📈 HDFC Bank Share Price Analysis: Solid Fundamentals Amid Short-Term Pressure — Should You Buy Now?

By: Special Market Correspondent

Published: July 20, 2025

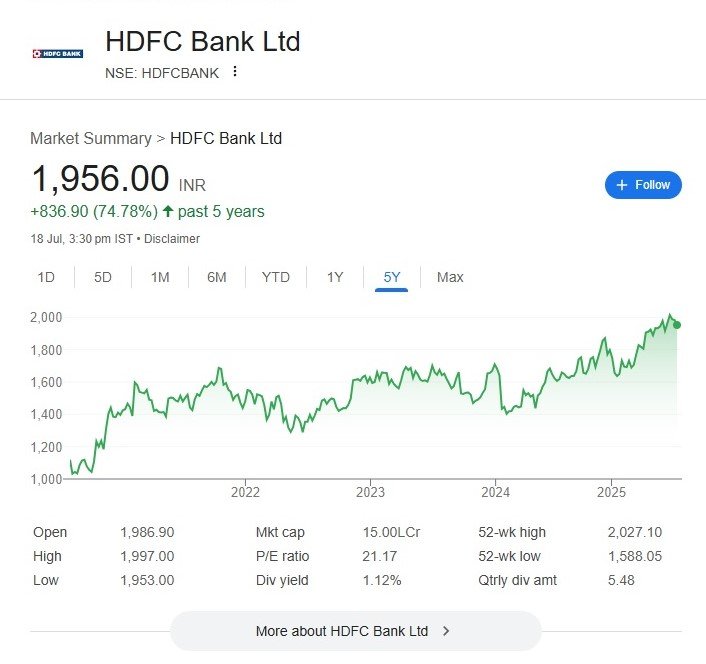

🔍 Overview: HDFC Bank Share Price 5-Year Performance Snapshot

Over the last five years, HDFC Bank share price (NSE: HDFCBANK) has demonstrated a consistent uptrend, posting a +74.78% gain with the stock climbing from around ₹1,120 to ₹1,956 as of July 18, 2025. The bank’s performance has been largely fueled by strong fundamentals, growth in retail and wholesale banking, and solid operational management.

- 📅 5-Year Change: +₹836.90

- 💰 Current Price: ₹1,956

- 📊 52-Week High: ₹2,027.10

- 🧮 52-Week Low: ₹1,588.05

- 💹 Market Cap: ₹15.00 Lakh Crore

- 💸 P/E Ratio: 21.17

- 🏦 Dividend Yield: 1.12%

🧾 Q1 FY26: Financial Highlights & Concerns

Despite a one-time pre-tax gain of ₹9,128 crore from the IPO of HDB Financial Services, HDFC Bank’s consolidated net profit fell to ₹16,258 crore (down from ₹16,475 crore YoY). This decline was attributed to a substantial increase in provisions totalling ₹14,442 crore, including ₹9,000 crore in floating provisions, signalling a cautious asset quality outlook.

📌 Other Key Figures:

- Standalone NII: ₹31,438 crore (+5.4% YoY)

- Net Interest Margin (NIM): 3.35% (vs 3.46% Q4FY25)

- Operating Expenses: ₹17,434 crore (+4.9% YoY)

- GNPA: 1.40% | Net NPA: 0.47%

- Return on Assets (ROA): 0.48%

- Capital Adequacy Ratio: 19.88%

- CASA Ratio: 33.9% (declined from 38.2%)

💸 Dividend & Bonus: A Sweetener for Long-Term Investors

The bank declared a special interim dividend of ₹5/share and a 1:1 bonus issue, both of which offer significant shareholder value. With the record date for the bonus issue set for August 27, HDFC Bank seems keen to reward its loyal investor base even amid short-term earnings moderation.

📉 Market Reaction & Street Expectations for HDFC Bank Share Price

Ahead of the earnings announcement, the stock dipped by 1.56% to ₹1,959. According to a marketing analyst, the Street was expecting a 7.4% YoY rise in net profit and a 7% rise in NII, both of which the bank underperformed.

Market Cap Surge: How ICICI Bank and HDFC Bank Are Leading the Charge in India’s Financial Boom

📈 Investment Verdict: Is HDFC Bank a Buy?

Despite the near-term dip in profitability, HDFC Bank Share Price remains a pillar of India’s private banking space:

✅ Strong fundamentals & high CAR

✅ Conservative provisioning signals prudence

✅ Bonus issue enhances retail appeal

✅ Stable margin outlook as rate cuts filter in

❗ Risks:

- Declining CASA ratio

- Slower-than-expected loan growth

- Margin compression due to deposit repricing

Recommendation for HDFC Bank Share Price: LONG-TERM BUY (Accumulation Phase)

Investors with a 3–5 year horizon can consider accumulating on dips, especially with the bonus issue and dividend cushioning the downside.

📌 Bottom Line

HDFC Bank share price has demonstrated resilience over the past five years, even amid global economic shifts, rising interest rates, and pandemic recovery. While short-term earnings may seem underwhelming, its conservative financial strategy and commitment to shareholder value make it a top choice for long-term, low-risk investors.

HDFC Bank Eyes ₹9,373 Crore Windfall as HDB Financial Services IPO Breaks Records

India Interest Rate: A Delicate Balancing Act

Discover more from

Subscribe to get the latest posts sent to your email.

2 COMMENTS