From Seed to Skyrocket: The Unprecedented Rise of Fertilisers And Chemicals Travancore Ltd with a ₹70,000 Crore Market Cap

From Seed to Skyrocket: The Unprecedented Rise of Fertilisers And Chemicals Travancore Ltd with a ₹70,000 Crore Market Cap

Certainly! Let’s delve into the fascinating story of Fertilisers And Chemicals Travancore Ltd (FACT), a company that has witnessed remarkable growth over the past five years.

The Rise of Fertilisers And Chemicals Travancore: A Multibagger Journey

Background and Historical Context

Fertilisers And Chemicals Travancore Ltd, incorporated in 1943, holds the distinction of being the first fertilizer manufacturing company in independent India. Headquartered in Kochi, Kerala, it is also the largest Central Public Sector Undertaking in the state. The company operates under the ownership of the Government of India and falls under the administrative control of the Ministry of Chemicals and Fertilizers.

Market Capitalization Surge

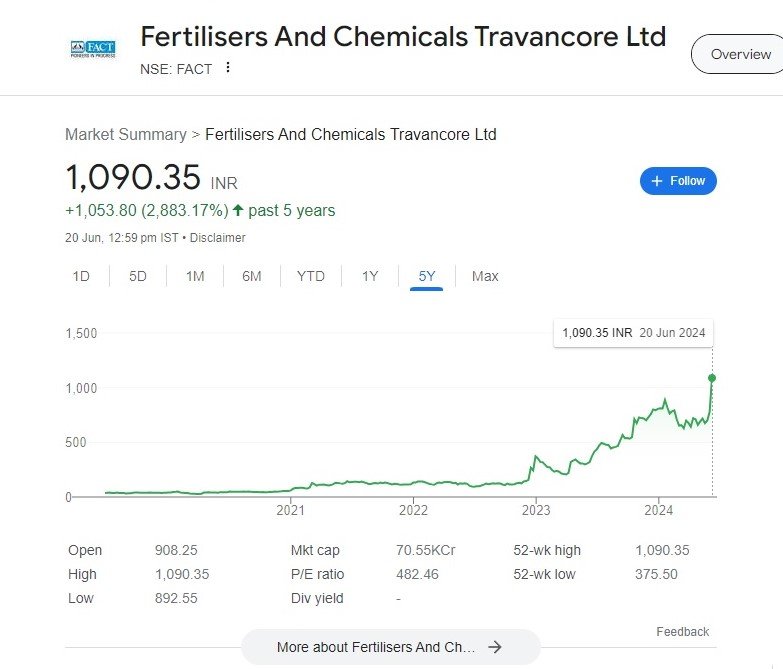

In recent times, Fertilisers And Chemicals Travancore Ltd has been on an extraordinary trajectory. As of now, its stock price has crossed the ₹1,000 mark, commanding a staggering market capitalization of ₹70,000 crore. This meteoric rise has caught the attention of investors and analysts alike.

Five-Year Performance

Let’s explore Fertilisers And Chemicals Travancore Ltd’s performance over the past five years:

- 2020: The stock began its ascent, doubling or more in value.

- 2021: The upward trend continued, contributing to the impressive surge.

- 2022: Another year of substantial growth.

- 2023: The stock maintained its momentum, further boosting investor confidence.

- 2024: With the recent surge, the stock has nearly tripled in value since 2019, reaching an astounding 2,883% return.

Investor Caution and Free Float Considerations

However, there’s a crucial caveat: the stock’s free float available for trading is limited. Based on the March shareholding pattern:

- The government still owns a whopping 90% stake in Fertilisers and Chemicals Travancore.

- The National Investment Fund (NIF) holds an 8.56% stake.

- The public, including Mutual Funds and Insurance companies, collectively owns only a 1.44% stake.

This low free float can lead to higher price volatility and impact. As an investor, exercise caution when dealing with such stocks. The pendulum can swing both above and below fair value, and liquidity challenges may arise.

Financial Snapshot

- Revenue: In the March 2024 quarter, Fertilisers And Chemicals Travancore Ltd’s revenue stood at ₹10.62 billion, reflecting a 14.98% YoY decrease.

- Operating Expense: Fertilisers And Chemicals Travancore Ltd incurred ₹3.28 billion in operating expenses, down 30.61% YoY.

- Net Income: Despite the surge, FACT reported a net loss of ₹612 million, compared to a net profit of ₹165.6 crore in the same quarter last year.

- Net Profit Margin: The net profit margin was -5.76%, indicating the challenges faced by the company.

- Earnings per Share (EPS): Not available in the provided data.

- EBITDA: Earnings before interest, taxes, depreciation, and amortization were ₹330.72 million.

- Effective Tax Rate: The company paid taxes at a rate of 62.65%.

Short-Term and Long-Term Targets

While the stock has already achieved remarkable gains, predicting precise targets can be challenging due to its unique dynamics. However, here’s a general outlook:

- Short-Term: Given the recent upper circuit surge, short-term targets could be volatile. Monitor market developments closely.

- Long-Term: With strong fundamentals and government backing, FACT may continue its growth trajectory. However, consider the limited free float and exercise prudence.

Remember, investing involves risks, and thorough research is essential. Always consult a financial advisor before making investment decisions. FACT’s journey is a testament to the power of persistence and strategic positioning in the market.

In summary, FACT’s multi-bagger journey is awe-inspiring, but tread carefully, keeping the unique circumstances in mind.

Happy investing!

More interesting Articles

Hindustan Aeronautics Limited (HAL) Stock Analysis: Soaring High on Defence Ministry’s RFP

Beat the Scorching Summer of 2024: Top 5 Air Conditioner Brands Keeping India Cool

Vodafone’s Strategic Exit: A $2.3 Billion Stake Sale in Indus Towers

Hyundai Motor Company Unveils Alcazar Facelift: A Game-Changer for the Auto Industry

Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround – News 24 Media

Raymond Group Stocks Jump Over 8.5% to Set New High:

Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Lucrative PSU Stocks: Public Sector Undertakings in India Reap Rewards from Government Policies

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Ride into the Future with Royal Enfield’s Electrifying 2024 Lineup

Top 10 Inverter Air Conditioners in India: Unmatched Cooling and Energy Savings

Vladimir Putin AI Deepfake Film Makes Waves at Cannes, Sells Big

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Paytm News- in Turmoil: COO Bhavesh Gupta’s Resignation Adds to the Storm – Latest Updates

Discover more from

Subscribe to get the latest posts sent to your email.

2 COMMENTS