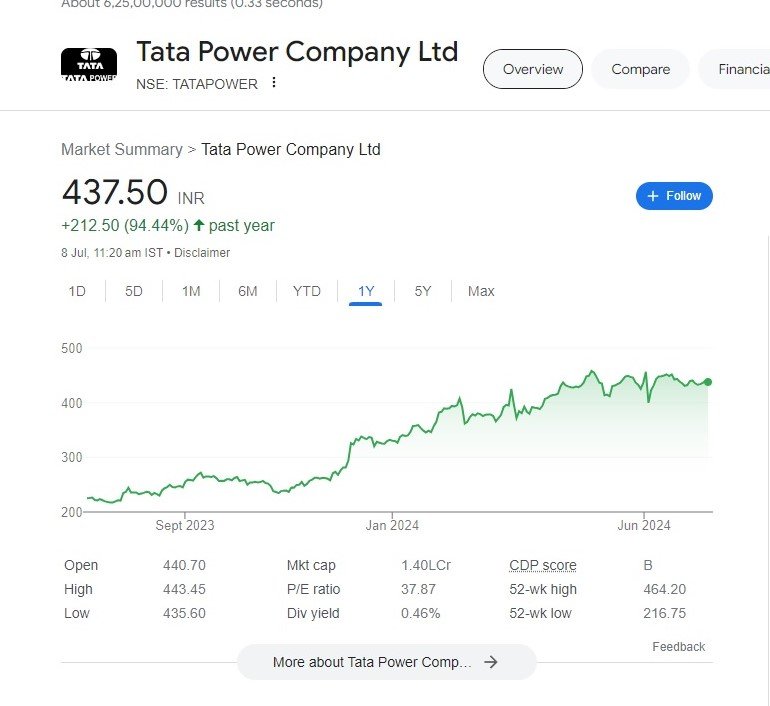

Stock Performance- Tata Power Company Limited

- Share Price Surge: Over the past year, Tata Power Company Limited’s stock price has witnessed an impressive 2x rise, outperforming many other companies in the market. Investors who held onto their Tata Power shares have reaped substantial gains.

Fundamentals and Financials

- Robust Revenue Growth: Tata Power Company Limited reported a 27% increase in revenue for the quarter ending March 31, 2024, reaching ₹15,846.50 crore. This growth reflects the company’s ability to generate income from its primary operations.

- Net Profit Margin: The net profit margin, which measures profit as a percentage of revenue, stands at 5.65%. This indicates efficient cost management and healthy profitability.

- Earnings per Share (EPS): Tata Power Company Limited’s EPS is ₹2.71, demonstrating consistent earnings growth. A positive EPS is crucial for long-term investors.

- Debt Concerns: However, it’s essential to consider the company’s debt levels. Tata Power’s high leverage and increasing debt could pose risks in the long term.

Investment Risks

- Valuation: The Tata Power Company Limited stock is currently trading at about 35 times the estimated earnings for the financial year ending March 2026, which is higher than its historical price-to-earnings ratio. This valuation may be a cause for concern.

- Brokerage Warnings: Goldman Sachs expects Tata Power’s stock to fall by as much as 45% over the next 12 months. Another brokerage, CLSA, also has a ‘Sell’ recommendation, citing expensive valuations and weak earnings.

Short-Term and Long-Term Targets

- Short-Term: Considering the bullish market trends, the stock could potentially reach ₹964 by mid-year.

- Long-Term: By the end of 2030, the price target for Tata Power is expected to potentially reach ₹1,152, assuming favourable market conditions.

Conclusion

Tata Power’s remarkable performance and strong fundamentals make it an attractive investment option. However, investors should carefully assess the risks associated with valuation and debt. As always, thorough research and a diversified portfolio are essential for successful investing.

Remember, the stock market is dynamic, and prudent decision-making is crucial. Happy investing! 🚀📈

More Articles

Yes Bank Limited Stock: A Comprehensive Analysis of Exciting Prospects and Ambitious Price Targets

Sena Leader’s Drunk Son Allegedly Driving BMW in Fatal Mumbai Accident: Sources

Rahul Gandhi: The Controversial Political Leader

Linguistic Diversity Shines: MPs Take Oath in Sanskrit, Hindi, and Other Languages

Om Birla Re-Elected as Lok Sabha Speaker: A Milestone of Bipartisan Unity

Asaduddin Owaisi’s Controversial Oath Sparks Debate on His Integrity in Parliament

Bhartruhari Mahtab Appointed as Pro-Tem Speaker for the 18th Lok Sabha: A Key Leadership Role

Hajj Deaths Toll Mounts as Hajj Pilgrims Suffer Amidst Extreme Heat and Poor Conditions

PM Modi Celebrates International Yoga Day in Srinagar

Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround – News 24 Media

Raymond Group Stocks Jump Over 8.5% to Set New High:

Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Lucrative PSU Stocks: Public Sector Undertakings in India Reap Rewards from Government Policies

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Discover more from

Subscribe to get the latest posts sent to your email.

2 COMMENTS