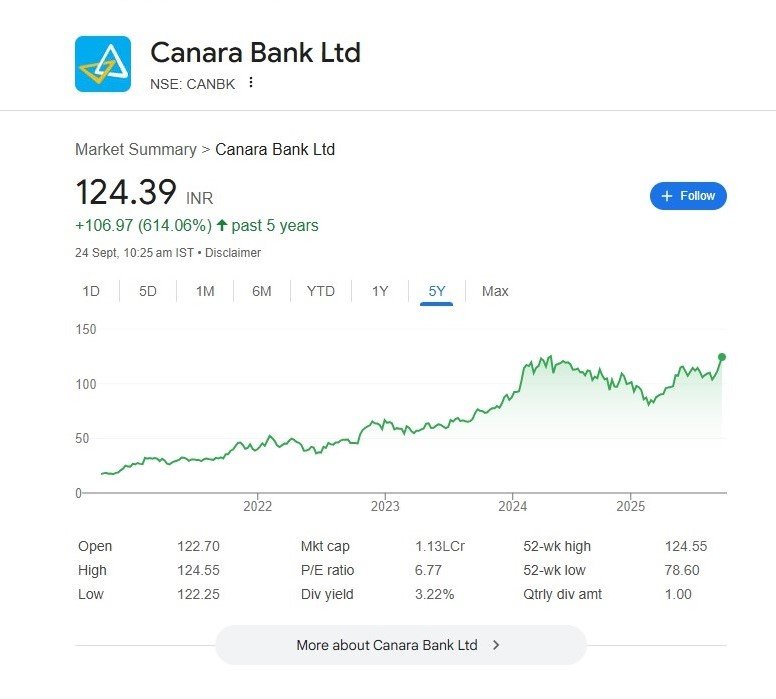

Canara Bank Share Price Soars 614% in 5 Years — Can This PSU Banking Star Keep the Momentum Alive?

Canara Bank share price has delivered a phenomenal 614% return over the past five years, cementing its position as one of the strongest performers among PSU banks. Currently trading at ₹124.39, the stock has touched a fresh 52-week high of ₹124.55, riding on improved profitability, stable asset quality, and strong credit growth. With a low P/E of 6.77 and a dividend yield of 3.22%, Canara Bank offers both growth and income potential. But the big question for investors remains — can this PSU banking giant sustain its stellar momentum in the coming years?

Performance Snapshot (Past 5 Years)

- Current Price: ₹124.39 (as of Sept 24, 2025)

- 5-Year Growth: +614.06%

- 52-Week Range: ₹78.60 – ₹124.55

- Market Cap: ₹1.13 Lakh Crore

- P/E Ratio: 6.77 (attractive vs industry average)

- Dividend Yield: 3.22% (steady income play)

Canara Bank share price Price Journey

- 2019–2021: The Canara Bank share price traded below ₹50, reflecting stress in the banking sector from rising NPAs.

- 2022: Canara Bank share price Momentum picked up after banking sector reforms and strong PSU recapitalisation, crossing ₹60.

- 2023: The Canara Bank share price rally accelerated with improved asset quality and declining NPAs; the stock crossed ₹100.

- 2024: Strong credit growth & improved profitability pushed shares above ₹120, making new highs.

- 2025: Despite volatility, shares remain stable above ₹120, consolidating gains.

Financial Strengths Driving Growth

- NPA Reduction: Canara Bank has consistently reduced Gross and Net NPAs, restoring investor confidence.

- Credit Growth: Loan book expansion, especially in retail and MSME, has supported earnings.

- Profitability: Recent quarters have seen double-digit growth in net profits due to lower provisioning.

- Dividend Play: Dividend yield at 3.22% adds income security for long-term investors.

- Valuation Comfort: At a P/E of 6.77, the stock remains undervalued compared to private peers.

Risks & Challenges

- PSU Banking Risks: Government ownership can lead to slower decision-making compared to nimble private banks.

- Global Economic Risks: Rising interest rates and global slowdown could impact credit demand.

- Competition: Aggressive private sector peers continue to capture higher-margin business.

Investment View at Canara Bank share price – Buy, Hold, or Sell?

- Short-Term View (6–12 months): The stock may face resistance near ₹130 due to recent highs. Profit-taking could create volatility.

- Medium-Term View (1–3 years): With improving balance sheet health, NPAs under control, and steady credit demand, Canara Bank can outperform broader PSU peers.

- Long-Term View (3–5 years): Strong dividend yield, low P/E, and solid earnings visibility make Canara Bank a value buy for long-term investors.

👉 Verdict:

- Long-term investors can hold/add at current levels, given undervaluation and strong fundamentals.

- Traders may adopt a buy-on-dips strategy with a stop-loss near ₹110.

The views, opinions, and analyses presented in this article are for informational and educational purposes only. They do not constitute financial advice or investment recommendations. Stock market investments are subject to market risks, and past performance is not indicative of future results. Investors are strongly advised to consult with a certified financial advisor or registered broker before making any investment or trading decisions. Neither the author nor News 24 Media shall be held responsible for any financial losses arising from investment actions based on this article.

Netweb Technologies Share Price Surges 30% in Five Sessions – What’s Driving the Rally?

Canara Bank share price, Canara Bank stock analysis, Canara Bank investment, PSU bank shares, multibagger bank stocks, Canara Bank share news, Canara Bank financials.

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS