Havells India: A Beacon of Growth in the Electrical Equipment Sector

Havells India Ltd., a prominent player in the electrical equipment industry, has recently reported a remarkable 42% increase in both profit and revenue for the first quarter of FY24. This impressive performance has caught the attention of investors and market analysts alike, highlighting the company’s robust growth trajectory and strategic initiatives.

Financial Performance

In the first quarter ending June 30, 2024, Havells India reported a consolidated net profit of ₹407.51 crore, up from ₹287.07 crore in the same period last fiscal year. The company’s revenue from operations also saw a significant rise, reaching ₹5,806.21 crore compared to ₹4,833.8 crore in the corresponding period a year ago. This growth was driven by strong sales across various segments, particularly in electrical consumer durables and the Lloyd brand of consumer products.

Segment-Wise Performance

- Electrical Consumer Durables: This segment recorded revenue of ₹1,055.42 crore, up from ₹877.52 crore in the same period last year.

- Lloyd Brand: The Lloyd brand of consumer products saw a substantial increase in revenue, reaching ₹1,928.72 crore compared to ₹1,310.92 crore in the previous fiscal.

- Cables Business: Revenue from the cables segment stood at ₹1,521.24 crore, up from ₹1,485.18 crore in the corresponding quarter last fiscal.

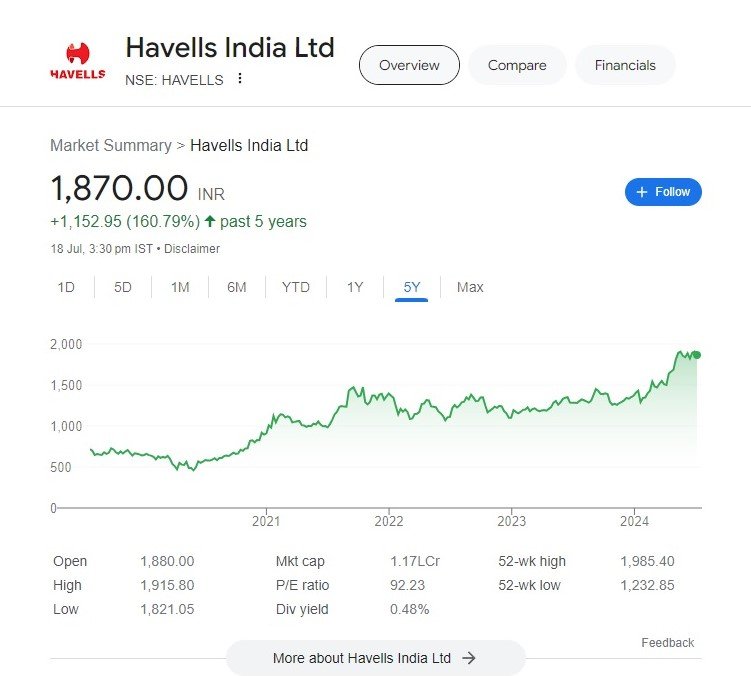

Stock Performance

Havells India’s stock has shown a strong performance over the past five years. As of July 18, 2024, the stock is trading at ₹1,861.1. Here’s a look at its performance over different time frames:

- 5-Year Performance: The stock has appreciated by approximately 158.90% over the past five years.

- 1-Year Performance: Over the last year, the stock has gained about 46.52%.

- Year-to-Date: Since the beginning of 2024, the stock has risen by 37.43%.

Short-Term and Long-Term Price Forecast

According to market analysts, Havells India’s stock is expected to continue its upward trajectory. The short-term forecast suggests a potential rise to ₹1,959.40 within the next 14 days. In the long term, the stock is projected to reach ₹2,675.99 by 2029, representing a potential return of around 42.75% over five years.

Investor Cautions

While Havells India’s recent performance and prospects appear promising, investors should exercise caution. Here are a few considerations:

- High Valuation: The stock’s current P/E ratio stands at 92.76, which is relatively high. This indicates that the stock may be overvalued, and any market corrections could impact its price.

- Market Volatility: The stock market is inherently volatile, and external factors such as economic downturns, political instability, or changes in regulatory policies could affect the stock’s performance.

- Sector-Specific Risks: As a player in the electrical equipment sector, Havells India is subject to risks such as fluctuations in raw material prices, technological changes, and competition from both domestic and international players.

Conclusion

Havells India’s impressive financial performance and strong stock market presence make it an attractive option for investors. However, it is essential to consider the potential risks and conduct thorough research before making investment decisions. With its strategic initiatives and robust growth across various segments, Havells India is well-positioned to continue its upward trajectory in the coming years.

More Articles

Raymond Group Shares Shockingly Plummet 40%: An In-Depth Analysis of Today’s Crash

Flipkart-Backed Truck Aggregator BlackBuck Excitingly Files for IPO, Targeting ₹550 Crore

Tata Power Company Limited: A High-Voltage Rising Star in the Stock Market

Yes Bank Limited Stock: A Comprehensive Analysis of Exciting Prospects and Ambitious Price Targets

Sena Leader’s Drunk Son Allegedly Driving BMW in Fatal Mumbai Accident: Sources

Rahul Gandhi: The Controversial Political Leader

Linguistic Diversity Shines: MPs Take Oath in Sanskrit, Hindi, and Other Languages

Om Birla Re-Elected as Lok Sabha Speaker: A Milestone of Bipartisan Unity

Asaduddin Owaisi’s Controversial Oath Sparks Debate on His Integrity in Parliament

Bhartruhari Mahtab Appointed as Pro-Tem Speaker for the 18th Lok Sabha: A Key Leadership Role

Hajj Deaths Toll Mounts as Hajj Pilgrims Suffer Amidst Extreme Heat and Poor Conditions

PM Modi Celebrates International Yoga Day in Srinagar

Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround – News 24 Media

Raymond Group Stocks Jump Over 8.5% to Set New High:

Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS