🚀 Suzlon Share Price Surges Over 1,500% in 5 Years: Is the Wind Energy Giant a Smart Bet Now?

🌬️ Wind of Change: Suzlon’s Meteoric Rise

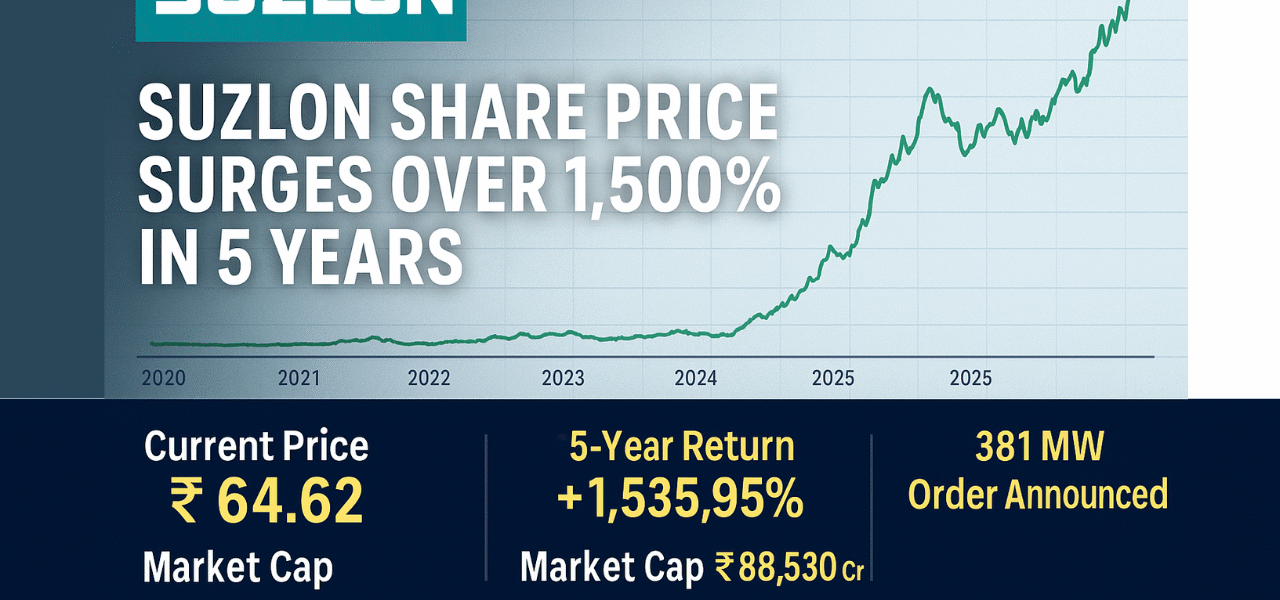

Suzlon Energy Ltd has been on a remarkable turnaround journey. From near bankruptcy in 2019 to being a multibagger by 2025, the company’s resilience is now catching investor attention. Its Suzlon share price has soared from around ₹4 five years ago to ₹64.62 today — a jaw-dropping 1,535% gain.

But what’s fueling this clean energy stock’s surge? The latest rally of 6.1% on August 1 came on the back of three major bullish triggers.

📈 Current Price: ₹64.62

📊 5-Year Return: +1,535.95%

💹 Market Cap: ₹88,530 Cr

📉 52-Week High/Low: ₹86.04 / ₹46.15

🧮 P/E Ratio: 42.79

📌 3 Key Catalysts Driving the Suzlon Share Price

1️⃣ Entry into the F&O Segment

Effective August 1, Suzlon shares are included in the Futures & Options (F&O) segment — a major milestone reflecting strong liquidity and investor confidence. This inclusion typically boosts trading volumes and attracts institutional interest.

2️⃣ Government Push for Local Manufacturing

The Indian government’s mandate on sourcing turbine components (blades, towers, gearboxes, generators, and bearings) from approved domestic manufacturers under ALMM (Approved List of Models & Manufacturers) significantly benefits Suzlon. This localisation is a game-changer for Indian wind energy players, improving margins and the demand pipeline.

3️⃣ Massive 381 MW Order from Zelestra

Suzlon recently bagged a 381 MW FDRE (Firm and Dispatch Renewable Energy) order from Zelestra India and its affiliates. The order includes 127 S144 turbines across:

- 🌀 Maharashtra – 180 MW

- 🌀 Madhya Pradesh – 180 MW

- 🌀 Tamil Nadu – 21 MW

This project is part of SJVN’s FDRE bid and supports both commercial and industrial sectors.

📉 5-Year Suzlon Share Price Chart Analysis

From mid-2022, Suzlon share price embarked on a steep upward trajectory, especially after clearing major debt and ramping up order execution. The recent peak of ₹86.04 in early 2025 shows bullish sentiment. While the stock has corrected slightly, it still maintains strong momentum above its 50- and 200-day moving averages.

Investor Insight: The current Suzlon share price of ₹64.62 shows healthy consolidation before another potential breakout.

Financial Reports & Presentations

📊 Valuation Snapshot

- P/E Ratio: 42.79 – slightly on the higher side, indicating future growth expectations.

- No dividend yield – suggests Suzlon is reinvesting profits for expansion.

- Market Cap: ₹88,530 crore – now a large-cap clean energy player.

⚠️ Risks to Watch

- High valuation can limit upside if earnings don’t meet expectations.

- Policy delays or volatility in global supply chains may impact turbine delivery.

- Global competition and tech adaptation costs could pressure margins.

🧠 Expert Take: Should You Buy Suzlon Shares?

✔️ BUY for Long-Term Investors

Suzlon’s turnaround story, favorable policy tailwinds, and large orders signal long-term growth. The inclusion in F&O and a strong project pipeline provide further support. For long-term ESG-conscious investors, Suzlon is a solid clean-energy play.

⚠️ However, wait for dips to accumulate and avoid chasing at peaks due to near-term volatility.

Suzlon Share Price Hits New 52-Week High: The Remarkable Surge of a Green Energy Giant

🔚 Conclusion

With India’s ambitious renewable targets and Suzlon’s strategic positioning, the stock could still have wind in its sails. But like any high-flying stock, disciplined investing with risk management is key.

#SuzlonSharePrice | #WindEnergy | #RenewableStocks | #StockMarketIndia | #CleanEnergyIndia | #Multibagger2025

SuzlonSharePrice, Suzlon Energy, Stock Market India, Renewable Energy, WindEnergy, CleanTech, InvestmentNews, Green Energy India, NSE Stocks, Make In India, Trading Alert, LongTerm Investing,

Discover more from

Subscribe to get the latest posts sent to your email.

2 COMMENTS