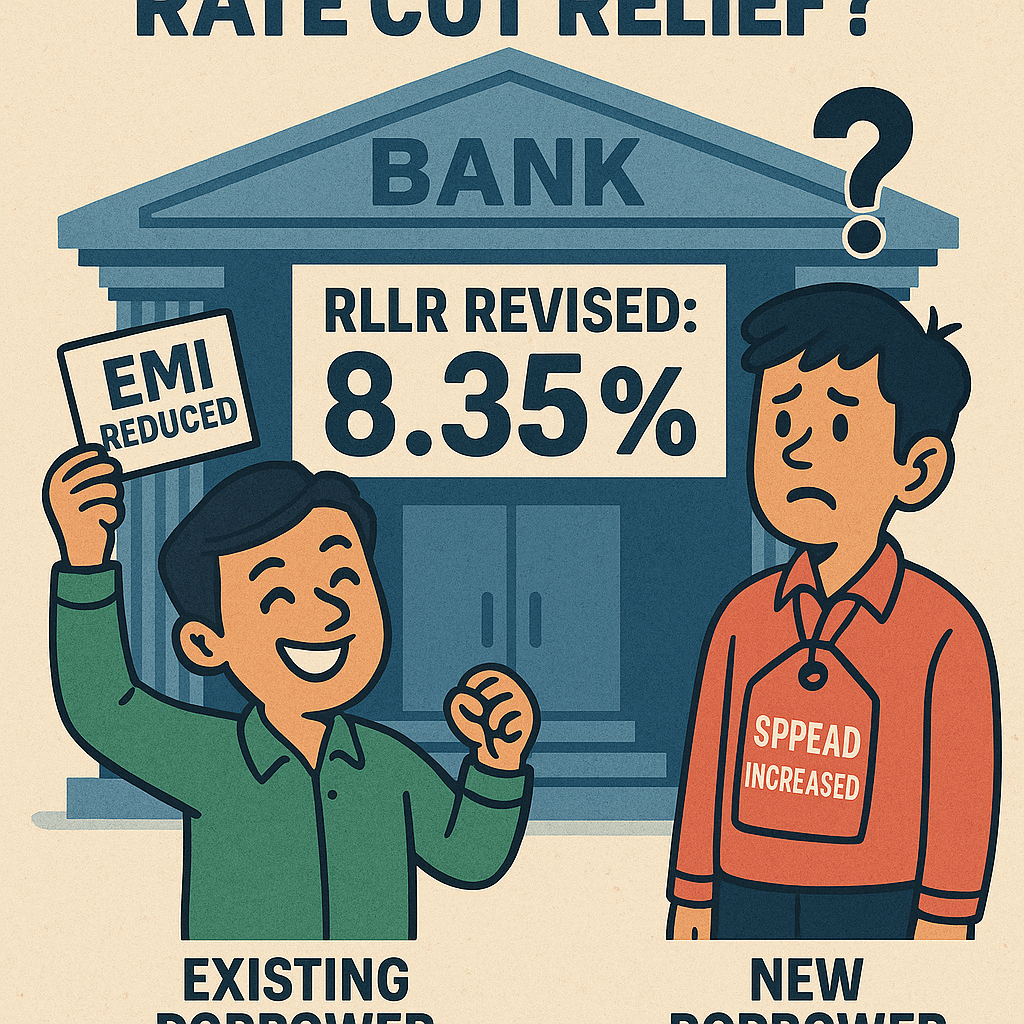

Bank Rate Cut Relief Hits Home: Existing Borrowers Gain as Banks Slash Lending Spreads

💸 Bank Rate Cut Relief Comes Faster for Existing Borrowers as Banks Adjust Lending Spreads

In a significant and borrower-friendly move for bank rate cut, major public sector banks (PSBs) have started slashing Repo-Linked Lending Rates (RLLR) immediately after the Reserve Bank of India (RBI) cut the repo rate, ensuring quicker relief for existing loan holders—a marked departure from past cycles.

🏦 Public Sector Banks Lead the Way to Bank Rate Cut

Bank of Baroda, Punjab National Bank, Bank of India, and UCO Bank have all reduced their RLLRs by 50 basis points, directly aligning with the recent RBI decision. These cuts benefit existing borrowers with floating-rate loans, which reset quarterly, making the transmission of monetary easing more efficient.

| Bank | Previous RLLR | New RLLR | Effective Date |

|---|---|---|---|

| Bank of Baroda | 8.65% | 8.15% | June 7 |

| Punjab National Bank | 8.85% | 8.35% | June 9 |

| Bank of India | 8.85% | 8.35% | June 6 |

| UCO Bank | 8.80% | 8.30% | [Date TBD] |

UCO Bank also announced a 10 bps cut in MCLR across tenors, balancing both RLLR and MCLR-linked customers.

🏛️ Private Banks Respond Cautiously to Bank Rate Cut

Private sector banks, traditionally more conservative in adjusting lending rates, are starting to follow suit—albeit cautiously:

- HDFC Bank: 10 bps MCLR cut across tenors from June 7

- Karur Vysya Bank: 10 bps cut in 6-month MCLR; 20 bps in 1-year MCLR

- ICICI Bank & Axis Bank: No rate cuts announced as of now

🔁 For Once, Existing Borrowers Reap First Benefits of Bank Rate Cut

This rate cycle is unique—unlike previous years when new borrowers gained first from reduced rates, this time existing borrowers are first in line, thanks to direct RLLR adjustments.

“Floating-rate loans linked to the repo now reset faster. And this time, the banks are cutting RLLR directly, without delay,” noted a senior banking analyst.

However, new borrowers may see higher loan costs, as banks are increasing the spread over repo rates to protect profit margins, limiting benefits for incoming customers.

💡 What’s the Difference: RLLR vs MCLR?

- RLLR (Repo-Linked Lending Rate): Moves directly with the RBI’s repo rate. More transparent and responsive.

- MCLR (Marginal Cost of Funds-Based Lending Rate): Adjusts more slowly, based on banks’ internal cost structures.

📈 The Takeaway

This shift signals a more borrower-centric lending environment, especially for those already locked into floating-rate loans. As India’s monetary policy turns accommodative, expect further adjustments, but spreads may continue to rise for new applicants.

#RateCut2025, #LoanRelief, #RLLRUpdate, #HDFCBank, #BankOfBaroda, #PNBRateCut, #MCLRvsRLLR, #FloatingRateLoan, #RepoRateTransmission, #BorrowerRelief2025

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS