Titan Company Ltd, one of the flagship consumer businesses of the Tata Group, has long been an investor favourite, especially for those seeking exposure to India’s booming retail and luxury segments. However, the recent 5% fall in Titan share price following a Q1 FY26 update that missed street expectations has left investors re-evaluating their positions. Is this a temporary blip or the start of a prolonged slowdown?

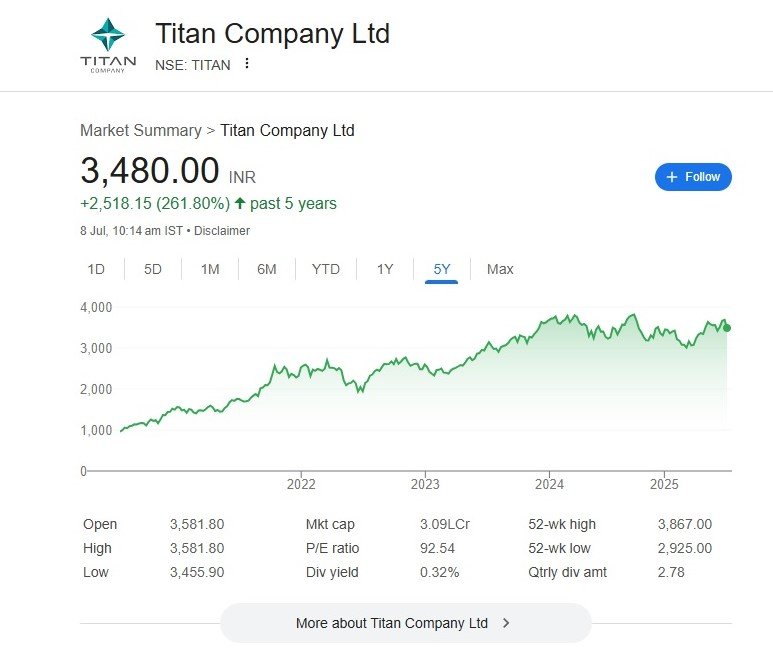

Titan share price 5-Year Performance Overview

- Current Titan share price (July 8, 2025): ₹3,480.00

- 5-Year Return: +261.80%

- 52-Week High/Low: ₹3,867 / ₹2,925

- Market Cap: ₹3.09 Lakh Cr

- P/E Ratio: 92.54 (indicative of rich valuations)

- Dividend Yield: 0.32%

Over the past five years, Titan share price has been on a remarkable uptrend, rising from just under ₹1,000 to nearly ₹4,000. The stock has delivered a whopping 261.8% return in that period, riding on India’s consumption boom and its own expanding retail footprint.

Titan share price Q1 FY26 Update: Key Takeaways

- Overall Consumer Business Growth: 20% YoY

- Jewellery Segment (Tanishq, Mia, Zoya): 18% growth (vs ~25% trend)

- Watches Business: 23% growth

- CaratLane: 38% growth

- Domestic Business Growth: 19% YoY

- International Business: 49% YoY growth

- Store Network: 3,322 total stores (3,291 domestic + 31 international)

Why Did Titan Share price Fall? The 5% drop in share price can be attributed to the following factors:

- Jewellery Growth Miss: The segment that contributes the lion’s share to Titan’s revenue saw just 17-18% growth, much below the 25% average investors had come to expect.

- Volatility in Gold Prices: High gold prices during May-June softened consumer sentiment, especially for high-margin studded jewellery, which saw weaker demand.

- Flat Buyer Growth: Despite store additions, footfalls remained weak, as noted by brokerages.

- Margin Pressures: While topline growth continues, margin compression in the jewellery segment is becoming a concern.

Technical Analysis The 5-year price chart reflects a strong uptrend but also hints at consolidation over the past 6-9 months.

- Support Levels: ₹3,350 (short-term), ₹3,000 (medium-term)

- Resistance Levels: ₹3,700-₹3,900 zone

- A breach below ₹3,350 may trigger further downside.

Should You Buy, Hold or Sell Titan Stock Now?

| Investor Type | Suggested Action |

|---|---|

| Long-Term Investors | Hold with a cautious eye on jewellery performance |

| Short-Term Traders | Wait for confirmation of support at ₹3,350 |

| New Investors | Accumulate gradually on dips below ₹3,300 |

Conclusion: Titan remains a jewel in the Tata Group crown, but its lofty valuations and slowing jewellery growth demand investor caution. With high base effects likely to moderate headline growth and macro pressures like gold price volatility at play, Titan could be headed for a period of range-bound performance.

Trent Share Price Analysis 2025: Is the Tata Retail Giant Losing Its Shine?

Disclaimer: This article is for educational purposes only and not financial advice. Please consult a registered investment advisor before making any investment decisions.

Titan share price, Titan Q1 FY26 results, Titan stock analysis, Tata group stocks, jewellery sector slowdown

Recent Posts

- Capgemini Acquires WNS for $3.3 Billion to Accelerate AI-Powered Intelligent Operations

- UAE Launches Nomination-Based Golden Visa UAE: A Revolutionary Pathway to Gulf Residency

Discover more from

Subscribe to get the latest posts sent to your email.

1 COMMENTS