📊 Sensex Eyes 84,000 as IT and Pharma Stocks Fuel Market Momentum Despite Midweek Dip

📉 Midweek Pullback Fails to Dampen Bullish Sentiment

Mumbai, July 2, 2025 –

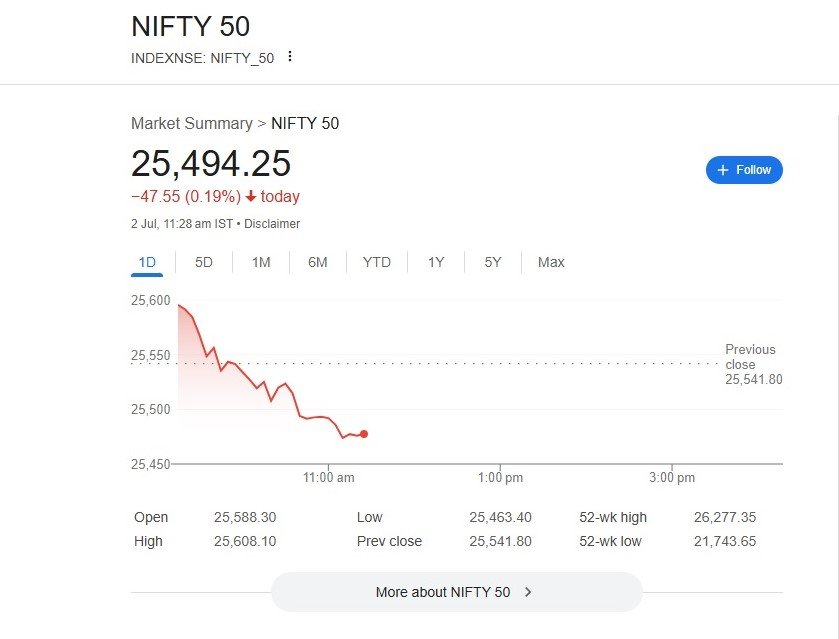

Indian equity benchmarks showed resilience on Wednesday despite a brief pullback in early trade. The BSE Sensex slipped by 200 points to trade at 83,540, while the NSE Nifty declined by 70 points, settling around 25,480.

Yet, investor sentiment stayed buoyant, with IT, metal, and pharma sectors leading the charge amid fluctuating global cues and institutional trade flows.

💻 Sectoral Highlights: Tech and Pharma Outperform

Among the top performers on the stock exchange, IT stocks were clear winners:

- Infosys, TCS, and Tech Mahindra each surged over 1%

- The NSE IT Index jumped 1.54%, underlining increased tech investor interest

- Pharma stocks like Cipla and Dr. Reddy’s posted modest gains

- Metal counters held firm, while FMCG and PSU banks lagged

Notable laggards included HDFC, Bajaj Fin serv, and Eternal (Zomato).

🌍 Global Cues: Asia Mixed, Wall Street Uncertain

Global indices showed no unified direction:

Asian Markets:

- 🇯🇵 Nikkei: ↓ 0.98% at 39,594

- 🇰🇷 Kospi: ↑ 1.17% at 3,053

- 🇭🇰 Hang Seng: ↑ 0.63%

- 🇨🇳 Shanghai Composite: ↓ 0.058%

U.S. Indices on July 1:

- 📈 Dow Jones: ↑ 0.91% at 44,495

- 📉 Nasdaq Composite: ↓ 0.82% at 20,203

- ⚖️ S&P 500: ↓ 0.11% at 6,198

💸 FIIs Sell, But DIIs Absorb Pressure

Institutional trade data from July 1 shows contrasting moves:

- FIIs (Foreign Institutional Investors): Net sellers worth ₹1,970.14 crore

- DIIs (Domestic Institutional Investors): Net buyers of ₹771.08 crore

June Summary:

- FIIs: Net buyers of ₹7,488.98 crore

- DIIs: Massive net purchases worth ₹72,673.91 crore

May Recap:

- FIIs: ₹11,773.25 crore

- DIIs: ₹67,642.34 crore

📅 Tuesday Market Recap

On July 1, the Sensex closed 91 points higher at 83,697, and Nifty rose 25 points to 25,542.

Top gainers:

- BEL, Reliance, UltraTech Cement, and Asian Paints (↑ 2.5%+)

Top losers:

- Trent, Tech Mahindra, Axis Bank, Eternal

The NSE Media Index dropped 1.31%, while metal, pharma, and PSU banks attracted buying interest.

🔮 Outlook: What’s Next for both stock exchanges?

Market experts maintain a bullish outlook, citing:

- Strong domestic liquidity

- Resilient corporate earnings

- Reduced global geopolitical tension

As the Sensex inches closer to 84,000, all eyes are now on Q2 earnings reports, upcoming inflation data, and the RBI’s monetary policy stance.

Sensex Soars 660 Points, Nifty Nears 25,000 as Bulls Return Across All Sectors; India VIX Sinks 6%

Sensex Soars 600 Points, Nifty Nears 25,000 on Global Optimism and India-US Trade Buzz

Sensex Soars 1,000 Points: Key Drivers and Future Outlook

Discover more from

Subscribe to get the latest posts sent to your email.