Exploring India’s Chabahar Port Agreement with Iran: Benefits and Risks Unveiled

Investigating India’s Chabahar Port Agreement with Iran: Benefits and Potential Risks

Introduction

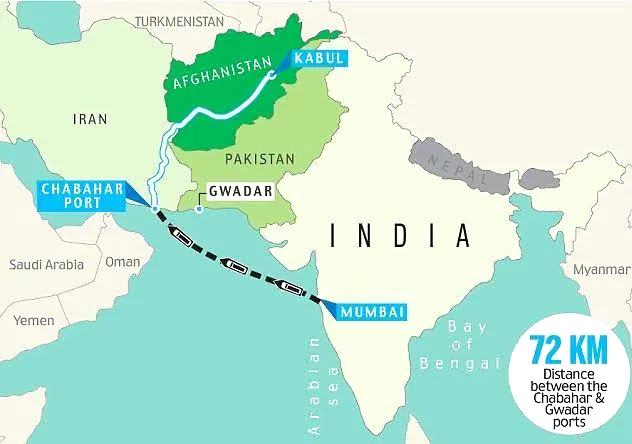

India’s recent 10-year agreement with Iran to manage a part of the Chabahar Port has significant implications for regional connectivity, trade, and geopolitical dynamics. In this investigative article, we’ll explore the benefits of this pact and the potential risks India should consider.

Benefits of the Chabahar Port Agreement

1. Strategic and Economic Significance

The Chabahar Port holds immense strategic importance for India. Here’s why:

- Bypassing Pakistan: The port allows India to bypass Pakistan’s ports in Karachi and Gwadar, providing direct access to landlocked Afghanistan and Central Asian countries. This alternative route is crucial for India’s trade and humanitarian assistance efforts.

- Counterbalancing China’s BRI: By investing in Chabahar, India aims to counterbalance China’s Belt and Road Initiative (BRI). Chabahar offers an alternative transit route, reducing dependence on China-dominated sea routes.

- Gateway to Central Asia: Chabahar serves as a gateway to Central Asia, facilitating trade and economic ties. India aims to integrate it into the International North-South Transport Corridor (INSTC) for efficient cargo movement between India and Central Asia.

2. Economic Opportunities through Chabahar Port

- Trade Expansion: Chabahar opens up new economic opportunities for Indian businesses. It provides an alternative transit route from the busy Persian Gulf and Strait of Hormuz, enhancing trade prospects.

- Investment in Infrastructure: India’s investment in Chabahar’s infrastructure (approximately $370 million) will improve cargo handling capacity, reduce transportation costs, and create jobs in the region.

3. Geopolitical Leverage of Chabahar Port

- Enhanced Regional Influence: Operating Chabahar strengthens India’s relations with Iran and boosts its influence in the region. It also fosters confidence among regional trading communities.

- Strategic Balance: Chabahar allows India to balance its interests vis-à-vis China and Pakistan. It provides a foothold in the region, ensuring India’s voice is heard in geopolitical discussions.

Potential Risks and Challenges

1. US Sanctions

- Warning from the US: The United States has warned that anyone engaging in business dealings with Iran, including Chabahar, may face potential sanctions due to existing US sanctions on Iran.

- Balancing Act: India must carefully navigate its foreign policy objectives while managing Chabahar. While the US acknowledges India’s goals, it emphasizes that sanctions on Iran remain in place.

2. Regional Rivalries

- Pakistan’s Response: Pakistan views Chabahar as a challenge to its Gwadar port, which is part of China’s BRI. Tensions between India and Pakistan could escalate, affecting regional stability.

- China’s Reaction: China closely monitors developments in the region. Chabahar’s growth may be perceived as a counter to China’s influence, potentially leading to diplomatic tensions.

3. Infrastructure and Security

- Infrastructure Development: India must ensure the timely and efficient development of Chabahar Port’s infrastructure. Delays or inefficiencies could hinder its full potential.

- Security Concerns: The region faces security threats from piracy, terrorism, and political instability. India must collaborate with Iran to address security challenges.

Conclusion

India’s Chabahar Port agreement with Iran is a bold move with far-reaching consequences. While the benefits are substantial, India must tread carefully, considering geopolitical complexities and potential risks. As the port becomes operational, India’s ability to manage these challenges will determine its success in reshaping regional trade dynamics.

In summary, India’s Chabahar Port agreement offers strategic advantages, economic opportunities, and geopolitical leverage. However, it also faces risks related to US sanctions, regional rivalries, and infrastructure development. India’s proactive approach and effective management will be crucial for realizing the full potential of Chabahar.

Note: The views expressed in this article are based on available information and analysis. 🌐🔍

More Articles

Tata Motors Share Price Analysis: Exploring Q4 FY24 Results and Market Performance!

Abbott India Ltd: Your Time-Tested Investment Gem for Steady Growth and Dividend Rewards!

Unlocking Wealth: How HPCL and BPCL Bonus Shares Transformed Investors’ Fortunes

Warren Buffett’s Bright View on India: Exploring Untapped Opportunities with Berkshire Hathaway

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Paytm News- in Turmoil: COO Bhavesh Gupta’s Resignation Adds to the Storm – Latest Updates

REC Share Price Skyrockets: Q4 FY’24 Net Profit Soars to New Heights!

Arvind Krishna: Architecting IBM’s Future and Leading Industry Transformation

GM Breweries Ltd: Brewing Success in Every Sip, A Closer Investment Opportunity

Resurgent Yes Bank Share Price: A Financial Phoenix’s Triumphant Ascent

ICICI Bank App Glitch: ICICI Bank Data Breach Exposes 17,000 Credit Card Holders

Cloud Evolution: IBM’s $6.4 Billion Acquisition of HashiCorp Sets New Industry Standards

EU Sets TikTok Ultimatum Over ‘Addictive’ New App Feature

The Fitness Tracker Market in India and South Asia: Challenges and Growth Prospects

Fixed Deposit Rates in India: A Beacon of Hope for Savvy Investors

Navigating the Storm: How the Iran Israel War Impacts Indian Economy and Investor Sentiments

Discover more from

Subscribe to get the latest posts sent to your email.