HDFC Bank: Unleashing Financial Power and Investor Confidence

Let’s delve into the performance of HDFC Bank stock and explore why it stands out in the market.

HDFC Bank: A Financial Powerhouse

Overview of HDFC Bank

HDFC Bank Limited, headquartered in Mumbai, India, is the country’s largest private-sector bank by assets. As of May 2024, it ranks as the world’s tenth-largest bank by market capitalization. The Reserve Bank of India has designated HDFC Bank as a Domestic Systemically Important Bank (DSIB), emphasizing its significance in the financial landscape.

Financial Strengths

1. Robust Financials

HDFC Bank’s financials are impressive. Let’s take a closer look:

- Revenue: In the fiscal quarter ending March 2024, HDFC Bank reported a staggering revenue of ₹668.89 billion, reflecting a remarkable year-on-year growth of 113.20%.

- Operating Expenses: Despite its rapid expansion, the bank managed its operating expenses effectively, totalling ₹491.28 billion in the same period.

- Net Income: HDFC Bank’s net income stood at ₹176.22 billion, demonstrating its profitability.

- Net Profit Margin: The bank’s net profit margin, a key indicator of efficiency, reached 26.35%.

- Earnings per Share (EPS): With an EPS of ₹21.67, HDFC Bank continues to reward its shareholders.

2. Dividends and Investor-Friendly Policies

- HDFC Bank consistently provides sustained dividends to its shareholders. This investor-friendly approach has contributed to its popularity among investors.

- The bank’s commitment to maintaining a healthy dividend yield (currently at 1.11%) reinforces its reputation as a reliable investment choice.

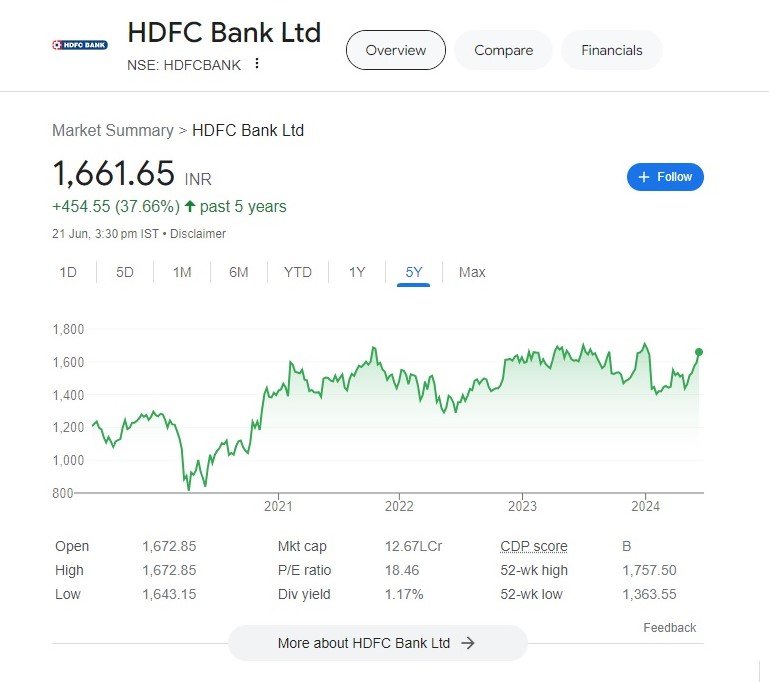

Market Performance

- Over the past year, HDFC Bank’s share price has shown resilience, with a 1-year return of -0.44%.

- Short-term gains have been promising: a 1-month return of 9.40% and a 5-day return of 1.45%.

- The bank’s market capitalization stands at a substantial ₹12.15 trillion.

Conclusion

HDFC Bank’s strong financials, investor-friendly policies, and sustained dividends position it as a formidable player in the banking sector. As India’s best bank, it continues to thrive, offering stability and growth potential to investors.

Remember, investing involves risks, and thorough research is essential. Always consult a financial advisor before making investment decisions.

More interesting Articles

Hindustan Aeronautics Limited (HAL) Stock Analysis: Soaring High on Defence Ministry’s RFP

Beat the Scorching Summer of 2024: Top 5 Air Conditioner Brands Keeping India Cool

Vodafone’s Strategic Exit: A $2.3 Billion Stake Sale in Indus Towers

Hyundai Motor Company Unveils Alcazar Facelift: A Game-Changer for the Auto Industry

Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround – News 24 Media

Raymond Group Stocks Jump Over 8.5% to Set New High:

Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Lucrative PSU Stocks: Public Sector Undertakings in India Reap Rewards from Government Policies

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Ride into the Future with Royal Enfield’s Electrifying 2024 Lineup

Top 10 Inverter Air Conditioners in India: Unmatched Cooling and Energy Savings

Vladimir Putin AI Deepfake Film Makes Waves at Cannes, Sells Big

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Discover more from

Subscribe to get the latest posts sent to your email.

5 COMMENTS