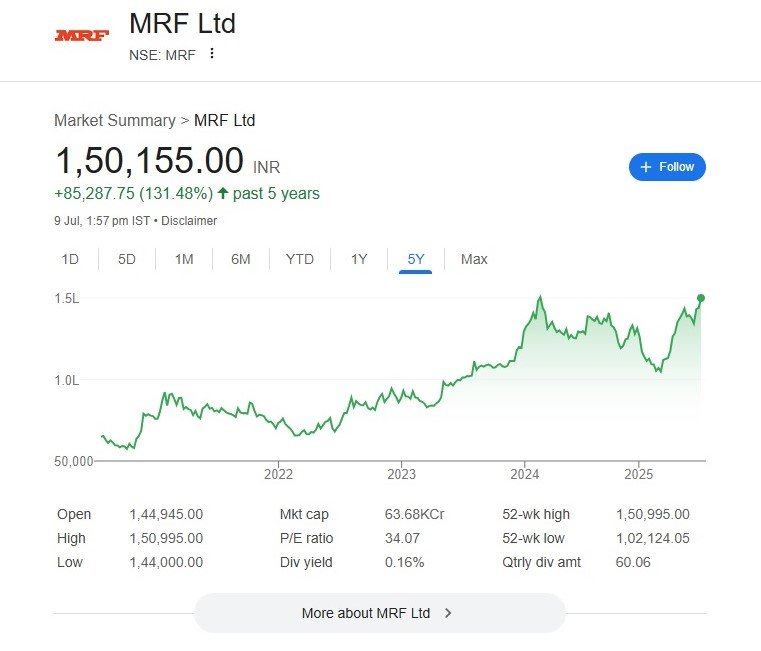

MRF Share Price Hits ₹1.5 Lakh: Is There More Fuel in the Tank?

📈 MRF Ltd, India’s most expensive stock by share price, continues to command attention with its strong performance on Dalal Street. On July 9, 2025, MRF shares closed at ₹1,50,155, marking a staggering 131.48% gain over the last 5 years.

With a legacy of manufacturing excellence, trusted brand equity, and a consistently strong balance sheet, MRF is once again in the spotlight — but is it still a good buy?

🔍 MRF Share Price 5-Year Performance at a Glance

- Current MRF Share Price (July 9, 2025): ₹1,50,155

- 5-Year Gain: +₹85,287.75 (+131.48%)

- 52-Week High / Low: ₹1,50,995 / ₹1,02,124

- Market Cap: ₹63,680 Crore

- P/E Ratio: 34.07

- Dividend Yield: 0.16%

- Quarterly Dividend (Latest): ₹60.06

MRF Share Price’s long-term growth trajectory has been powered by strong fundamentals, disciplined management, and a near-legendary reputation for quality. The tire giant’s share price, which was just above ₹64,000 five years ago, has steadily risen to breach the ₹1.5 lakh mark — reaffirming its blue-chip status.

📊 Technical Analysis: Where Does MRF Stand Now?

- The MRF Share Price 5-year chart shows periods of steady consolidation followed by breakouts, especially post-2023.

- After a short-term correction in early 2024, MRF saw renewed buying interest, pushing the stock to new highs in mid-2025.

- Support Levels: ₹1,35,000

- Resistance Zone: ₹1,51,000 – ₹1,55,000

If it sustains above ₹1.51 lakh, MRF could enter a new bullish phase, with potential targets in the ₹1.60 lakh range. However, valuations remain on the higher side.

🚗 What’s Driving MRF Share Price’s Growth?

- Auto Sector Recovery:

The uptick in passenger and commercial vehicle sales has driven OEM demand for tires. MRF, with its dominant position, is a key beneficiary. - Rural Demand Revival:

MRF has a strong rural footprint. With improving monsoons and farm sentiment, demand for tractor and two-wheeler tires has improved. - Premiumization of Portfolio:

MRF continues to focus on premium radial tires and high-margin segments, boosting profitability. - Capex & R&D Investments:

Ongoing investments in new technology and capacity expansion have kept the brand ahead of competitors.

🧮 Valuation View

With a P/E ratio of 34.07, MRF is trading at a premium compared to peers like Apollo Tyres and CEAT. However, given its strong brand moat and stable financials, long-term investors still see it as a solid defensive bet.

🔁 Buy, Hold, or Wait?

| Investor Type | Suggested Action |

|---|---|

| Long-Term Investors | ✅ Hold – Quality stock with leadership |

| Value Investors | ⚠️ Wait for Dip – High valuations |

| Swing Traders | 🔁 Watch ₹1.51L breakout or ₹1.35L support |

📝 Conclusion

MRF Ltd continues to be the benchmark for stability and long-term wealth creation in India’s stock market. While valuations are lofty, its leadership in the tire industry, consistent dividend payout, and brand strength make it an enduring asset in any long-term portfolio.

That said, new entrants may wait for better entry points, especially if broader markets correct or earnings growth slows.

MRF share price, MRF stock analysis, MRF tyre share, MRF price target, auto stocks India, tyre industry stocks, top Indian blue-chip stocks

Recent Posts

- BSE Shares -BSE, Angel One, CDSL Shares Rebound After SEBI Quells Leverage Link Fears

- Special Ops Season 2 Release Delayed to July 18: Kay Kay Menon Returns to Battle Cyber Terrorism

- Dassault Rafale Breaks Silence on Rafale jet Rumors After Operation Sindoor Controversy

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS