Ambuja Cement Share Price Soars: Solidifying Market Dominance with Penna Cement Acquisition

Ambuja Cement Share Price Soars: Solidifying Market Position with Strategic Penna Cement Acquisition

Let’s delve into the transformative journey of Ambuja Cements, highlighted by its recent strategic acquisition of Penna Cement. This pivotal move has not only reshaped the competitive landscape of the cement industry but also offers investors a unique opportunity to reassess their portfolios. In this comprehensive analysis, we will explore the implications of this acquisition, examine Ambuja Cements’ stock performance, and uncover potential targets that could drive future growth and profitability. Join us as we unravel the key insights and strategic advantages that make Ambuja Cements a compelling consideration for savvy investors.

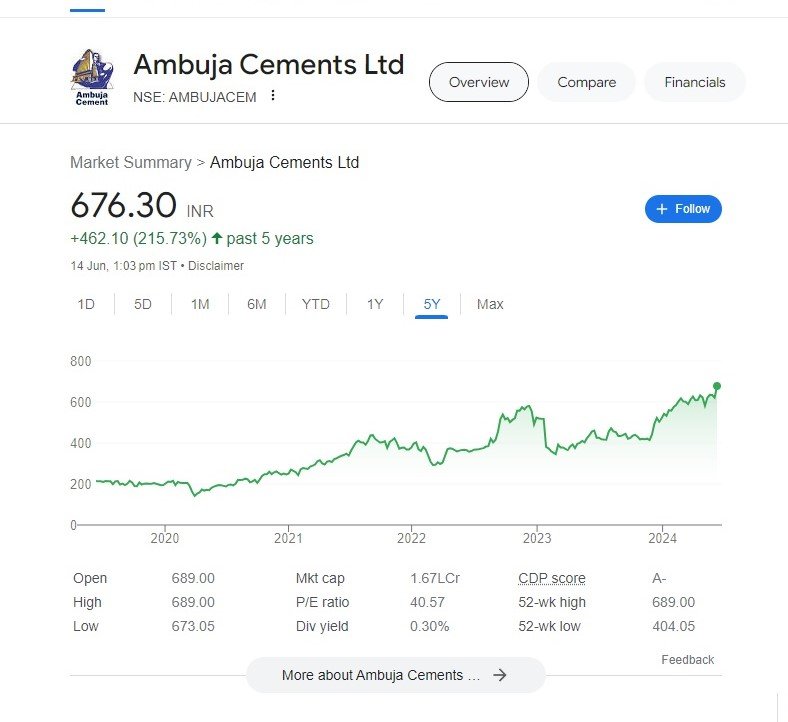

Ambuja Cement Share Price

Ambuja Cement Share Price (NSE: AMBUJACEM)

Recent Acquisition:

- Ambuja Cements recently acquired 100% shares of Penna Cement Industries Limited for an enterprise value of ₹10,422 crore.

- This acquisition positions Ambuja to expand its market presence in South India and reinforces its position as a pan-India leader in the cement industry.

The acquisition of Penna Cement by Ambuja Cements has significant implications for Ambuja Cement Share Price market share:

- Overall Group Capacity: The acquisition adds 14 million metric tons per annum (MTPA) to the group’s capacity, bringing the total to 89 MTPA. The Adani Group aims for 140 MTPA by 2028.

- Pan-India Market Share: Ambuja’s market share is expected to increase by nearly 2% across India due to this acquisition.

- South Indian Market: In the South Indian market, Ambuja’s market share is projected to rise by nearly 8%.

Stock Performance:

- Ambuja Cement Share Price Current Price: ₹677.70 (as of June 14, 2024, 01:04 PM IST).

- 52-Week High: ₹689.00; 52-Week Low: ₹404.05.

- 1-Year Return: +46.16%; 5-Year Return: +210.45%3.

- The stock has shown consistent growth over the past few years.

Short-Term Analysis:

- Ambuja Cement Share Price Price Chart: The 1-day, 5-day, and 1-month charts indicate positive momentum, with recent gains of 4.53%, 9.98%, and 14.49%, respectively.

- Support Levels: Immediate support lies around ₹673.05.

- Short-Term Target: Considering the recent uptrend, a short-term target could be around ₹705.26 to ₹714.01.

Long-Term Analysis:

- Analyst Consensus: The average target price of Ambuja Cement Share Price is ₹644.11, implying an upside of 8.28% from the current price.

- Long-Term Forecast (2029): WalletInvestor predicts a stock price of ₹1,056.64.

- 5-Year Forecast: Potential increase to ₹1,181.92.

- 10-Year Forecast: Potential increase to ₹1,635.22.

Conclusion:

- Ambuja Cements’ acquisition of Penna Cement enhances its growth prospects.

- Investors should consider both short-term gains and long-term potential when evaluating this stock.

Remember, always conduct your own research and consult a financial advisor before making investment decisions. 🚀📈

More Articles

Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround – News 24 Media

Raymond Group Stocks Jump Over 8.5% to Set New High:

Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Lucrative PSU Stocks: Public Sector Undertakings in India Reap Rewards from Government Policies

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Ride into the Future with Royal Enfield’s Electrifying 2024 Lineup

Top 10 Inverter Air Conditioners in India: Unmatched Cooling and Energy Savings

Vladimir Putin AI Deepfake Film Makes Waves at Cannes, Sells Big

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Paytm News- in Turmoil: COO Bhavesh Gupta’s Resignation Adds to the Storm – Latest Updates

Discover more from

Subscribe to get the latest posts sent to your email.