GM Breweries Ltd: Brewing Success in Every Sip, A Closer Investment Opportunity

By News 24 Media, Business Correspondent

GM Breweries Ltd: A Closer Look

Introduction

GM Breweries Ltd is a prominent player in the Indian alcoholic beverage industry. Established in 1981, the company primarily engages in the production and sale of alcoholic beverages, including beer and country liquor. Let’s delve into the key aspects that investors should consider.

1. Financial Performance

Revenue and Profitability

- GM Breweries Ltd has demonstrated consistent revenue growth over the years. Its ability to capture market share and expand its product portfolio has contributed to this positive trend.

- The company’s profitability metrics, such as operating margins and net profit margins, are stable. However, investors should closely monitor any fluctuations.

Cash Flow and Liquidity

- While GM Breweries Ltd generates cash from its core business operations, recent trends indicate declining cash flow. Investors should assess the reasons behind this and evaluate the impact on the company’s liquidity position.

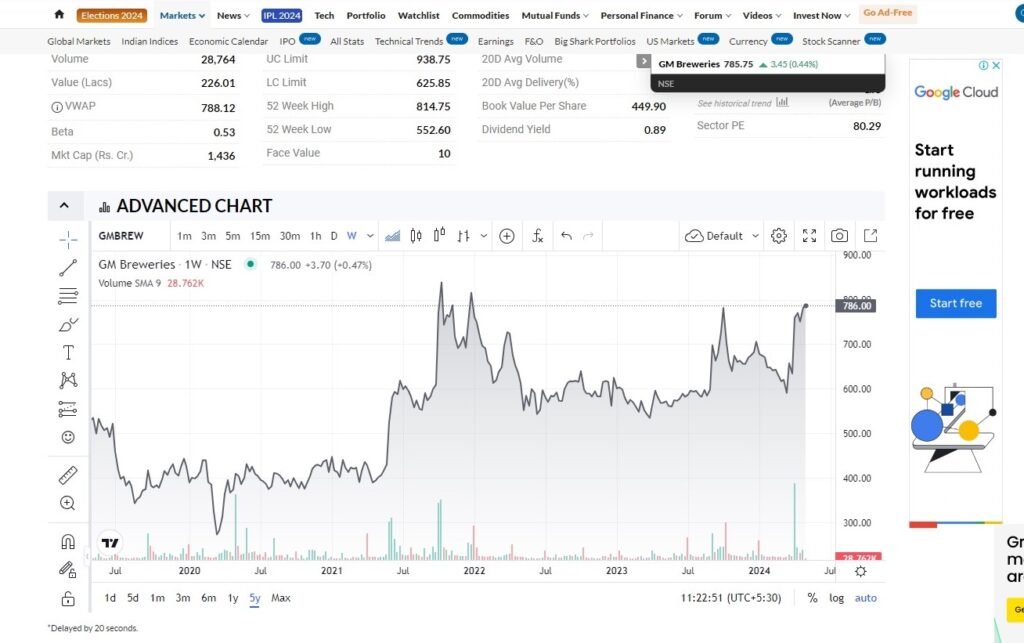

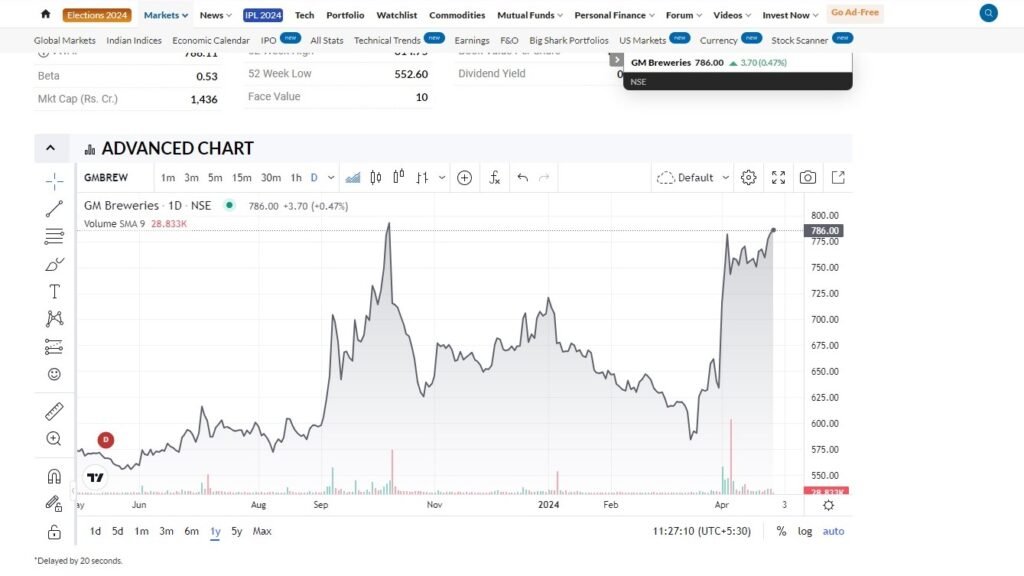

2. Share Price Movement

- GM Breweries Ltd’ share price has been on an upward trajectory, reflecting positive sentiment among investors. As of April 26, 2024, the stock is trading at ₹785.75.

- The 52-week range spans from ₹552.60 to ₹814.75, indicating substantial volatility. Investors should consider their risk tolerance and investment horizon.

3. Strengths and Opportunities

Strengths

- Strong Momentum: The stock price is currently above short, medium, and long-term moving averages, signalling positive momentum.

- Market Position: GM Breweries Ltd holds a significant market share in the alcoholic beverage segment.

Opportunities

- Low P/E Ratio: The current trailing twelve-month (TTM) P/E ratio is attractive, making it potentially undervalued.

- Industry Growth: India’s alcoholic beverage industry continues to grow, providing opportunities for GM Breweries to expand.

4. Risks and Threats

Threats

- Non-Core Income: Investors should monitor any increasing trend in non-core income, as it may impact the company’s overall financial health.

Investment Perspective

- GM Breweries appears to be a mid-range performer with average financial performance and moderate price momentum.

- Long-term and medium-term investors seeking exposure to the alcoholic beverage industry may find GM Breweries an interesting pick.

Conclusion

GM Breweries Ltd’s positive share price movement reflects investor confidence. However, investors must conduct thorough due diligence, considering both strengths and risks. As always, diversification and a long-term perspective are essential for successful investing.

Remember that investing involves risks, and it’s advisable to consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute investment advice. Always conduct your research and consult with professionals before making investment decisions.

More Business Articles

Resurgent Yes Bank Share Price: A Financial Phoenix’s Triumphant Ascent

ICICI Bank App Glitch: ICICI Bank Data Breach Exposes 17,000 Credit Card Holders

Cloud Evolution: IBM’s $6.4 Billion Acquisition of HashiCorp Sets New Industry Standards

EU Sets TikTok Ultimatum Over ‘Addictive’ New App Feature

The Fitness Tracker Market in India and South Asia: Challenges and Growth Prospects

Fixed Deposit Rates in India: A Beacon of Hope for Savvy Investors

Navigating the Storm: How the Iran Israel War Impacts Indian Economy and Investor Sentiments

Driving Innovation with AI and Hybrid Cloud: A Look Ahead

Tesla Electric Vehicle Announces Workforce Reduction Amidst Global Challenges

The Rise of Gold Prices Amidst Geopolitical Turmoil: An Extensive Analysis

The Strategic Petroleum Buffer: India’s Prudent Approach Amidst Middle East Tensions

Discover more from

Subscribe to get the latest posts sent to your email.

12 COMMENTS