Let’s dive into an in-depth analysis of UltraTech Cement’s recent acquisition of a 23% stake in India Cements and explore its implications for investors.

UltraTech Cement’s Acquisition of India Cements: A Strategic Move

Background:

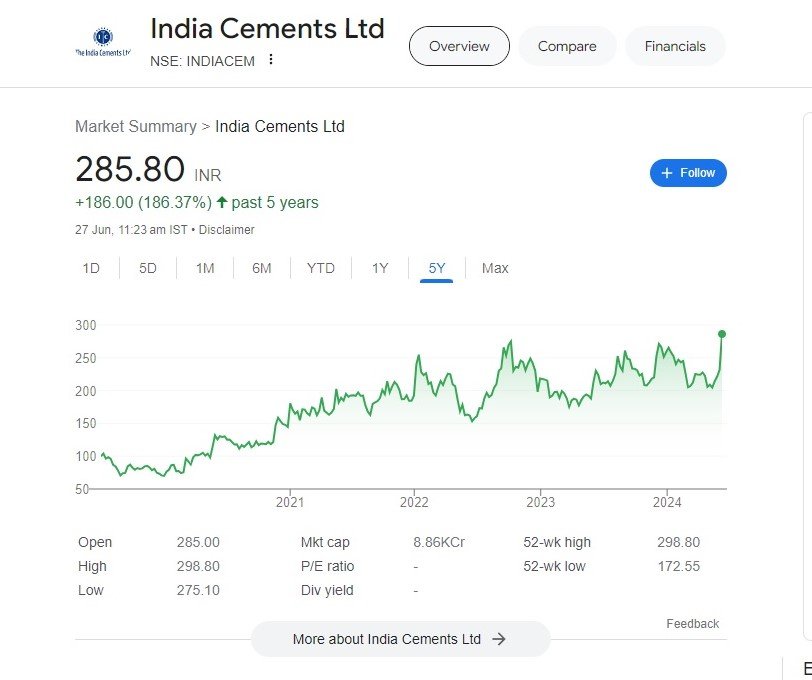

- Deal Details: UltraTech Cement, a leading cement manufacturer, has approved the acquisition of around 23% stake in Chennai-based India Cements Ltd. The deal is valued at approximately ₹1,885 crore, with UltraTech purchasing 70.6 million shares of India Cements at a price of up to ₹267 per share.

- Strategic Rationale: UltraTech’s move aims to strengthen its market position and expand its footprint in the cement industry. India Cements’ established presence in South India complements UltraTech’s existing operations.

Investor Considerations:

- Stock Price Movement:

- Following the news, UltraTech’s stock surged 6% to a fresh record high of ₹11,811, while India Cements’ shares rose 12.5% to ₹295.75.

- Investors should closely monitor both stocks for further price movements.

- Five-Year Stock Price Chart:

- India Cements’ stock has grown significantly over the past five years, with a 116.81% increase.

- Analyzing historical trends can provide insights into potential future performance.

- Financial Health of India Cements:

Net Loss:

- In the last 12 months (TTM), India Cements reported a net loss of ₹227.34 Crore.

- This financial performance warrants scrutiny, especially considering the company’s market capitalization.

Debt Situation:

- India Cements carries a concerning debt of ₹2,618.23 Crore.

- Investors should closely monitor the company’s efforts to manage its debt burden.

Operational Challenges:

- The company faces operational challenges, particularly related to higher power and fuel requirements compared to industry averages.

- These challenges have contributed to a rating of BB+ by CareEdge.

Recent Performance:

- While past returns have been positive, the recent quarter saw a 14.28% decline in earnings and a 14.7% drop in revenue.

- Investors should consider these trends when evaluating investment opportunities.

Let’s explore the financial health of UltraTech Cement:

Debt-to-Equity Ratio:

- UltraTech Cement has a total shareholder equity of ₹602.8 billion and a total debt of ₹103.0 billion, resulting in a debt-to-equity ratio of 17.1%.

- A lower debt-to-equity ratio generally indicates a healthier financial position.

Interest Coverage Ratio:

- UltraTech Cement’s EBIT (Earnings Before Interest and Taxes) stands at ₹98.2 billion, leading to an interest coverage ratio of 10.1.

- This ratio reflects the company’s ability to cover interest payments from its operating profits.

Valuation Metrics:

- The company operates with high earnings multiples, with an expected P/E ratio of 43.79 for the current fiscal year and 35.85 for the next fiscal year.

- UltraTech Cement’s enterprise value-to-sales ratio is also relatively high at 4.39 times its current sales.

Investment Considerations:

- Industry Outlook: Understand the cement industry’s overall outlook, demand-supply dynamics, and growth prospects.

- Company Fundamentals: Evaluate India Cements’ revenue growth, profitability, and operational efficiency.

- Risk Assessment: Consider risks related to debt levels, regulatory changes, and market volatility.

- Long-Term View: Assess whether the investment aligns with your long-term financial goals.

Conclusion:

UltraTech Cement’s acquisition of India Cements signifies a strategic move, but investors should conduct thorough due diligence. Analyze financials, study the industry landscape, and consider your risk tolerance before making investment decisions.

Remember that investing involves risks, and it’s essential to consult with a financial advisor to tailor your investment strategy to your specific circumstances.

More interesting Articles

Quant Mutual Fund Unveiled: The Front-Running Scandal and SEBI’s Investigation

HDFC Bank: Unleashing Financial Power and Investor Confidence

Hindustan Aeronautics Limited (HAL) Stock Analysis: Soaring High on Defence Ministry’s RFP

Beat the Scorching Summer of 2024: Top 5 Air Conditioner Brands Keeping India Cool

Vodafone’s Strategic Exit: A $2.3 Billion Stake Sale in Indus Towers

Hyundai Motor Company Unveils Alcazar Facelift: A Game-Changer for the Auto Industry

Reliance Power Emerges Debt-Free: Anil Ambani’s Remarkable Turnaround – News 24 Media

Raymond Group Stocks Jump Over 8.5% to Set New High:

Ixigo IPO: Flying High or Turbulence Ahead? A Deep Dive into India’s Profitable Travel Tech Unicorn

Adani Group Stocks Surge on Anticipated NDA Victory: What Investors Need to Know

Lucrative PSU Stocks: Public Sector Undertakings in India Reap Rewards from Government Policies

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Ride into the Future with Royal Enfield’s Electrifying 2024 Lineup

Top 10 Inverter Air Conditioners in India: Unmatched Cooling and Energy Savings

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS