JSW Cement Share Price Falls After Muted Stock Market Debut: Should You Buy, Sell, or Hold?

📈 JSW Cement’s highly anticipated IPO has stirred mixed reactions in the market. Despite being oversubscribed 7.7 times, the JSW Cement Share Price saw only a muted debut, listing at ₹153.50 — just 4% above the issue price — before slipping back. Investors are now questioning whether the cement major’s long-term expansion plans will outweigh the short-term volatility. Our analysis dives into the listing performance, opinions, financial outlook, and investor strategies to help you decide whether to buy, hold, or wait on JSW Cement.

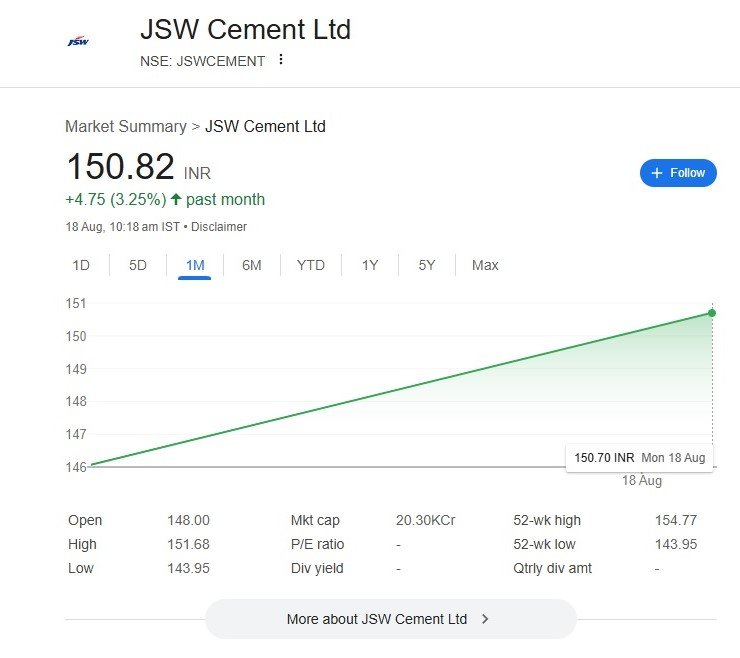

📊 Current JSW Cement Share Price Snapshot (as of Aug 18, 2025):

- Price: ₹150.82 (+3.25% in the past month)

- 52-week High: ₹154.77

- 52-week Low: ₹143.95

- Market Cap: ₹20,300 Cr+

- IPO Price Band: ₹139 – ₹147

- Listing Price (NSE): ₹153.50 (+4.4% from issue price)

📉 Market Debut: A Flat Start Despite Oversubscription

JSW Cement Ltd, a subsidiary of the JSW Group, entered the stock market with much anticipation after its IPO was oversubscribed 7.77 times. However, the JSW Cement Share Price saw a muted debut, opening at ₹153.50 on NSE and ₹153 on BSE, just about 4% above the issue price.

The JSW Cement Share Price touched a high of ₹154.70 on the listing day but later fell over 3%, erasing most listing gains and settling near ₹150–151.

📌 Opinions

- Market Analysts believe that the JSW Cement Share Price is “somewhat stagnant.” For short-term investors expecting quick gains, this may be disappointing. The analyst suggests a stop-loss strategy at ₹145 to protect capital.

- The company, being among India’s top 10 cement producers, has expansion plans to double its capacity. However, inconsistent revenue growth and elevated valuation mean investors should expect volatility. Another view of analysis recommends:

- Stop-loss at ₹138 for listing gain seekers.

- Hold for medium-to-long term if betting on growth.

⚙️ Company Fundamentals

JSW Cement is in an expansion phase:

- Fresh issue: ₹1,600 Cr + OFS worth ₹2,000 Cr.

- Funds allocation:

- ₹800 Cr for a new integrated facility in Nagaur, Rajasthan.

- ₹520 Cr for debt repayment.

- Balance for corporate purposes.

While this indicates growth momentum, the financial performance remains uneven. Revenue and PAT have been volatile over the past three years, which raises concerns about sustainability in earnings.

📊 JSW Cement Share Price Analysis & Trend

From the chart (past 1 month):

- Steady upward climb from ₹146 → ₹150.82.

- Resistance near ₹154.77 (52-week high).

- Strong support zone: ₹145–₹147.

This suggests the stock is consolidating in a narrow band, with short-term traders needing caution.

🚦 Investment Outlook: Buy, Sell, or Hold?

✅ Short-Term Investors:

- Gains from listing were minimal. The stock may remain sideways. Keep a stop-loss at ₹145, and avoid fresh entries until stability is seen.

✅ Medium-to-Long-Term Investors:

- With expansion plans, debt reduction, and industry growth (cement demand linked to infra push), JSW Cement has potential.

- However, financial inconsistency and high valuation pose risks. A cautious hold strategy is advisable for those already invested.

✅ New Investors:

- Best to wait for better entry levels or until consistent financial growth is reported.

📌 Conclusion

The JSW Cement share price reflects a mixed story—muted debut despite oversubscription, ambitious expansion plans, but inconsistent earnings. Investors should weigh short-term volatility against long-term growth prospects.

👉 Final Take:

- Traders: Strict stop-loss.

- Long-term Investors: Hold.

- New Investors: Wait & watch.

📢 Disclaimer: The views, opinions, and recommendations mentioned are based on publicly available information and inputs from market experts. They do not represent the views of News 24 Media. Investors are advised to consult a certified financial advisor before making investment decisions.

Muthoot Finance Share Analysis: A Golden Rally Backed by Solid Fundamentals

Discover more from

Subscribe to get the latest posts sent to your email.

2 COMMENTS