Mazagon Dock, BDL Lead Defence Stock Surge as Israel-Iran War Deepens Global Security Woes

Mumbai | June 17, 2025

Indian defence stocks rallied sharply on Monday, fueled by escalating geopolitical tensions as the Israel-Iran war entered its fifth day. Investors rushed into defence-linked counters, betting on long-term government orders and rising export potential amid global instability.

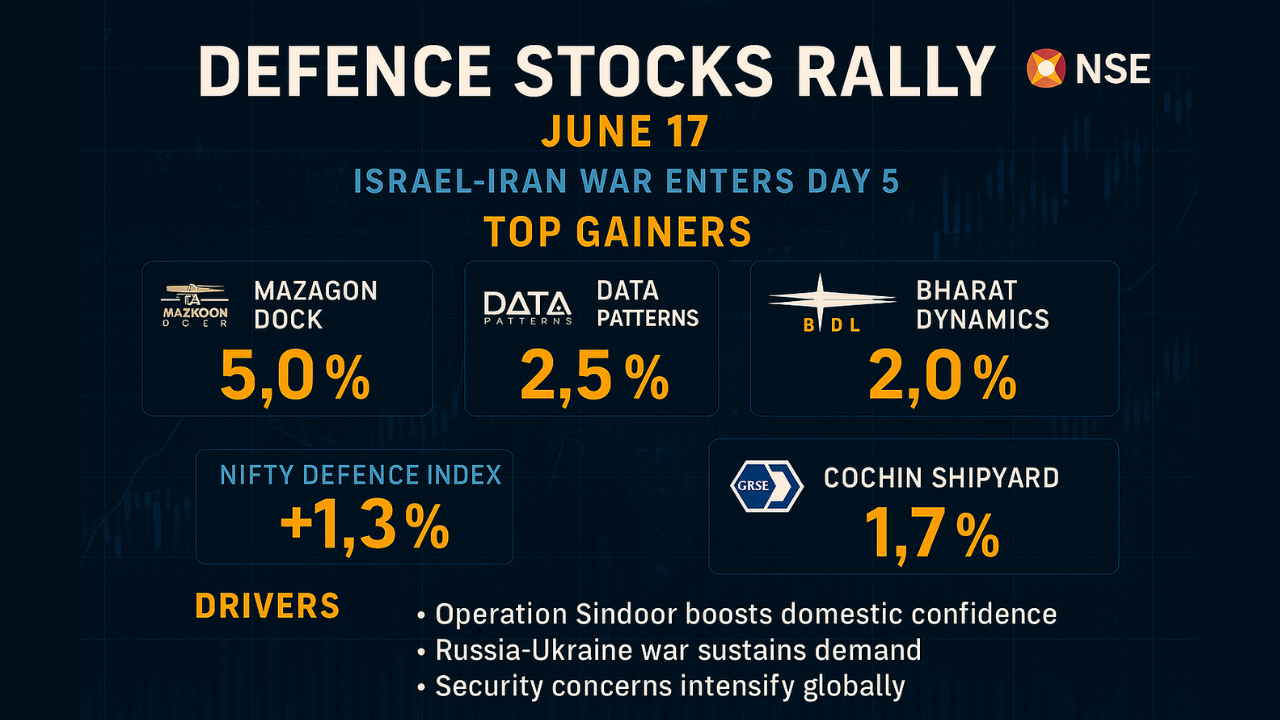

The Nifty Defence Index rose 1.3% intraday, with several frontline stocks posting gains of up to 5%.

📈 Defence Stocks Gain Amid Global Uncertainty

The current Defence Stock rally is being driven by a convergence of geopolitical flashpoints:

- The Israel-Iran conflict, heightening global demand for defence preparedness

- India’s Operation Sindoor reaffirms confidence in indigenous military capabilities

- The ongoing Russia-Ukraine war, which continues to stretch global defence supply chains

Leading the charge was Mazagon Dock Shipbuilders, which jumped nearly 5% to ₹3,322, reversing a four-day losing streak. Other notable gainers included:

- Data Patterns: +2.5%

- Bharat Dynamics Ltd (BDL): +2%

- Garden Reach Shipbuilders & Engineers (GRSE): +2%

- Cochin Shipyard: +1.7%

- Paras Defence, BEML, and DCX India: +1% each

📊 Analyst Commentary: Optimism With a Note of Caution

Despite the strong uptrend, analysts urge caution. Analysts are of the view:

“Defence stocks rallied post Operation Sindoor, corrected due to profit-booking, and are now climbing again due to Middle East tensions. Long-term prospects remain positive, but valuations are heating up. Investors should be selective.”

💰 India’s Expanding Defence Outlook

India’s defence ecosystem has become increasingly strategic:

- Current defence spending stands at 1.9% of GDP, with expectations to rise to 3–4% over the next decade

- The Indian government aims to export defence equipment worth ₹25,000 crore by FY26, with Make-in-India policies driving private and public sector collaboration

🧠 The Bigger Picture

With global instability redefining defence priorities, India’s manufacturing and export potential in the sector is receiving a structural boost. While the Israel-Iran war adds short-term triggers, the long-term case for India’s defence companies is being underpinned by policy support, strategic alliances, and technological upgrades.

Investors are advised to balance short-term momentum with valuation checks and long-term fundamentals.

#MazagonDock #BDL #DefenceStocks #IsraelIranConflict #OperationSindoor #IndianMarkets #MakeInIndia

Bharat Dynamics, Indian defence stocks, Israel-Iran conflict stock market, Nifty Defence Index rally, Operation Sindoor impact

Discover more from

Subscribe to get the latest posts sent to your email.

2 COMMENTS