Mazagon Dock Share Analysis: Soaring 58% in a Year — Is This Defence Giant Ready for Its Next Breakout

Mazagon Dock Shipbuilders Ltd (NSE: MAZDOCK) has emerged as a standout performer in India’s defence and shipbuilding sector, delivering an impressive 58% return over the past year. As one of the leading public sector undertakings (PSUs) in naval shipbuilding, its stock has not only captured investor attention but also demonstrated strong momentum backed by robust fundamentals and growing strategic relevance. This article takes a closer look at the stock’s 1-year price trend, key support and resistance levels, and what the future may hold for this defence powerhouse.

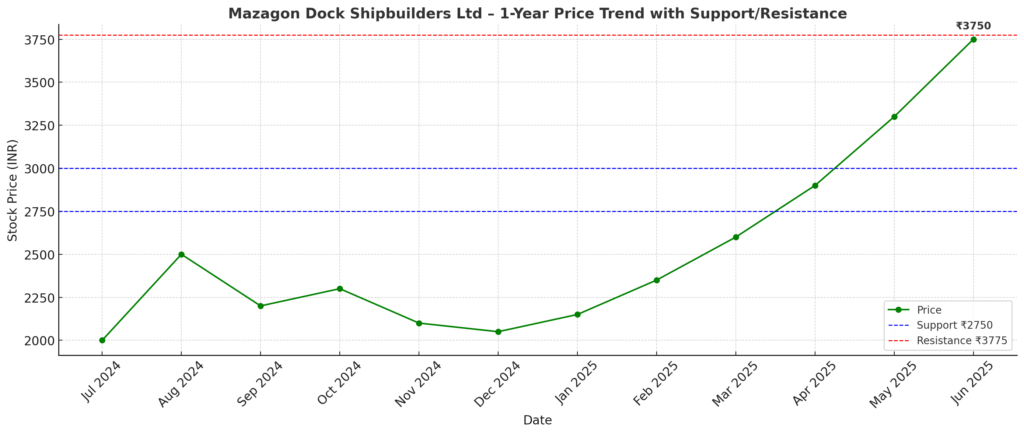

🚀 Stock Performance Overview of Mazagon Dock (1-Year):

- Current Price: ₹3,304.50 (as of June 17, 2025)

- 1-Year Return: +58.18% – Outstanding performance with strong momentum.

- 52-Week Range: ₹1,918.05 – ₹3,775.00

- Recent Trend: Reached an all-time high of ₹3,775 in June 2025 before a mild pullback.

📊 Key Financial Indicators:

| Metric | Value | Interpretation |

|---|---|---|

| P/E Ratio | 55.23 | High – reflects premium valuation, typical of growth stocks. |

| Market Cap | ₹1.33 Lakh Cr | Large-cap – offers stability with institutional interest. |

| Dividend Yield | – | No data provided – likely a reinvestment-driven company. |

📈 Technical Analysis:

- Strong Uptrend:

- The Mazagon Dock stock has seen a steady upward trajectory post-January 2025.

- Higher highs and higher lows confirm a bullish trend.

- Breakout Zone:

- The breakout above ₹3,000 was crucial – sustained buying pushed it toward ₹3,775.

- The current dip is a healthy pullback, not a breakdown yet.

- Support Zones:

- ₹3,000 – psychological support and previous resistance.

- ₹2,750 – strong technical support seen in April-May 2025.

- Resistance Zone:

- ₹3,775 – recent 52-week high; may act as near-term resistance.

💼 Fundamental & Sectoral Context:

- Defence PSU Advantage: Mazagon Dock benefits from increasing government focus on defence indigenisation.

- Order Book Strength: Historically strong order book in shipbuilding and submarines.

- Geo-political Boost: Heightened global tensions (e.g., Israel-Iran) often boost sentiment in defence stocks.

Mazagon Dock, BDL Lead Defence Stock Surge as Israel-Iran War Deepens Global Security Woes

📌 Recommendation:

✅ Short-Term Traders:

- Watch for a breakout above ₹3,775 for a fresh rally.

- Ideal buy-on-dip zone: ₹3,000–₹3,100.

- Stop-loss for short-term trades: ₹2,950.

✅ Long-Term Investors:

- Still a strong buy on corrections, given the growth potential in defence manufacturing.

- Consider staggered buying if the stock falls to ₹3,000–₹3,150 levels again.

⚠️ Risks to Watch:

- High Valuation (P/E > 55): Needs earnings to grow to justify current pricing.

- Correction Risk: After sharp rallies, profit booking may drag the price temporarily.

- Sector Dependence: Tied heavily to government defence spending and orders.

🔚 Conclusion:

Mazagon Dock Shipbuilders Ltd is a high-momentum, fundamentally strong defence PSU with strong institutional interest. Given its growth trajectory and sectoral tailwinds, it’s a favorable stock for both swing traders and long-term investors, though best accumulated during market pullbacks.

⚠️ Disclaimer:

This content is for informational purposes only and not investment advice. Stock trading involves risk. Always consult a SEBI-registered advisor before investing. Do not rely solely on this analysis.

Discover more from

Subscribe to get the latest posts sent to your email.

4 COMMENTS