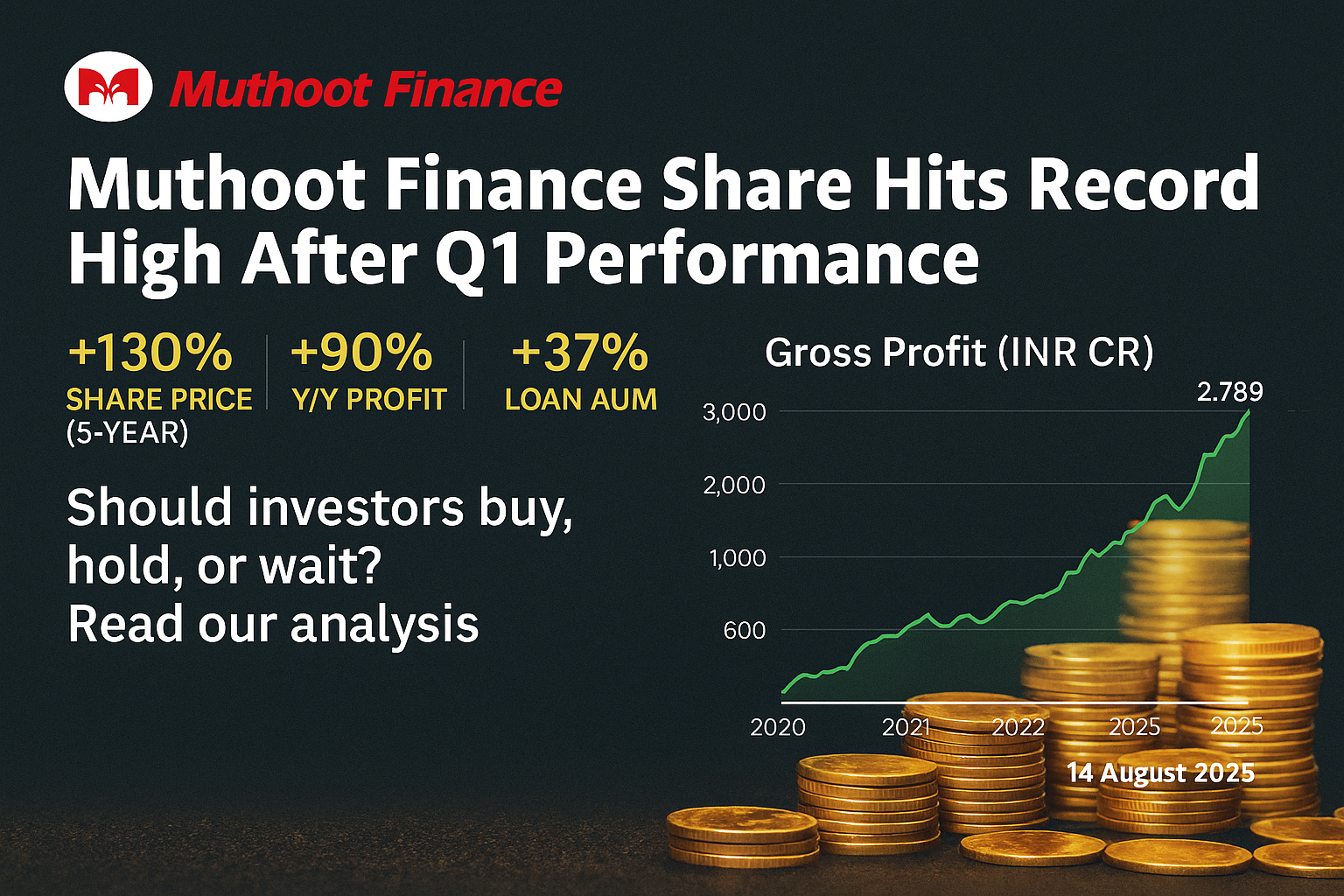

Muthoot Finance Share has delivered a remarkable rally over the past five years, rising nearly 130% and recently hitting the upper circuit after a record-breaking Q1FY26 performance. With robust profit growth, expanding loan assets, and strong broker confidence, the gold loan giant continues to attract investor attention — but is it time to buy, hold, or wait for a dip?

Muthoot Finance Share Five-Year Performance Overview

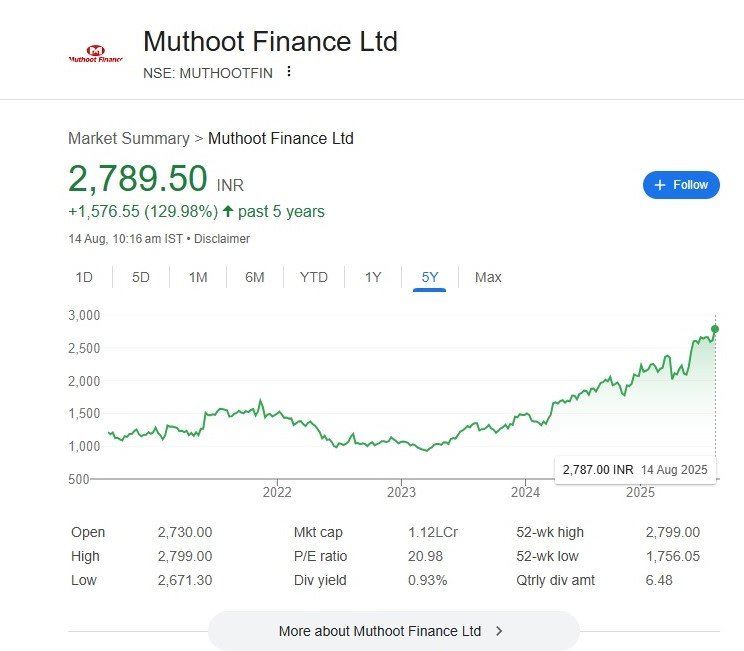

Muthoot Finance Ltd, India’s largest gold loan NBFC, has delivered a stellar five-year performance for investors. From around ₹1,213 in mid-2020 to ₹2,789.50 on August 14, 2025, the stock has gained nearly 130%, comfortably outperforming the Nifty 50 and sector peers.

The Muthoot Finance Share chart indicates:

- Stable phase (2020–2021) – Limited volatility with moderate gains.

- Bullish breakout (late 2021) – Price surged past ₹1,500 on strong earnings and favourable gold loan demand.

- Consolidation (2022–early 2023) – Temporary correction with prices dipping close to ₹1,000, providing an attractive entry point.

- Uptrend (mid-2023–2025) – Sustained rally supported by robust earnings, record AUM, and rising gold prices.

Muthoot Finance Share Q1FY26: Record-Breaking Quarter

The recent 10% upper circuit was triggered by a blowout Q1FY26 performance:

- Net Profit: ₹2,046 crore, +89.6% YoY – highest-ever quarterly profit.

- Net Interest Income (NII): ₹3,473 crore, +50.6% YoY.

- Net Interest Margin (NIM): Improved to 12.15% from 11.51%.

- Loan Assets Under Management: ₹1.33 lakh crore, +37% YoY – an all-time high.

Brokerage Reactions:

- Morgan Stanley: Target ₹2,920, citing strong ROE, EPS growth, and negligible asset quality risk.

- Jefferies: Target ₹2,950, highlighting gold price tailwinds and LTV ratio upside.

- Motilal Oswal: Neutral with ₹2,790 target, noting premium valuation at 2.4x FY27 PBV.

Financial Strength & Growth Drivers

- Dominance in the Gold Loan Segment:

Muthoot commands a leading market share, benefiting from India’s rising gold prices and rural credit demand. - High ROE & Profitability:

ROE is expected to sustain around 21% over FY26–28. - Low Asset Quality Risk:

Gold loans have minimal NPAs due to the secured nature of collateral. - Loan-to-Value Flexibility:

Potential to enhance yields if LTV caps are revised upward.

Muthoot Finance Share Valuation & Investment Outlook

At ₹2,789.50, Muthoot Finance trades at:

- P/E: 20.98

- P/BV: ~2.4x (FY27 est.)

- Dividend Yield: 0.93%

While valuations are not cheap, the premium reflects consistent earnings growth, strong asset quality, and defensive positioning in uncertain markets.

Investment Suggestion:

- For Existing Investors: Hold – The stock has momentum and could see up to 18% upside in the medium term, but partial profit booking near ₹2,950–₹3,000 is advisable.

- For New Investors: Buy on Dips – Wait for a pullback towards ₹2,600–₹2,650 to enter with a 2–3 year horizon.

Key Risks

- Gold Price Volatility: Sharp declines could affect loan book growth.

- Regulatory Changes: Changes in LTV caps or NBFC regulations could impact margins.

- Interest Rate Movements: A significant rise in funding costs may compress spreads.

Conclusion

Muthoot Finance share remains a compelling story of steady wealth creation, backed by record profitability, a strong balance sheet, and a dominant position in the gold loan market. For long-term investors, it continues to shine — much like the metal it lends against.

NSDL Share Price: Can India’s Largest Depository Turn Into a Multibagger?

Disclaimer: The views, opinions, recommendations, and suggestions expressed in this article are based on public market data and brokerage commentary. They do not represent the views of News 24 Media. Investors should consult a qualified financial advisor before making any investment or trading decisions.

Discover more from

Subscribe to get the latest posts sent to your email.

3 COMMENTS