Stock Market Today: Nifty 50 and Sensex Surge to Record Highs Amid Exit Poll Predictions

Stock Market Today: Nifty 50 and Sensex Soar to New Heights Amid Exit Poll Predictions

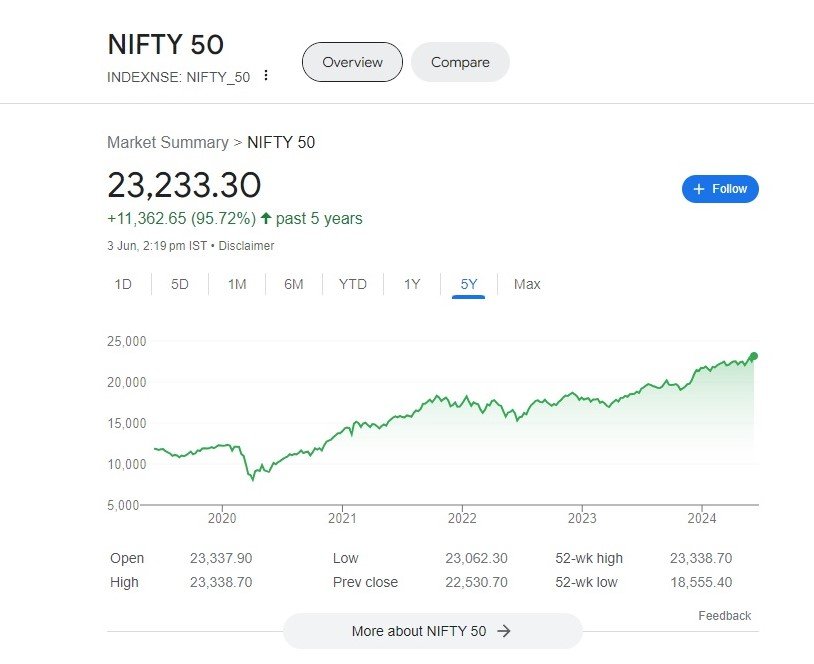

The Indian stock market witnessed a historic surge on Monday, June 3, 2024, as the Nifty 50 and Sensex indices opened at record highs. This remarkable upswing was fueled by exit polls predicting a landslide victory for the National Democratic Alliance (NDA) in the ongoing Lok Sabha elections. The Nifty 50 jumped 3.58% to reach 23,338.70, while the Sensex gained 3.55% to hit a new all-time high of 76,738.89.

Market Reaction to Exit Polls

The exit polls largely drove the market’s euphoria, indicating a decisive win for the BJP-led NDA government. The polls projected the NDA to secure around 370 seats, with some predicting as many as 400 seats. This outcome is expected to provide stability and continuity in policy-making, boosting investor confidence and driving the market upward.

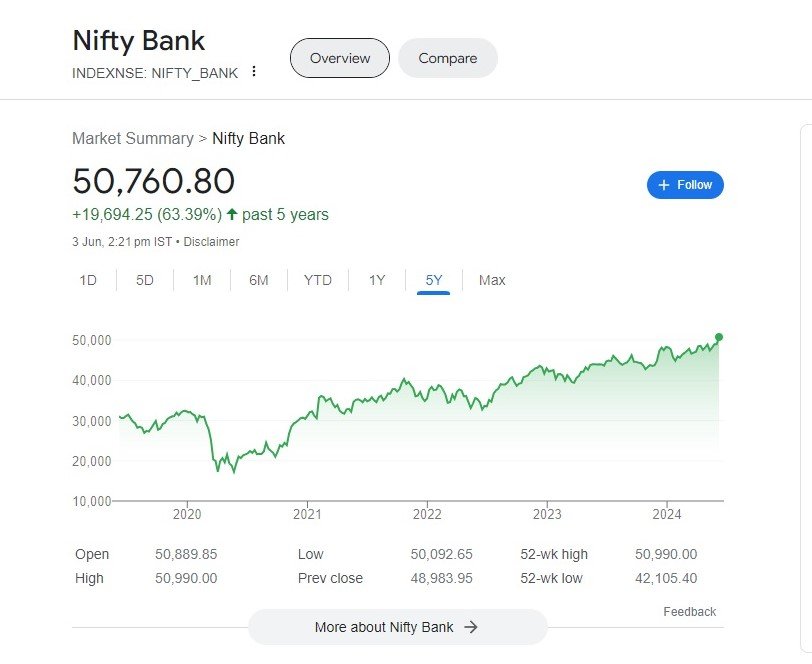

Sectoral Performance Nifty 50

The market’s broad-based rally saw significant gains across various sectors. The Bank Nifty index, in particular, touched a new lifetime high of 50,990, indicating a strong sentiment in the banking sector. Other notable gainers included Power Grid, Adani Ports, Shriram Finance, L&T, NTPC, SBI, Axis Bank, M&M, ICICI Bank, and Ultratech Cement, which rose between 3% to 7%.

Expert Insights -Nifty 50

Analysts attributed the market’s surge to the exit polls, which have alleviated political uncertainty and volatility concerns. Prashanth Tapse, Senior VP (Research) at Mehta Equities, noted that the market is poised for a strong start to June, driven by optimistic exit poll results predicting a significant win for the BJP-led NDA. Other experts emphasized the positive impact of a stable government on the economy and capital markets, which will continue to push its economic agenda.

Portfolio Strategy-Nifty 50

Experts suggested booking 50% of their profits for short-term investors, as the Nifty 50 index has reached the upper end of its rising channel pattern. Long-term investors, however, were advised to consider India’s growth trajectory over the next 3-5 years when deciding on equities. Analysts at Axis Securities and Geojit Financial Services recommended stocks such as SBI, Bank of Baroda, REC, NTPC, JSW Energy, Suzlon, RVNL, J Kumar Infra, and Hindustan Aeronautics for medium-to-long-term investments.

Major Factors-Nifty 50

The key factors driving the Nifty 50 and Sensex to new highs on June 3, 2024, were primarily driven by exit polls predicting a landslide victory for the National Democratic Alliance (NDA) in the ongoing Lok Sabha elections. This outcome is expected to provide stability and continuity in policy-making, boosting investor confidence and driving the market upward.

- Exit Polls Predicting NDA Victory: Exit polls projected the NDA to secure around 370 seats, with some predicting as many as 400 seats. This outcome is expected to provide stability and continuity in policy-making, boosting investor confidence and driving the market upward.

- Market Expectations of Economic Growth: India’s GDP exceeding estimates at 8.2% for FY24 and a robust growth rate in the manufacturing sector have contributed to the market’s optimism about the economy’s prospects.

- Global Market Sentiment: The global equity markets cheered the Federal Reserve’s decision to keep interest rates unchanged, positively impacting the Indian market. The Dow Jones surged by 574 points, and the dollar index retreated, further supporting the market’s rally.

- Broader Market Participation: All sectors in the domestic market were in the positive territory, with Nifty Metal and Nifty PSU Bank seeing significant gains. The broader market also outperformed the benchmarks, with the BSE Midcap and BSE Smallcap indices gaining 2% each.

- Technical Factors: The Nifty 50 index has reached the upper end of its rising channel pattern, and a move above the current high could extend the rally towards 23,500 – 24,000.

Conclusion

The Indian stock market’s record-breaking performance on June 3, 2024, was a direct result of the exit polls predicting a landslide victory for the NDA. The market’s optimism was fueled by the prospect of a stable government, which will continue to drive economic growth and stability. As investors, it is essential to remain patient and wait for clarity post-election results before making investment moves. For long-term investors, the Indian economy’s growth trajectory over the next few years remains a promising prospect for equities.

More Articles

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Lucrative PSU Stocks: Public Sector Undertakings in India Reap Rewards from Government Policies

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Ride into the Future with Royal Enfield’s Electrifying 2024 Lineup

Top 10 Inverter Air Conditioners in India: Unmatched Cooling and Energy Savings

Vladimir Putin AI Deepfake Film Makes Waves at Cannes, Sells Big

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Paytm News- in Turmoil: COO Bhavesh Gupta’s Resignation Adds to the Storm – Latest Updates

REC Share Price Skyrockets: Q4 FY’24 Net Profit Soars to New Heights!

Arvind Krishna: Architecting IBM’s Future and Leading Industry Transformation

GM Breweries Ltd: Brewing Success in Every Sip, A Closer Investment Opportunity

Resurgent Yes Bank Share Price: A Financial Phoenix’s Triumphant Ascent

Discover more from

Subscribe to get the latest posts sent to your email.