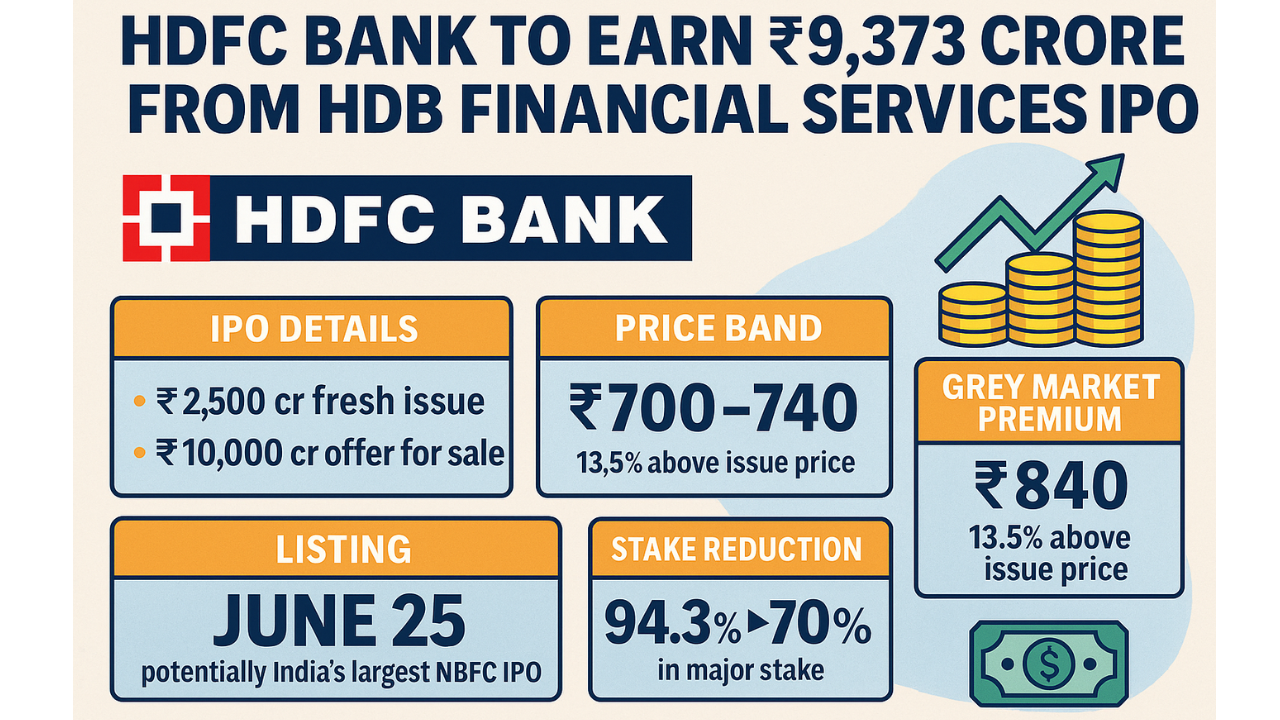

Mumbai, June 21, 2025 – In a landmark move set to reshape India’s non-banking financial landscape, HDFC Bank is poised to earn a staggering ₹9,373 crore profit from the Initial Public Offering (IPO) of its NBFC arm, HDB Financial Services. The HDB Financial Services IPO, opening June 25, is being hailed as the largest NBFC public issue in India’s market history.

🔍 HDB Financial Services IPO Breakdown: Massive Value Unlocked

According to the Red Herring Prospectus (RHP):

- ₹2,500 crore fresh equity issue

- 135.13 million shares offered by HDFC Bank under Offer for Sale (OFS)

- Price band: ₹700–₹740 per share

- Grey Market Premium (GMP): ₹840 — a 13.5% premium over the upper band

With HDFC Bank’s average share acquisition cost at ₹46.4, the profit at ₹740 per share will net the bank ₹9,373 crore, making this one of the most lucrative divestments in recent financial history.

📈 Strategic Timeline

- Anchor Book Opens: June 24

- IPO Window: June 25–27

- Allotment Date: June 30

- Expected Listing: July 2 (BSE & NSE)

Retail investors can bid in lots of 20 shares, requiring a minimum investment of ₹14,800.

💡 Why It Matters

HDB Financial Services IPO is more than just a cash grab. As an Upper Layer NBFC, the RBI guidelines required HDB to go public by September 2025. The capital raised will bolster Tier-1 capital and fuel future lending growth, especially in SME, consumer lending, and microfinance.

Post-HDB Financial Services IPO, HDFC Bank’s stake will reduce from 94.3% to ~70%, but the company will remain a subsidiary.

🔎 Expert Insight

“This IPO solidifies HDFC’s strategic grip over India’s retail lending space. With robust books, healthy margins, and strong parentage, HDB is set for a blockbuster listing,” said Senior Analyst at stock Market.

HDB Financial Services IPO, HDFC Bank windfall, NBFC IPO India, grey market premium HDB Finance, HDB IPO timeline, HDFC profit from OFS, #HDBFinancialIPO #HDFCBank #NBFC #IPOAlert #WindfallGain #InvestmentNews

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS