HAL Share Price Target: Sukhoi Engine Clearance Set to Drive Order Book Growth—What’s Next for Hindustan Aeronautics?

HAL Share Price Target: Sukhoi Engine Clearance to Boost Order Book—What’s Next for Hindustan Aeronautics Stock?

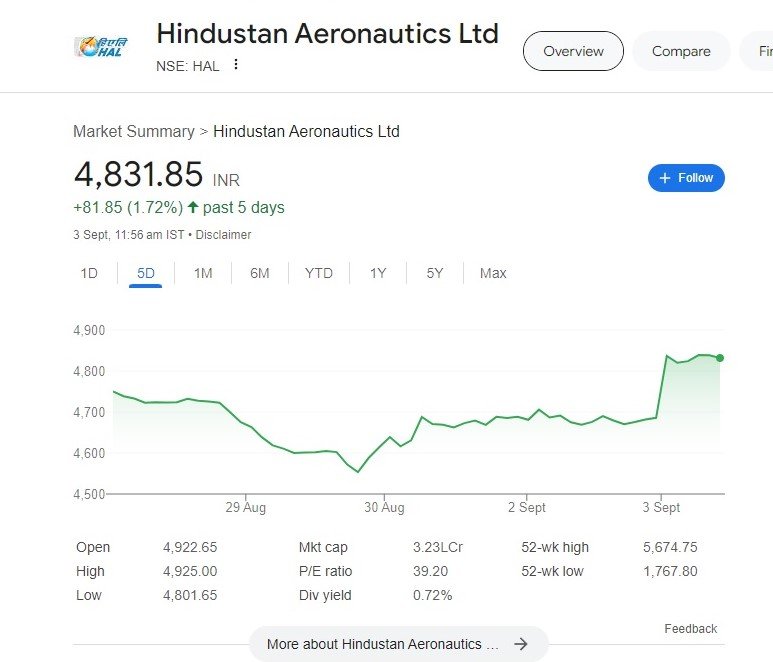

Bengaluru, September 3, 2024 – Hindustan Aeronautics Limited (HAL), India’s leading aerospace and defence company, is poised for a significant boost in its order book following the recent clearance of the Sukhoi engine project. The approval, which has been eagerly awaited by both investors and industry insiders, is expected to drive HAL’s stock upward, despite ongoing challenges with the Tejas MK I A orders.

Sukhoi Engine Clearance: A Game-Changer for HAL share price

The clearance of the Sukhoi engine project marks a pivotal moment for HAL, as it positions the company to secure substantial orders from the Indian Air Force (IAF) and other defence agencies. The project involves the indigenization and production of critical components for the Sukhoi fighter jets, a move that aligns with the Indian government’s push for self-reliance in defense manufacturing.

With this clearance, HAL is expected to see a significant uptick in its order book, adding to its already robust pipeline of defence contracts. The project is not only crucial for HAL’s revenue growth but also for enhancing its technical capabilities and global competitiveness.

Challenges with Tejas MK I A Orders

While the Sukhoi engine clearance is a positive development, HAL has been grappling with issues related to the Tejas MK I A orders. The indigenous light combat aircraft (LCA) program, which was intended to be a cornerstone of HAL’s future growth, has faced delays and cost overruns. These challenges have raised concerns among investors about the timely execution of the Tejas orders and its impact on HAL’s financial performance.

However, analysts remain optimistic about HAL’s long-term prospects, citing the company’s strong fundamentals and its strategic importance to India’s defence sector. The resolution of issues related to the Tejas program, combined with new orders from the Sukhoi project, could potentially offset any short-term setbacks.

Multi-Year Double-Digit Earnings Growth Potential for HAL Share Price

Despite the challenges, HAL is well-positioned to deliver multi-year double-digit earnings growth, driven by a combination of its existing order book, new project clearances, and strategic partnerships. According to analysts at Antique, the company’s earnings growth potential, coupled with its robust return ratio profile of 20%, makes it an attractive investment opportunity.

The return ratio, a key metric for evaluating a company’s financial health, indicates that HAL is effectively managing its capital to generate strong returns for shareholders. With a return on equity (RoE) of 20%, HAL is outperforming many of its peers in the defence sector, underscoring its efficiency and profitability.

Valuation: An Attractive Buy?

At its current valuation, HAL Share Price is considered attractively priced by market experts, particularly when taking into account its growth potential and strong return profile. The HAL Share Price valuation reflects a balance between the risks associated with project execution and the upside from new orders and strategic initiatives.

Analysts believe that the recent developments, including the Sukhoi engine clearance, could act as a catalyst for HAL Share Price, pushing it towards higher price targets. The company’s ability to secure new orders, streamline its production processes, and resolve issues with the Tejas program will be critical in determining the stock’s trajectory in the coming months.

Where Is HAL Share Price Headed?

The road ahead for HAL appears promising, with several key projects in the pipeline and strong government support for indigenization in defense manufacturing. The company’s focus on innovation, combined with its strategic importance to national security, positions it well for sustained growth.

In the short term, HAL Share Price may experience volatility as the market digests news of the Sukhoi engine clearance and ongoing challenges with the Tejas orders. However, in the medium to long term, the stock is expected to trend upward, driven by robust earnings growth, a strong order book, and attractive valuations.

Investors looking for exposure to India’s burgeoning defence sector may find HAL to be a compelling option, especially given its track record of delivering consistent returns and its strategic importance in the country’s defence ecosystem.

More Articles

Jio Finance Share Soars 9%: Will JFS Break Free from Consolidation?

Dalal Street Week Ahead: Key Factors to Watch as PMI Data and Global Trends Shape Market Outlook

NBCC News: Stock Price Soars 18% Amid Excitement Over Bonus Issue Plans

Anil Ambani Reliance Infrastructure Leads Sharp Decline in Group Stocks on August 26, 2024

Zydus Share Price Tumbles After Controversial Sterling Biotech Acquisition

Nvidia and OpenAI Hit with Lawsuit Over Alleged Unauthorized Use of YouTube Videos for AI Training

Reliance Power Share Price Soars: Anil Ambani-Owned Stock Hits Upper Circuit, What’s Next?

Elon Musk to Join Trump’s Cabinet? A Bold Move That Could Transform Tech and Policy!

Technical Glitches Mar Trump Musk Interview, Sparking Meme Frenzy and Online Debate

Sena Leader’s Drunk Son Allegedly Driving BMW in Fatal Mumbai Accident: Sources

Rahul Gandhi: The Controversial Political Leader

Linguistic Diversity Shines: MPs Take Oath in Sanskrit, Hindi, and Other Languages

Om Birla Re-Elected as Lok Sabha Speaker: A Milestone of Bipartisan Unity

Asaduddin Owaisi’s Controversial Oath Sparks Debate on His Integrity in Parliament

Bhartruhari Mahtab Appointed as Pro-Tem Speaker for the 18th Lok Sabha: A Key Leadership Role

Discover more from

Subscribe to get the latest posts sent to your email.

4 COMMENTS