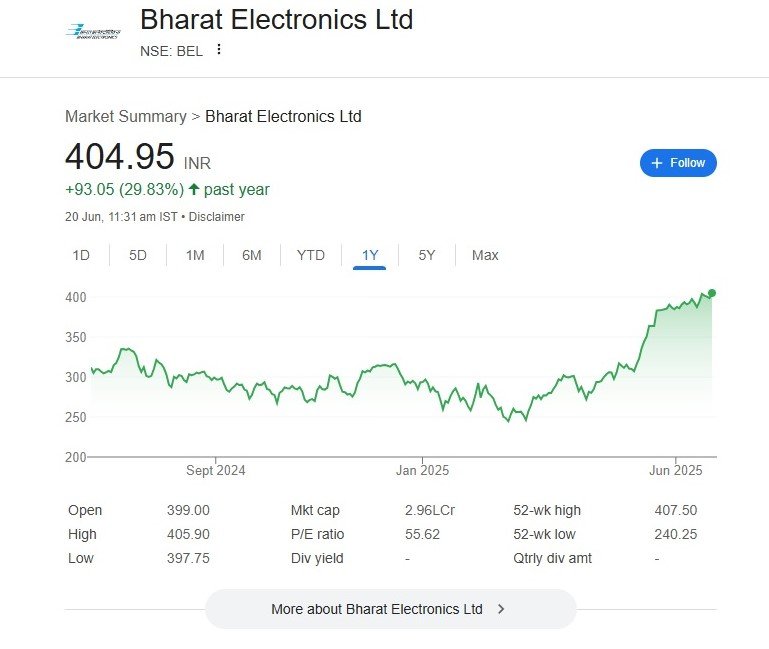

Bharat Electronics Ltd (BEL), a cornerstone in India’s defence and strategic electronics sector, has delivered a solid 29.83% return over the past year, reaffirming its position as a dependable performer among PSUs. With rising geopolitical tensions and India’s focused push on indigenised defence manufacturing, Bharat Electronics Ltd has witnessed a strong breakout, touching a new 52-week high of ₹407.50. This analysis delves into the stock’s current technical setup, valuation insights, and what lies ahead for long-term investors and short-term traders alike.

📊 Overview:

- Current Price (as of June 20, 2025): ₹404.95

- 1-Year Return: +29.83% — Strong annual gain, outperforming many PSU and defence peers.

- 52-Week Range: ₹240.25 (Low) – ₹407.50 (High, just touched).

- Market Cap: ₹2.96 Lakh Cr — large-cap company.

- P/E Ratio: 55.62 — indicates growth optimism.

- Dividend Yield: Not listed — reinvestment-focused or capital gains-oriented.

📈 Price Action & Technical Analysis of Bharat Electronics Ltd:

🔺 Trend Overview:

- The stock was range-bound between ₹260 and ₹310 for most of the year.

- A strong breakout occurred from March 2025 onwards, leading to new highs.

- Recent momentum suggests renewed institutional buying or positive sectoral triggers.

🔍 Support Zones:

- ₹350–₹360: New support after the breakout.

- ₹300: Strong historical support and previous resistance.

- ₹240–₹260: Long-term base and 52-week low.

📍 Resistance Zone:

- ₹407.50: Fresh 52-week high — may witness some consolidation or profit booking around this level.

- No major resistance beyond this due to uncharted territory.

🧠 Fundamental & Strategic Insights:

- Bharat Electronics Ltd is a key defence PSU, benefiting from India’s push for defence indigenisation.

- Focus on radar systems, electronic warfare, and AI-based military tech is aligned with current geopolitical needs.

- Backed by strong government contracts and R&D spending, offering consistent long-term potential.

🧾 Investment Recommendation:

| Investor Type | Suggestion |

|---|---|

| Short-Term Traders | Wait for a pullback or consolidation around ₹380–₹390 before re-entering. Momentum remains strong but may cool briefly. |

| Long-Term Investors | Attractive entry even at current levels with SIP or staggered approach; long-term fundamentals remain robust. |

| Cautious Investors | Accumulate on dips near ₹360–₹380 with a stop-loss at ₹340. |

⚠️ Risks to Watch:

- Valuation Risk: P/E of 55+ indicates the stock is priced for strong future earnings.

- PSU Volatility: Despite being stable, PSUs are still sensitive to policy and geopolitical changes.

- Sector Dependence: Heavy reliance on government defence budgets.

📌 Conclusion:

Bharat Electronics Ltd (BEL) is a technically and fundamentally strong stock, showing breakout strength and sectoral tailwinds. The recent rally may invite consolidation, but long-term prospects remain bright for investors betting on India’s defence modernization story.

BEL share price analysis, Bharat Electronics Ltd stock forecast, BEL breakout level, defence sector stocks, PSU shares India, BEL support and resistance, BEL technical chart 2025, NSE BEL stock trend.

This content is for informational purposes only and not investment advice. Stock trading involves risk. Always consult a SEBI-registered advisor before investing. Do not rely solely on this analysis.

Recent Posts

- SUN TV Family Feud Erupts: Dayanidhi Maran Accuses Brother Kalanithi of ₹3,500 Crore Share Fraud

- Iranian Missile Hits Israeli Hospital in Deadliest Day Yet as Israel-Iran Conflict Enters Day 7

- Inside India’s Largest Film Set: 38,000 Sq Ft of Horror, Grandeur & Prabhas Power in ‘The RajaSaab’

Discover more from

Subscribe to get the latest posts sent to your email.