🚀 Eternal Share Price Soars to Record High Despite Profit Slump – Should You Buy or Hold?

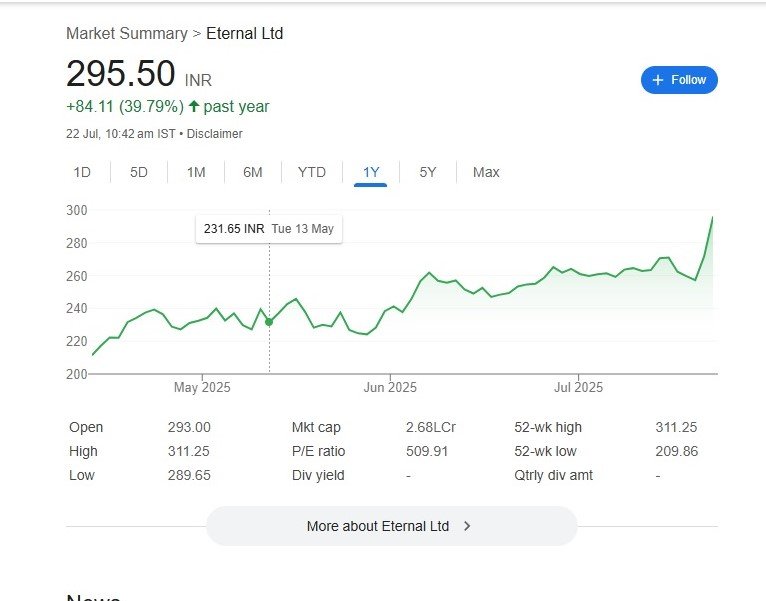

Eternal Ltd (Eternal Share price), formerly known as Zomato, has made a significant impact on the market. As of July 22, 2025, its share price surged to ₹295.50, reflecting a 39.79% increase over the past year. With a 52-week high of ₹311.25 and strong investor interest, the stock is now grabbing attention not just for its performance, but for what lies beneath the numbers.

📈 Eternal Share Performance Snapshot

- Current Price: ₹295.50

- 1-Year Gain: +39.79% (₹84.11)

- 52-Week High/Low: ₹311.25 / ₹209.86

- P/E Ratio: 509.91

- Market Cap: ₹2.68 Lakh Crore

The chart reflects a sharp upward momentum since mid-May, aligning with bullish sentiment around its growing quick commerce segment—Blinkit.

🧾 Eternal Share Q1 FY26 Results: Revenue Up, Profit Down

Despite posting a 90% YoY drop in net profit to ₹25 crore (down from ₹253 crore last year), Eternal managed to boost investor optimism. How?

- Revenue: ₹7,167 crore (+70% YoY)

- Blinkit Revenue: ₹2,400 crore

- Food Delivery Revenue: ₹2,261 crore

- EBITDA: ₹115 crore (↓35% YoY)

The secret sauce lies in Blinkit. For the first time, Blinkit’s Net Order Value (NOV) surpassed that of Zomato’s food delivery vertical, signalling a tectonic shift in consumer behaviour and business focus.

💬 What Management Is Saying

“Our B2C operations have now reached nearly $10 billion in annualised NOV, with quick commerce accounting for nearly half of it,”

– Akshant Goyal, CFO, Eternal Ltd

Out now – our Q1FY26 Report: https://t.co/xSHGbtK0Hj

— Deepinder Goyal (@deepigoyal) July 21, 2025

Quick snapshots:#Performance

Consolidated Adjusted Revenue grew 67% YoY (22% QoQ) to INR 7,563 crore.#NetOrderValue

NOV of our B2C businesses (@zomato, @letsblinkit, @lifeindistrict) grew 55% YoY (16% QoQ) to INR 20,183… pic.twitter.com/C9DZafNbFZ

This optimistic outlook on Blinkit’s future—despite current losses—has re-energised market sentiment.

📊 Brokerages React: Mixed But Mostly Bullish

✅ Bullish Calls

- Jefferies: Buy, Target ₹400

- CLSA: High-conviction Outperform, Target ₹385

- Bernstein: Outperform, Target ₹320

These firms highlight Blinkit’s explosive growth, improved margins, and easing competitive pressure as key strengths.

❌ Bearish Note

- Macquarie: Underperform, Target ₹150

- Cites lag in food delivery growth

- Concerns over prolonged loss cycle despite Blinkit surge

💡 Eternal Share Price Outlook: Should You Buy, Sell, or Hold?

✅ Buy/Hold If You:

- Believe in long-term growth of quick commerce

- Trust the management’s shift toward high-growth segments

- Can absorb short-term volatility and high valuation (P/E ~510)

⚠️ Caution If You:

- Are seeking near-term profitability

- Worry about margin pressures in food delivery

- Prefer low-risk, dividend-paying stocks (no dividend declared)

📌 Final Take

While Eternal Ltd’s profit fell sharply, the story is not about the past—but about the future of Blinkit and quick commerce. The stock’s 40% annual surge reflects high investor conviction in its transition from food delivery to a broader B2C retail play.

Despite elevated valuation metrics and short-term risks, Eternal Share Price appears to be riding a new growth curve that could reward long-term believers.

Eternal Share Price, Blinkit Growth, Zomato IPO, Quick Commerce India, Best Indian Tech Stocks 2025, Stock Market News, Zomato vs Blinkit, IPO Listing News

CEO of Zomato and His Wife Grecia Munoz Surprise Everyone: From the Boardroom to the Door

Deepinder Goyal’s LAT Aerospace Set to Disrupt Regional Aviation in India

Discover more from

Subscribe to get the latest posts sent to your email.

2 COMMENTS