Sensex and Nifty Nosedive After Election Result; Recovery Hinges on PM Modi’s Third Term

Sensex and Nifty Nosedive After Election Result; Recovery Hinges on PM Modi’s Third Term

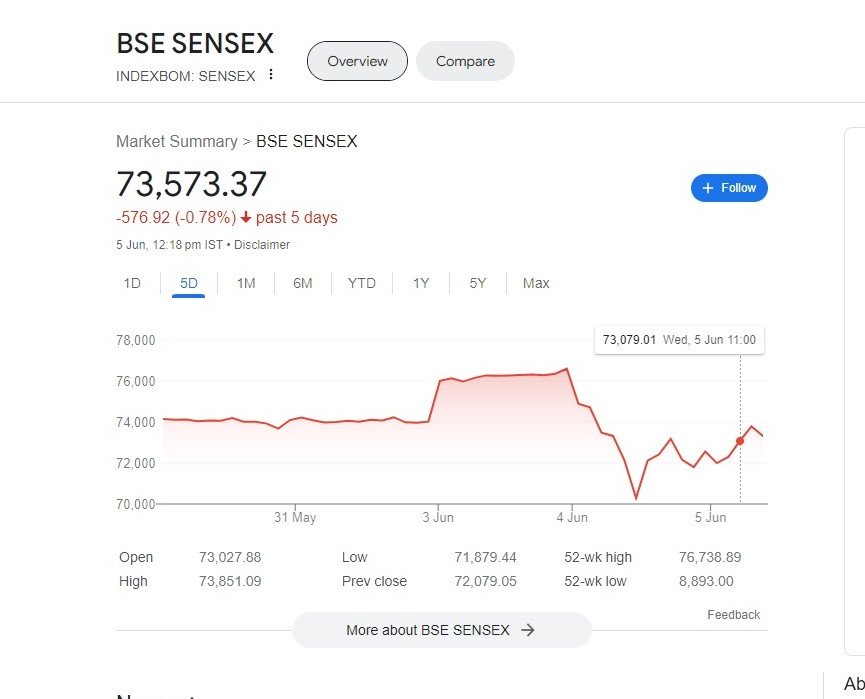

The Indian stock market witnessed a dramatic plunge yesterday and today, as the Lok Sabha election results threw up a surprise for investors. The benchmark indices, Sensex and Nifty, suffered their worst decline since 1999, erasing a staggering Rs 31 trillion of investor wealth. The sharp selloff was fueled by concerns over the composition of the incoming government and its political stability.

Election Results Disappoint Investors

The initial trends from the counting of votes showed the Bharatiya Janata Party (BJP) trailing behind expectations, with the National Democratic Alliance (NDA) likely to form the government with a reduced majority. This led to a massive sell-off in the markets, with the Sensex plummeting by 6,000 points and the Nifty shedding nearly 1,900 points during intraday trading.

Sensex and Nifty Market Reaction

The broader Nifty Midcap 100 and Nifty Smallcap 100 fell by 7.8 and 8.2 per cent respectively, indicating a widespread impact on the market. The India Vix, a barometer of market volatility, surged by 27 per cent, hinting at more turbulence ahead. Foreign Portfolio Investors (FPIs) were net sellers to the tune of Rs 12,436 crore, the highest single-day selling by them.

Recovery Hinges on PM Modi’s Third Term

However, as the day progressed, investors began to regain confidence, buoyed by the prospect of Prime Minister Narendra Modi securing a third term. The Sensex and Nifty recovered some of their losses, with the Sensex closing at 72,079 and the Nifty at 21,885. While the decline was significant, the market’s resilience in the face of uncertainty is a testament to the faith investors have in the Indian economy.

What Lies Ahead for Investors

As the dust settles, investors are left to ponder the implications of the election results on the market. The reduced majority for the NDA may lead to a more cautious approach to economic policies, potentially impacting the growth trajectory of the country. However, the stability and continuity that a third term for PM Modi could bring may help to mitigate these concerns.

Market Trends

In the short term, investors can expect the market to remain volatile, with the India Vix likely to remain elevated. The broader market indices, such as the Nifty Midcap 100 and Nifty Smallcap 100, may continue to face headwinds. However, if the government is able to stabilize the economy and implement policies that boost growth, the market could recover and even see a resurgence.

Conclusion

The Indian stock market’s reaction to the Lok Sabha election results was a stark reminder of the importance of political stability in shaping investor sentiment. While the short-term outlook may be uncertain, the prospect of PM Modi’s third term has given investors a glimmer of hope. As the market navigates these uncharted waters, investors will be closely watching the government’s policy decisions and their impact on the economy.

More Articles

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Lucrative PSU Stocks: Public Sector Undertakings in India Reap Rewards from Government Policies

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Ride into the Future with Royal Enfield’s Electrifying 2024 Lineup

Top 10 Inverter Air Conditioners in India: Unmatched Cooling and Energy Savings

Vladimir Putin AI Deepfake Film Makes Waves at Cannes, Sells Big

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Paytm News- in Turmoil: COO Bhavesh Gupta’s Resignation Adds to the Storm – Latest Updates

REC Share Price Skyrockets: Q4 FY’24 Net Profit Soars to New Heights!

Arvind Krishna: Architecting IBM’s Future and Leading Industry Transformation

Discover more from

Subscribe to get the latest posts sent to your email.