Netweb Technologies Share Price Surges 30% in Five Sessions – What’s Driving the Rally?

Netweb Technologies has emerged as one of India’s most exciting technology stocks, with Netweb Technologies Share Price rallying an impressive 30% in just five sessions. Backed by a ₹1,734 crore strategic order to power India’s sovereign AI infrastructure, the company has attracted strong investor interest, pushing its five-year gains to over 245%. But with valuations now running high, investors are asking: is this the right time to buy, hold, or wait?

Netweb Technologies Share Price Five-Year Performance Overview

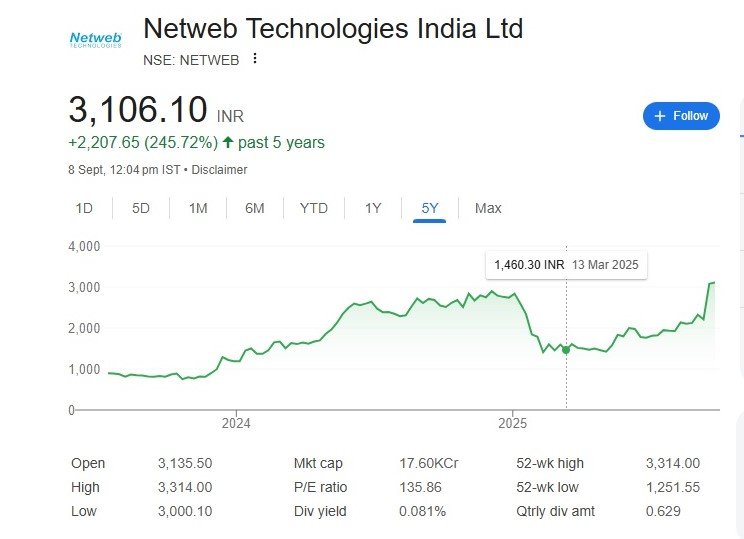

Netweb Technologies India Ltd. has delivered extraordinary shareholder value over the last five years. As per the uploaded chart:

- 5-Year Growth: The share price has surged 245.72%, climbing from around ₹900 levels in early 2020 to ₹3,106.10 as of September 8, 2025.

- Volatility: The stock hit a 52-week high of ₹3,314.00 and a 52-week low of ₹1,251.55, reflecting significant volatility but also strong upward momentum.

- Recent Momentum: In the last five trading sessions alone, the stock has surged 30%, indicating renewed investor interest.

What’s Fueling the Netweb Technologies Share Price Rally?

The surge is driven by a strategic order worth ₹1,734 crore that Netweb Technologies secured to power India’s sovereign AI infrastructure. This order involves:

- Deployment of GPU-accelerated AI platforms built on NVIDIA’s Blackwell architecture.

- Strengthening India’s compute capacity under the IndiaAI Mission, enabling indigenous large multimodal models and scalable AI solutions.

- Execution timeline scheduled between Q4 FY26 and H1 FY27.

This deal is considered a nationally strategic project, cementing Netweb’s role in India’s AI and high-performance computing (HPC) ambitions.

Financial Snapshot of Netweb Technologies share price

- Market Cap: ₹17,600 crore, placing it in the mid-cap category.

- P/E Ratio: 135.86 – significantly above industry averages, suggesting investors are pricing in strong future growth.

- Dividend Yield: 0.081% – the company remains a growth-oriented play rather than a dividend stock.

- Quarterly Performance: Netweb has consistently shown strong revenue and profit growth, boosted by demand in AI, HPC, and data centre solutions.

Strategic Strengths

- Strong Industry Position: A leading OEM in high-end computing solutions (HCS), specialising in AI systems, HPC clusters, and private cloud platforms.

- Technological Edge: Proprietary platforms like Tyrone Camarero AI, optimised for generative AI and exascale computing.

- Government Partnerships: Close collaboration with the Indian government adds both credibility and long-term revenue visibility.

Risks to Watch

- High Valuation: The current P/E of 135.86 indicates rich valuations. Any earnings miss could lead to sharp corrections.

- Execution Risk: Large government projects often face delays. Timely execution of the ₹1,734 crore order is critical.

- Global Competition: Competing with global giants in AI and HPC could pressure margins.

Netweb Technologies share price and Investment Outlook – Buy, Sell, or Hold?

For investors, the Netweb Technologies share price represents both high growth potential and high risk.

- For Long-Term Investors: HOLD or accumulate on dips. Netweb’s positioning in India’s sovereign AI mission makes it a multi-year growth story.

- For Traders: Exercise caution. The stock has rallied 30% in five sessions and could see near-term profit booking. A stop-loss near ₹2,850 is advisable.

- Analyst View: With India aggressively pushing AI and HPC infrastructure, Netweb remains a key beneficiary. Brokerages are bullish but recommend staggered buying to balance volatility.

✅ Verdict: Netweb Technologies is emerging as a strategic AI play for India, with strong fundamentals and government-backed growth. While valuations are stretched, the long-term story remains compelling.

Netweb Technologies share price, Netweb Technologies stock analysis, Netweb AI order ₹1,734 crore, Netweb Technologies sovereign AI project, Netweb Technologies stock surge, Netweb stock buy or sell, Netweb Technologies investment

PM Modi Unveils Vikram 32-bit Processor: India’s First Indigenous Space-Grade Semiconductor Chip

Disclaimer: The views and investment suggestions above are based on market data and company fundamentals. This is not financial advice. Investors should consult certified financial advisors before making decisions.

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS