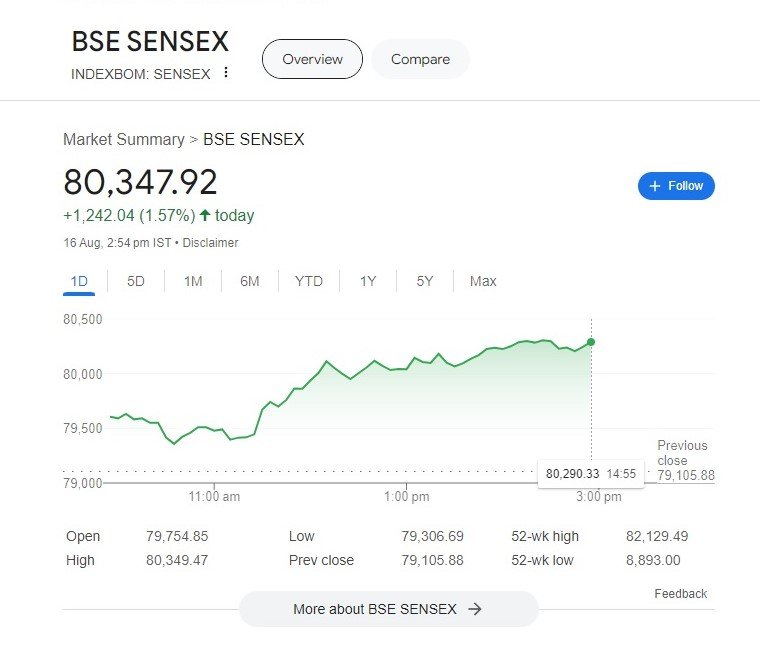

Sensex Surges 1,000 Points: Key Drivers and Future Outlook

Mumbai, August 16, 2024 – The Indian stock market witnessed a remarkable surge as the BSE Sensex soared by over 1,000 (1242) points, reflecting a significant boost in investor confidence. This bullish trend has been driven by a confluence of factors, with cooling U.S. inflation playing a pivotal role. Here, we delve into the six key factors propelling this rally and explore the implications for the Indian stock market and investor sentiment.

Key Factors Driving the Bull Run

- Cooling U.S. Inflation: The latest U.S. consumer price data revealed a moderation in inflation, with the annual rate slowing to below 3% for the first time since early 2021. This cooling inflation has fueled expectations of imminent interest rate cuts by the Federal Reserve, boosting global investor confidence and supporting stock market gains worldwide.

- Positive U.S. Retail Sales Data: Robust retail sales data from the U.S. indicated resilient consumer spending, easing fears of an imminent recession. This positive sentiment from the U.S. markets carried over to Indian equity indices, contributing to the surge in the Sensex.

- Decline in Dollar Index: The dollar index, which tracks the movement of the greenback against a basket of major currencies, declined below the 103 level. A weaker dollar makes emerging market assets more attractive, encouraging foreign investments in Indian equities.

- Strong Corporate Earnings: Several Indian companies reported strong quarterly earnings, particularly in the technology and automotive sectors. This has bolstered investor confidence in the growth prospects of these sectors, driving up stock prices.

- Foreign Institutional Investor (FII) Inflows: The cooling U.S. inflation and positive economic data have led to increased FII inflows in the Indian market. Foreign investors are finding Indian equities more attractive due to the favourable interest rate differential and robust economic growth prospects.

- Sectoral Gains: Gains were observed across various sectors, including technology, automotive, and banking. Information technology companies, which earn a significant share of their revenue from the U.S., saw substantial gains, further propelling the Sensex upward.

Implications for the Indian Stock Market

The surge in the Sensex has significant implications for the Indian stock market and investor sentiment. The cooling of U.S. inflation has alleviated fears of aggressive interest rate hikes, leading to a more favourable investment environment. This has resulted in increased foreign investments and a positive outlook for Indian equities.

Market analysts suggest that the current rally could be sustained if the U.S. Federal Reserve proceeds with the anticipated rate cuts. Additionally, strong corporate earnings and robust economic indicators in India are likely to support continued growth in the stock market.

Insights from Market Analysts

Looking ahead, market analysts are optimistic about the future trends in the Indian stock market. According to a recent report, the Indian stock market will continue to be influenced by global economic trends, fiscal policies, and sector-specific developments2. Investors are expected to focus on sectors demonstrating resilience and growth potential while remaining cautious about those facing structural challenges.

Ridham Desai, Chief Equity Strategist for India at Morgan Stanley, highlighted the growing domestic investment in equities, improving social equity, and a fast-evolving tech sector as key factors supporting earnings cycle growth and a corresponding lift to share prices.

In conclusion, the recent surge in the Sensex reflects a confluence of positive factors, with cooling U.S. inflation playing a central role. As the Indian stock market continues to navigate global economic trends, investor sentiment remains buoyant, supported by strong corporate earnings and favourable economic indicators.

More Interesting Articles

Impact of Hindenburg Research’s Allegations on Adani Enterprises and Related Stocks

Unmasking Hindenburg Research: Exposing the Hidden Agenda Behind the Allegations

Sensex Today: Market Meltdown as BSE Sensex Dives Over 1,800 Points

Stock Market Update: Nifty Surges Past 25,000, Sensex Gains 170 Points

SEBI Unveils the Truth About Intraday Trading: Hidden Risks, New Regulations, and Investor Impact

Ola Electric IPO: Retail Subscription Opens August 2, Valuation Soars to $4.4 Billion

KPIT Share Price Soars: In-Depth Analysis of Recent Surge and Promising Investment Potential

Nifty & Sensex Plunge on Budget Announcements, Rebound Strongly: Key Insights for Investors

Union Budget 2024: Nirmala Sitharaman Unveils Bold Vision for India’s Future

PM Modi Urges Urgent Unity and Constructive Debate Ahead of Crucial Budget Session

Bangladesh’s Shoot-on-Sight Order Amid Mounting Student Protests: A Deepening Crisis

Aishwarya Rai Bachchan and Abhishek Bachchan: Addressing Rumors of Rift and Separation

Hardik Pandya Divorce: Cricketer and Natasa Stankovic Announce Split After Four Years of Marriage

Tragic Loss: Travel Influencer Aanvi Kamdar Falls to Her Death in Gorge Accident

Supreme Court Upholds Maintenance Rights for Divorced Muslim Women Under Section 125 CrPC

Sena Leader’s Drunk Son Allegedly Driving BMW in Fatal Mumbai Accident: Sources

Rahul Gandhi: The Controversial Political Leader

Linguistic Diversity Shines: MPs Take Oath in Sanskrit, Hindi, and Other Languages

Discover more from

Subscribe to get the latest posts sent to your email.