Trident Ltd (Trident Share), a prominent player in the home textiles and paper products space, has given its shareholders reason to cheer. The stock surged 7% on July 25, touching an intraday high of ₹33.66, following an impressive 90% YoY jump in net profit for the April–June 2025 quarter. This performance has reignited investor interest in the textile major, which supplies to global retail giants like Walmart and Target.

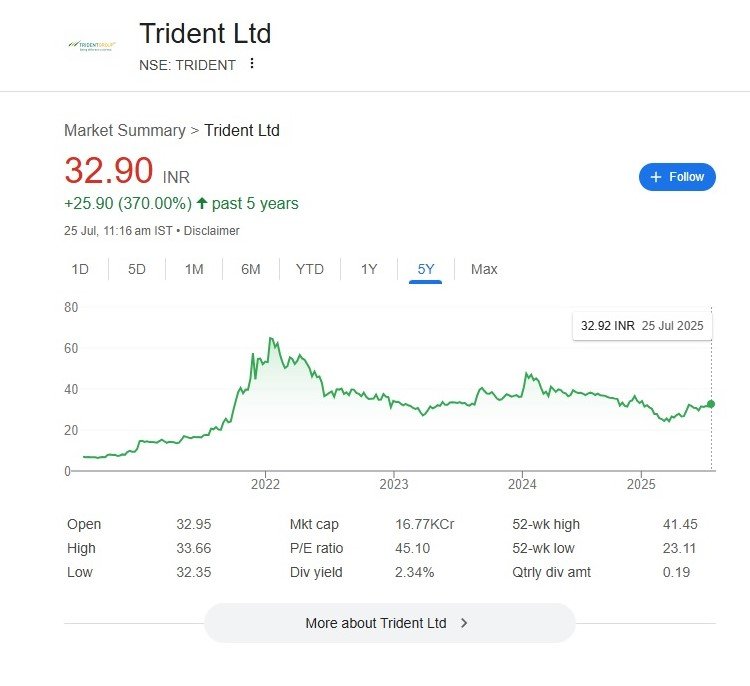

🔍 5-Year Trident Share Price Analysis

Over the past five years, Trident share price has delivered a whopping 370% return, climbing from sub-₹10 levels to the current ₹32.90 mark as of July 25, 2025. Here’s a snapshot of the movement:

- 📊 High Volatility: The stock hit its peak in early 2022, rising above ₹60 amid a market boom. However, it saw a prolonged correction throughout 2023.

- 📉 Sideways Consolidation: From 2023 to mid-2025, the stock moved largely sideways, fluctuating between ₹23–₹40.

- 💹 Recent Momentum: In the last 3 months, Trident shares have gained 20%, signalling a potential trend reversal fueled by improved fundamentals.

📊 Key Financial Highlights (Q1 FY26)

- Net Profit: ₹140 crore (↑ 90% YoY)

- Revenue: ₹1,706.8 crore (↓ 2.1% YoY)

- EBITDA: ₹291 crore (↑ 29.3% YoY)

- Operating Margin: Expanded from 12.9% to 17%

The sharp profit growth came despite a slight dip in revenue, mainly due to a 7% reduction in overall expenses and softening cotton prices, which have long impacted margins.

💼 Other Key Developments

- 🏦 Fundraising Plans: The board has approved raising ₹500 crore via Non-Convertible Debentures (NCDs).

- 📈 Volume Spike: Over 5 crore shares traded on July 25 — far higher than the one-week average of 96 lakh shares.

- 💰 Dividend Yield: 2.34%, appealing to income-seeking investors.

📉 Valuation & Market Metrics

- Current Price: ₹32.90

- 52-Week Range: ₹23.11 – ₹41.45

- P/E Ratio: 45.10

- Market Cap: ₹16,770 crore

- Dividend Yield: 2.34%

While the P/E ratio of 45 appears elevated, the recent turnaround in profitability justifies a re-rating by the market.

📈 Investment Outlook: Should You Buy Trident Shares?

Pros:

- Strong Q1 performance with margin expansion.

- Lower raw material costs are improving profitability.

- Strong brand presence with global retail tie-ups.

- The dividend yield is attractive for long-term holders.

Cautions:

- Volatile price history.

- P/E is still relatively high compared to the industry average.

- Any spike in cotton prices or operational inefficiencies may reverse gains.

Recommendation: Trident is a hold with a positive bias. Short-term traders may consider booking partial profits around ₹35–₹38 levels, while long-term investors can accumulate on dips for a target of ₹45–₹50 over 12–18 months, backed by improved earnings visibility.

Final Word

With a stellar track record of 370% returns over five years and a sharp recovery in profitability, Trident shares are back in the spotlight. While short-term volatility remains a risk, the long-term fundamentals and demand outlook in global home textiles remain encouraging.

Trident share, Trident share price, Trident stock analysis, Trident Ltd Q1 result, Trident shares rally, Trident share price target, Trident profit growth, Should I buy Trident shares, Trident cotton prices impact, Trident NCD approval, Trident stock forecast, Trident share latest news, Best textile stock India, Trident vs competitors, Trident dividend yield

Recent Posts

- Anil Ambani’s Reliance Group Responds to ED Raids, Denies Wrongdoing in Yes Bank Loan Probe

- Olectra Greentech Share Price Jumps 33% in a Month: Breakout or Bubble? Full Stock Analysis Inside

- Fake Embassy Westarctica Busted in Ghaziabad: How Harshvardhan Jain Exploited the Fantasy of Micronations and Ran a Phantom Diplomatic Mission

Discover more from

Subscribe to get the latest posts sent to your email.