REC Share Price Rallies as Impressive Rise in Net Profit in Q4 FY’24

REC Limited, formerly known as Rural Electrification Corporation Limited, has witnessed a remarkable surge in its consolidated net profit during the fourth quarter of FY’24. Here are the key highlights:

- Net Profit Growth: REC’s consolidated net profit soared by 33%, reaching ₹4,079.09 crore during the March quarter (Q4 of FY’24). This impressive performance can be attributed to higher income.

- Total Income: The company’s total income during the fourth quarter rose to ₹12,706.66 crore, compared to ₹10,254.63 crore in the year-ago period.

- Full-Year Performance: For the entire FY24, REC achieved a net profit of ₹14,145.46 crore, up from ₹11,166.98 crore in FY23. The income also rose to ₹47,571.23 crore in FY24, compared to ₹39,520.16 crore a year earlier.

- REC Share Price

This robust financial performance reflects REC’s resilience and growth potential in the power sector.

Historical REC Share Price and Performance

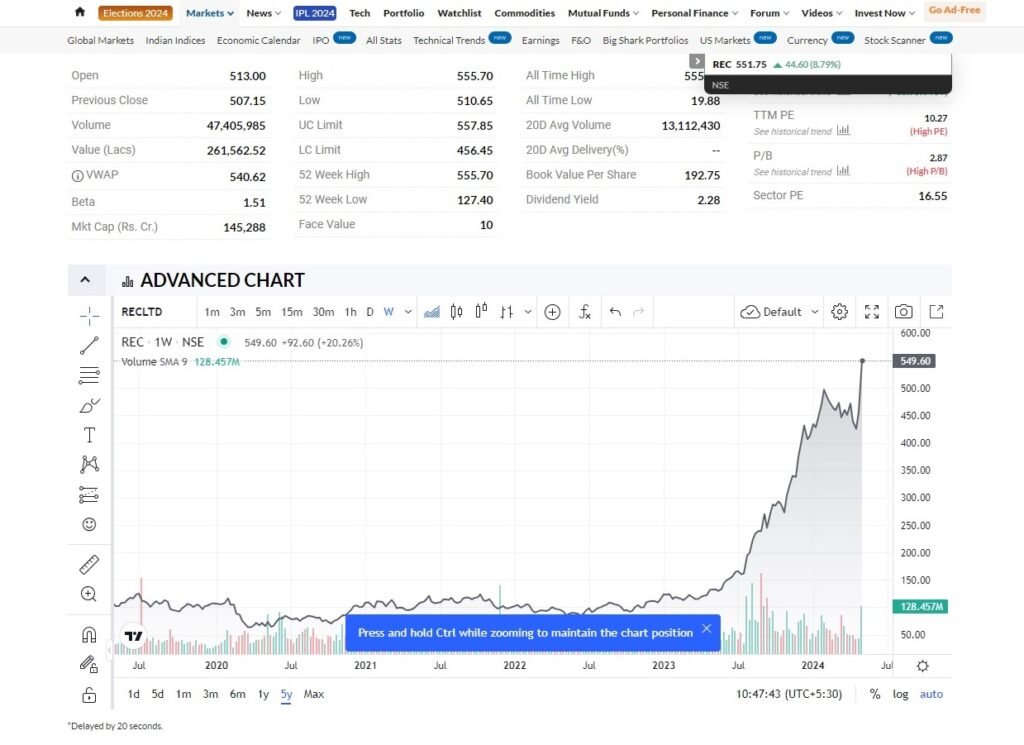

Five-Year Historical Price of REC Share Price

Let’s explore the historical stock prices of REC over the past five years:

- April 2019: The stock was trading around ₹107.32.

- April 2024: REC’s share price surged to ₹457, marking an impressive 325% growth over this period.

Recent Performance and Outlook

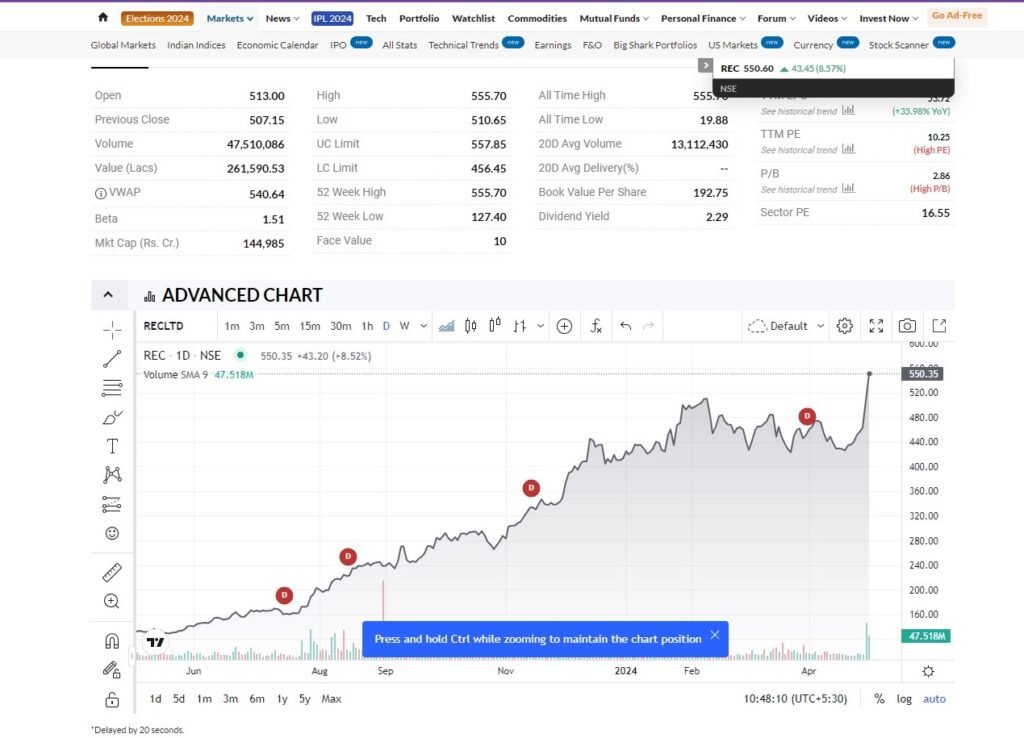

- Short-Term Momentum: REC’s stock has recently rallied, gaining over 10% in a week, reaching a fresh 52-week high of ₹140.80. Technical indicators suggest further upside potential.

- Long-Term Potential: With a 3-year return of 381.92% compared to Nifty 100’s 56.29%, REC has outperformed the broader market. Its strong financials and growth prospects make it an attractive investment option.

One-Year Historical Price of REC Share Price

Reasons to Consider Investing in REC Shares– REC Share Price

- Power Sector Growth: REC plays a pivotal role in financing and promoting power projects across India. As the country continues to focus on infrastructure development, REC stands to benefit from increased power demand and expansion.

- Government Support: Being under the Ministry of Power, REC enjoys government backing and stability. It is a crucial player in achieving the goal of universal electrification.

- Strong Financials: REC’s consistent net profit growth and robust income demonstrate its financial strength.

- Infrastructure Investment: India’s infrastructure push, including renewable energy projects, augurs well for REC’s long-term potential.

- Dividend Yield: REC offers a dividend yield of 2.86%, making it attractive for income-seeking investors.

In conclusion, considering REC’s financial performance, growth prospects, and government support, now could be an opportune time to consider investing in REC shares.

Remember to conduct your research and consult a financial advisor before making any investment decisions. Happy investing! 🚀📈

Disclaimer: The information provided here is for educational purposes only and does not constitute financial advice. Always perform due diligence and consider your risk tolerance before investing.

More Articles

Arvind Krishna: Architecting IBM’s Future and Leading Industry Transformation

GM Breweries Ltd: Brewing Success in Every Sip, A Closer Investment Opportunity

Resurgent Yes Bank Share Price: A Financial Phoenix’s Triumphant Ascent

ICICI Bank App Glitch: ICICI Bank Data Breach Exposes 17,000 Credit Card Holders

Cloud Evolution: IBM’s $6.4 Billion Acquisition of HashiCorp Sets New Industry Standards

EU Sets TikTok Ultimatum Over ‘Addictive’ New App Feature

The Fitness Tracker Market in India and South Asia: Challenges and Growth Prospects

Fixed Deposit Rates in India: A Beacon of Hope for Savvy Investors

Navigating the Storm: How the Iran Israel War Impacts Indian Economy and Investor Sentiments

Driving Innovation with AI and Hybrid Cloud: A Look Ahead

Tesla Electric Vehicle Announces Workforce Reduction Amidst Global Challenges

Discover more from

Subscribe to get the latest posts sent to your email.

15 COMMENTS