Full Steam Ahead: RVNL Share Price Reach Record Heights After South Eastern Railways Order

Let’s dive into an informative article about Rail Vikas Nigam Ltd (RVNL share price), its recent share price surge, dividend history, and potential investment outlook.

Rail Vikas Nigam Ltd (RVNL share price): A Brief Overview

Rail Vikas Nigam Limited (RVNL) is an Indian central public sector enterprise that serves as the construction arm of the Ministry of Railways. Its primary focus is on project implementation and transportation infrastructure development. RVNL was incorporated in 2003 to meet the country’s growing infrastructural needs and fast-track railway projects. As a Navratna PSU under the administrative control of the Ministry of Railways, RVNL plays a crucial role in creating railway equipment and constructing vital rail infrastructure.

Recent Share Price Surge

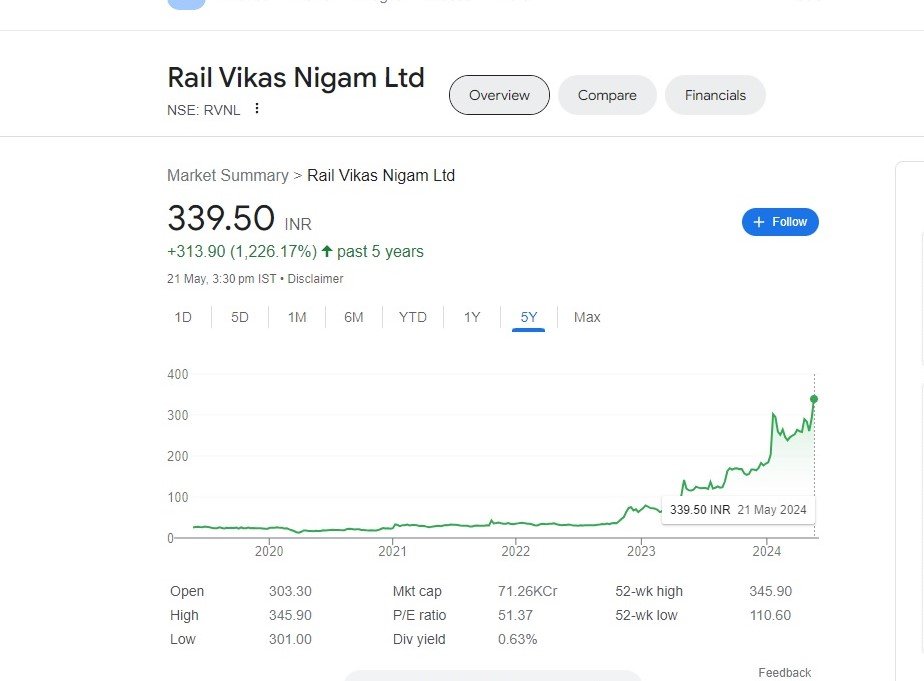

RVNL’s share price recently soared to an all-time high of ₹345.90 on the NSE following a large order win from South Eastern Railways. The announcement of receiving a letter of acceptance for an order worth ₹239 crore contributed to this surge. Investors have taken notice of this positive development, leading to increased demand for RVNL shares.

Five-Year Share Price Chart

Let’s analyze RVNL share price performance over the past five years:

- 1-Year Return: RVNL share price has risen by an impressive 146.26% over the last year.

- 5-Year Return: Over the past five years, RVNL share price has surged by a remarkable 1281.11%.

Dividend History

RVNL has consistently paid dividends over the last few years. In the past five years, it has declared dividends seven times, totalling ₹4.98 per share. While the dividend yield is currently modest at 0.73%, it’s essential to consider the overall growth potential and the company’s financial health.

Investment Outlook

Short-Term Perspective

RVNL’s recent order win and strong share price performance suggest positive momentum. However, investing in any stock at an all-time high requires caution. Short-term investors should closely monitor market trends, technical indicators, and any news related to RVNL share price. The average target price of ₹130 indicates a potential upside of 7% from the current market price.

Long-Term Perspective

For long-term investors, RVNL share price’s growth story remains compelling. The company’s role in railway infrastructure development, government support, and ongoing projects position it well for the future. Consider the following targets:

- Short-Term Target (T1): ₹345.22

- Intermediate Target (T2): ₹348.67

- Long-Term Target (T3): ₹355.29

Remember to set appropriate stop-loss levels to manage risk effectively. RVNL’s fundamentals, project pipeline, and execution capabilities will play a crucial role in determining its long-term success.

In conclusion, while RVNL share price is currently at an all-time high, investors should weigh the potential gains against the risks. Conduct thorough research, consult financial advisors, and consider your investment horizon before making any decisions. Always diversify your portfolio and invest based on your risk tolerance and financial goals.

Disclaimer: This article provides general information and does not constitute investment advice. Please consult a financial professional before making any investment decisions.

More Articles

Haldiram’s Ownership Battle: Blackstone Challenges Bain-Temasek for Control

Tata Motors Share Price Analysis: Exploring Q4 FY24 Results and Market Performance!

Abbott India Ltd: Your Time-Tested Investment Gem for Steady Growth and Dividend Rewards!

Unlocking Wealth: How HPCL and BPCL Bonus Shares Transformed Investors’ Fortunes

Warren Buffett’s Bright View on India: Exploring Untapped Opportunities with Berkshire Hathaway

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Paytm News- in Turmoil: COO Bhavesh Gupta’s Resignation Adds to the Storm – Latest Updates

REC Share Price Skyrockets: Q4 FY’24 Net Profit Soars to New Heights!

Arvind Krishna: Architecting IBM’s Future and Leading Industry Transformation

GM Breweries Ltd: Brewing Success in Every Sip, A Closer Investment Opportunity

Resurgent Yes Bank Share Price: A Financial Phoenix’s Triumphant Ascent

ICICI Bank App Glitch: ICICI Bank Data Breach Exposes 17,000 Credit Card Holders

Cloud Evolution: IBM’s $6.4 Billion Acquisition of HashiCorp Sets New Industry Standards

EU Sets TikTok Ultimatum Over ‘Addictive’ New App Feature

The Fitness Tracker Market in India and South Asia: Challenges and Growth Prospects

Fixed Deposit Rates in India: A Beacon of Hope for Savvy Investors

Navigating the Storm: How the Iran Israel War Impacts Indian Economy and Investor Sentiments

Discover more from

Subscribe to get the latest posts sent to your email.

2 COMMENTS