🧾 Nirmala Sitharaman Tables Revised New Income Tax Bill in Lok Sabha, Marking Historic Tax Reform

In a landmark move aimed at overhauling India’s six-decade-old tax framework, Finance Minister Nirmala Sitharaman introduced the Revised New Income Tax Bill, 2025, in the Lok Sabha on Monday. The fresh draft replaces the withdrawn February version. It incorporates nearly all recommendations from the Select Committee chaired by BJP MP Baijayant Panda, promising a modern, simplified, and litigation-resistant direct tax code.

🏛 Why the February Draft Was Withdrawn

The earlier draft, tabled on February 13, was withdrawn last week due to drafting errors, ambiguous phrasing, and corrections to cross-references. Explaining the need for a fresh draft, Sitharaman said:

“Suggestions have been received which are required to be incorporated to convey the correct legislative meaning… The fresh draft will serve as the basis for replacing the 1961 Act.”

📜 Key Features of the Revised New Income Tax Bill

The updated legislation seeks to replace the Income Tax Act of 1961, which has undergone over 4,000 amendments and become unwieldy. The new bill features:

- Simplified legal language for better public understanding

- Digital-first, faceless assessment framework to reduce corruption and harassment

- Streamlined deductions and procedures to lower litigation

- Retention of existing tax slabs and capital gains rules for stability

- “Trust first, scrutinise later” philosophy to ease the taxpayer experience

🔍 Major Recommendations Accepted from the Select Committee

| Clause | Recommendation |

|---|---|

| Clause 21 | Remove “in normal course”; clarify actual vs. deemed rent for vacant properties |

| Clause 22 | Apply 30% standard deduction post municipal tax; extend pre-construction interest deduction |

| Clause 19 | Allow commuted pension deductions for non-employees |

| Clause 20 | Prevent taxation of temporarily unused commercial properties as “house property” income |

💡 Notable Provisions of New Income Tax Bill

- Anonymous Donations — Limited to purely religious trusts, excluding those engaged in social services

- TDS Refunds — Taxpayers can claim refunds even after the ITR deadline without penalties

- Tax Notices — Mandatory prior notice and taxpayer response before action

🧮 What’s Next?

If passed, the New Income Tax Bill will replace the 63-year-old Income Tax Act, ushering in one of India’s most ambitious tax reforms. Parliamentary Affairs Minister Kiren Rijiju praised the process of withdrawal and reintroduction, calling it “legislative efficiency in action.”

✍️ Author’s View

The Indian taxation system has historically been complex, unpleasant for taxpayers, prone to corruption, and largely modelled on outdated British-era rules. Since independence, the tax structure has remained an unwanted and ever-increasing burden on citizens.

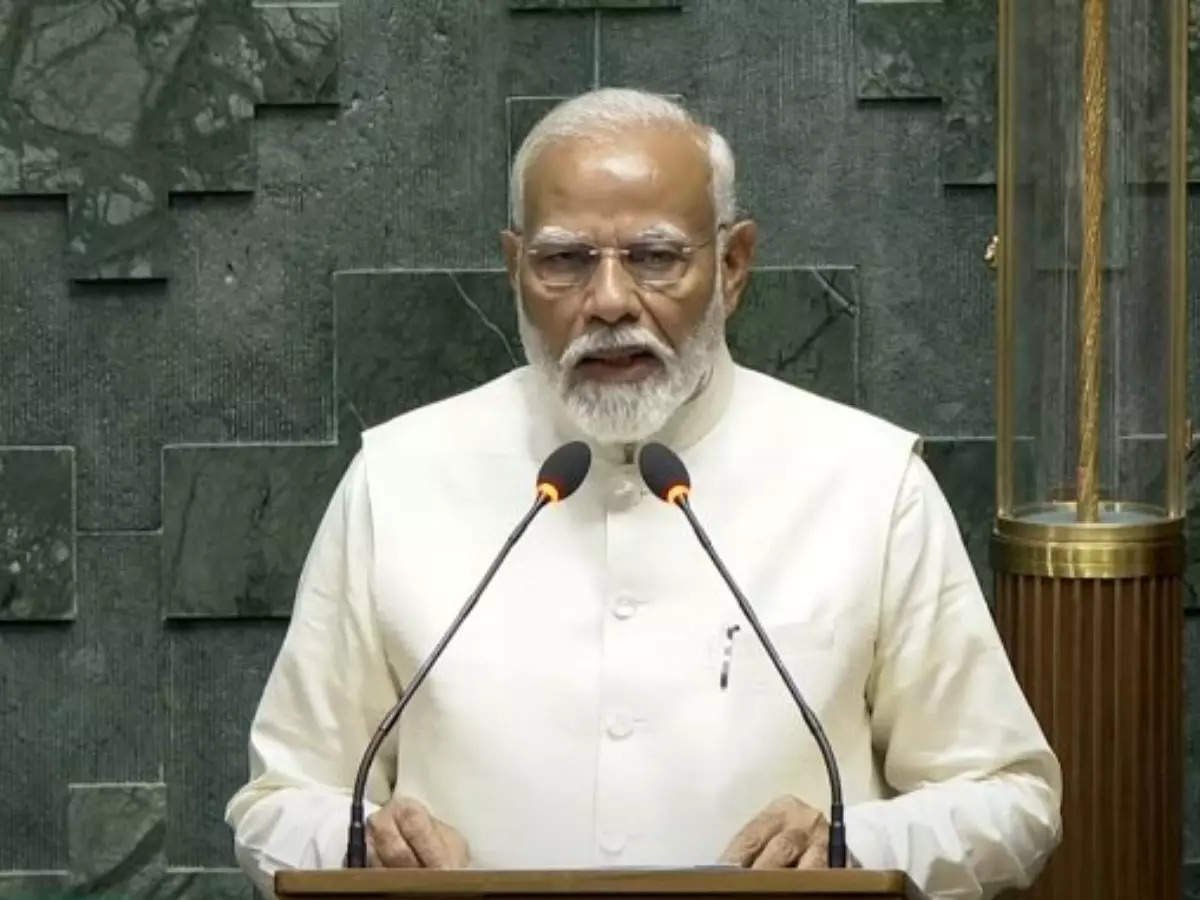

However, under Prime Minister Narendra Modi’s leadership, gradual progress has been made towards reform, albeit slowly. This revised New Income Tax Bill is a positive and much-needed step towards making taxation transparent, convenient, and minimally intrusive, reducing direct interaction with bureaucrats.

While the move comes late in the game, it deserves appreciation as the first real step towards a taxpayer-friendly system. To truly transform India’s tax environment, more such big reforms must follow at regular intervals.

Discover more from

Subscribe to get the latest posts sent to your email.