Lucrative PSU Stocks: Public Sector Undertakings in India Reap Rewards from Government Policies

Lucrative PSU Stocks: Public Sector Undertakings in India Benefit from Government Policies

Here’s an in-depth analysis of the remarkable ascent of Public Sector Undertaking (PSU) company stocks under the Modi administration’s policies. These strategic initiatives have profoundly influenced the stock market, leading to substantial gains for several Public Sector Undertakings in India. Let’s explore the specifics:

Introduction

The National Democratic Alliance (NDA), led by the Bharatiya Janata Party (BJP), has been at the helm of India’s governance for several years. During this period, Public Sector Undertakings in India have experienced remarkable growth, driven by favourable government policies and strategic initiatives. In this article, we explore the rise of PSU stocks, identify the top beneficiaries, and discuss their investment potential.

The Rise of PSU Stocks

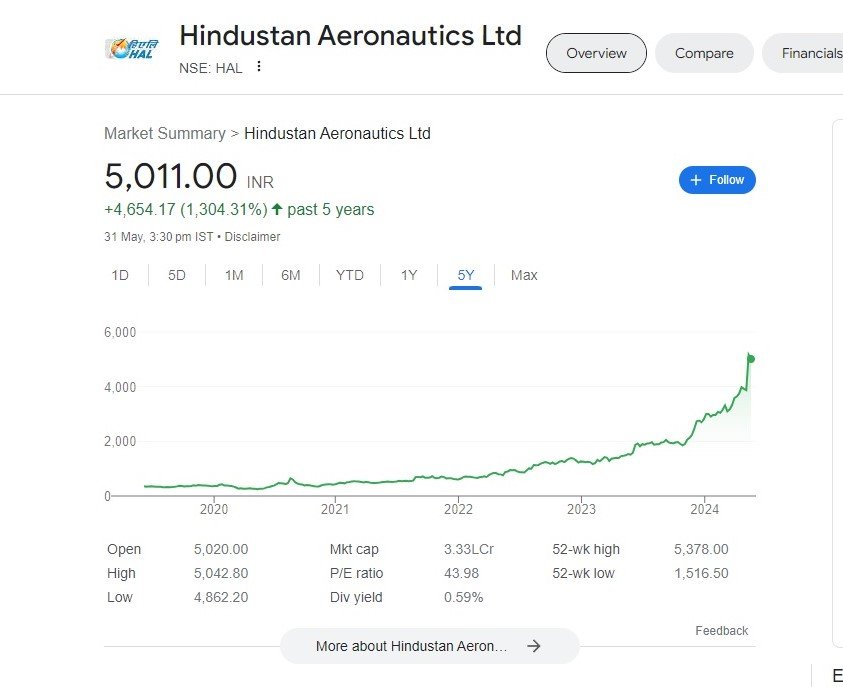

Over the past four years, the market capitalization (m-cap) of 52 BSE PSU index stocks has multiplied nearly fivefold. This impressive performance underscores the positive impact of government policies on Public Sector Undertakings in India. Let’s take a closer look at some of the standout performers:

Rail Vikas Nigam Ltd (RVNL): RVNL has delivered exceptional returns, with gains ranging from 1,000% to 2,150%. The company plays a crucial role in railway infrastructure development, benefiting from increased government spending on rail projects.

Hindustan Aeronautics Ltd (HAL): HAL, a key player in the defence sector, has seen substantial growth. The BJP government’s focus on national security and Indigenous defence production has boosted HAL’s prospects.

Cochin Shipyard Ltd: Cochin Shipyard, engaged in shipbuilding and repair, has also witnessed impressive returns. Government initiatives in the maritime sector have contributed to its success.

Hindustan Copper Ltd: As a major copper producer, Hindustan Copper has capitalized on rising metal prices and government support for domestic mining.

Indian Bank: Indian Bank’s stock price has surged, reflecting its strong financials and prudent management.

Investment Outlook of Public Sector Undertakings in India

Analysts believe that Public Sector Undertakings in India stocks should continue to deliver healthy returns if the NDA retains power in the ongoing elections. However, it’s essential to consider potential risks, such as an unexpected election outcome. A de-rating of PSU stocks could occur if the NDA fails to secure a majority.

Policy Impact on Public Sector Undertakings in India Stocks

The BJP government’s policies have directly influenced PSU companies. Notable examples include:

- Defence Sector: The government’s emphasis on defence modernization, increased defence spending, and support for indigenous production has benefited defence-related PSUs.

- Infrastructure and Railways: Investments in infrastructure projects and railway development have boosted companies like RVNL and Cochin Shipyard.

Conclusion

As the election results unfold, investors closely watch Public Sector Undertakings in India stocks. While the Modi government’s policies have been favourable, prudent investment decisions require assessing both opportunities and risks. Investors should consider diversifying their portfolios and conducting thorough research before investing in PSU stocks.

Remember, the stock market is dynamic, and past performance does not guarantee future gains. Consult with financial advisors and stay informed to make informed investment choices.

Disclaimer: This article provides general information and does not constitute financial advice. Always consult a professional before making investment decisions.

More Articles

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Ride into the Future with Royal Enfield’s Electrifying 2024 Lineup

Top 10 Inverter Air Conditioners in India: Unmatched Cooling and Energy Savings

Vladimir Putin AI Deepfake Film Makes Waves at Cannes, Sells Big

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Paytm News- in Turmoil: COO Bhavesh Gupta’s Resignation Adds to the Storm – Latest Updates

REC Share Price Skyrockets: Q4 FY’24 Net Profit Soars to New Heights!

Arvind Krishna: Architecting IBM’s Future and Leading Industry Transformation

GM Breweries Ltd: Brewing Success in Every Sip, A Closer Investment Opportunity

Resurgent Yes Bank Share Price: A Financial Phoenix’s Triumphant Ascent

ICICI Bank App Glitch: ICICI Bank Data Breach Exposes 17,000 Credit Card Holders

Discover more from

Subscribe to get the latest posts sent to your email.

9 COMMENTS