Tata Motors Share Price Analysis: Exploring Q4 FY24 Results and Market Performance!

Tata Motors Share Price: A Closer Look at Q4 FY24 Results and Share Price Analysis

Embark on an enlightening journey through this meticulously researched article focusing on Tata Motors, where we delve into the company’s recent performance, dissect share price trends, and offer valuable investment cautionary insights for potential investors.

1. Tata Motors Q4 FY24 Results Overview

Tata Motors recently released its consolidated Q4 FY24 results, showcasing robust performance across its automotive businesses. Here are the key highlights:

- Revenue: ₹120.0K Cr (up 13.3%)

- EBITDA: ₹17.9K Cr (up 26.6%)

- EBIT: ₹11.0K Cr (up ₹3.8K Cr)

- Profit Before Tax (bei): ₹9.5K Cr (up ₹4.4K Cr)

- Net Profit: ₹17.5K Cr (up ₹12.0K Cr)

Notably, all three auto businesses—Jaguar Land Rover (JLR), Tata Commercial Vehicles, and Tata Passenger Vehicles—contributed to this strong performance. JLR’s revenue increased by 10.7%, while Tata Commercial Vehicles and Tata Passenger Vehicles also showed positive growth.

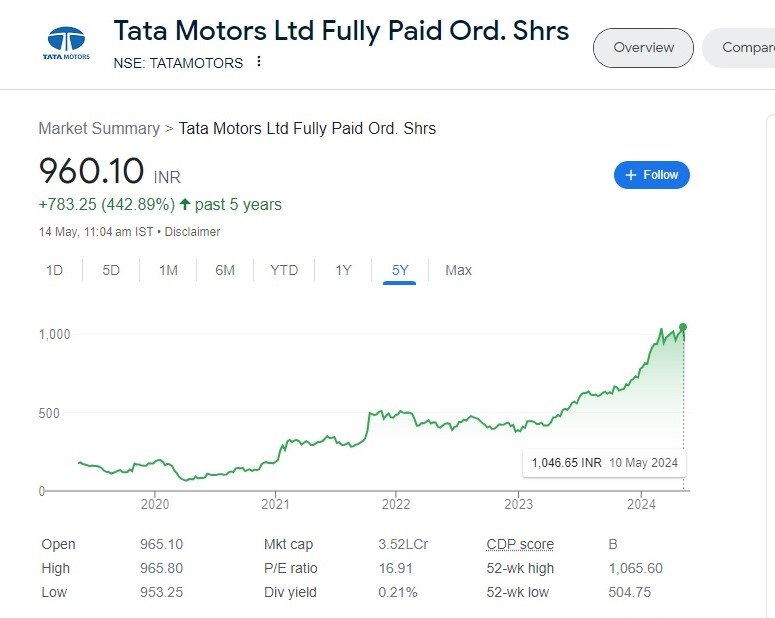

2. Five-Year Tata Motors Share Price Analysis

Let’s examine Tata Motors share price trends over the past five years:

2024 Tata Motors Share Price Target

- Current Price (as of May 10, 2024): ₹1047.25

- Target 1 (2024): ₹1150.92 (up 9.89%)

- Target 2 (2024): ₹1169.27 (up 11.65%)

- Target 3 (2024): ₹1191.49 (up 13.77%)

The Tata Motors Share Price has already surged by ₹267.30 (34.27%) from January 1, 2024, to May 10, 2024. However, it faces resistance at its 52-week high of ₹1065.59. Investors should be cautious and consider potential stop-loss levels.

2025 Tata Motors Share Price Target

- Target 1 (2025): ₹1495.12 (up 42.76%)

- Target 2 (2025): ₹1510.07 (up 44.93%)

- Target 3 (2025): ₹1538.76 (up 46.93%)

3. Tata Motors Share Price –Investment Caution

While Tata Motors shows promise, here are some cautionary points for investors:

- Domestic Demand: The company remains cautiously optimistic about domestic demand in FY25, especially in the first half. Keep an eye on market trends and economic indicators.

- Premium Luxury Segment: Despite concerns, the premium luxury segment is expected to remain resilient. However, external factors can impact overall demand.

- Debt Reduction: Tata Motors aims to become net automotive debt-free by FY25. Monitor their progress in reducing debt.

Remember that investing involves risks, and thorough research is essential. Consult a financial advisor before making any investment decisions.

In conclusion, Tata Motors’ strong performance and strategic initiatives position it well for the future. However, prudent investors should exercise due diligence and consider their risk tolerance before buying Tata Motors shares. 🚗💼📈

More Articles

Abbott India Ltd: Your Time-Tested Investment Gem for Steady Growth and Dividend Rewards!

Unlocking Wealth: How HPCL and BPCL Bonus Shares Transformed Investors’ Fortunes

Warren Buffett’s Bright View on India: Exploring Untapped Opportunities with Berkshire Hathaway

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Paytm News- in Turmoil: COO Bhavesh Gupta’s Resignation Adds to the Storm – Latest Updates

REC Share Price Skyrockets: Q4 FY’24 Net Profit Soars to New Heights!

Arvind Krishna: Architecting IBM’s Future and Leading Industry Transformation

GM Breweries Ltd: Brewing Success in Every Sip, A Closer Investment Opportunity

Resurgent Yes Bank Share Price: A Financial Phoenix’s Triumphant Ascent

ICICI Bank App Glitch: ICICI Bank Data Breach Exposes 17,000 Credit Card Holders

Cloud Evolution: IBM’s $6.4 Billion Acquisition of HashiCorp Sets New Industry Standards

EU Sets TikTok Ultimatum Over ‘Addictive’ New App Feature

The Fitness Tracker Market in India and South Asia: Challenges and Growth Prospects

Fixed Deposit Rates in India: A Beacon of Hope for Savvy Investors

Navigating the Storm: How the Iran Israel War Impacts Indian Economy and Investor Sentiments

Driving Innovation with AI and Hybrid Cloud: A Look Ahead

Tesla Electric Vehicle Announces Workforce Reduction Amidst Global Challenges

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS