Glenmark Share Price Surges on AbbVie Mega Deal: Is This the Pharma Rerating India Was Waiting For?

📈 Glenmark Share Price Surges on AbbVie Mega Deal: Is This the Pharma Rerating India Was Waiting For?

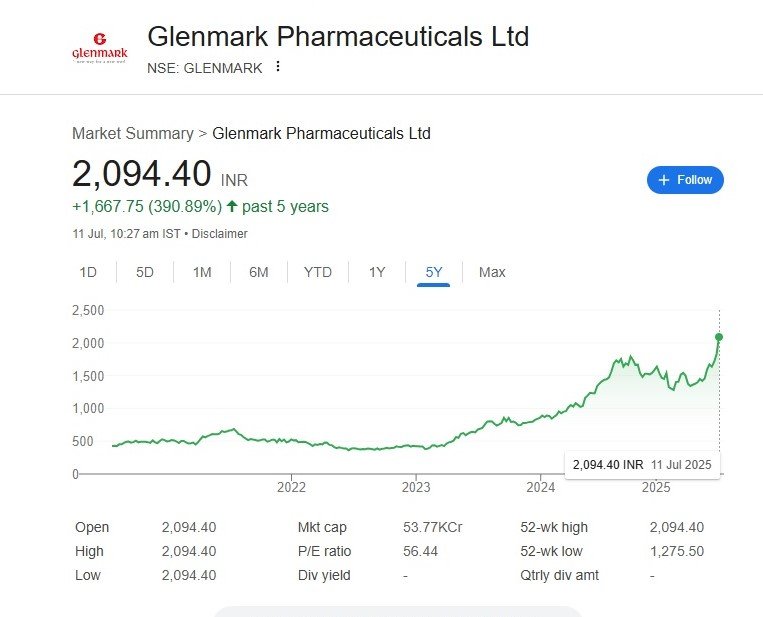

Glenmark Share Price (as of July 11, 2025): ₹2,094.40

- 5-Year Gain: ₹+1,667.75 (+390.89%)

- 52-Week High/Low: ₹2,094.40 / ₹1,275.50

- Market Cap: ₹53.77K Cr

- P/E Ratio: 56.44

- Dividend Yield: Not applicable

🔍 Glenmark Share Price 5-Year Performance Analysis

Over the last five years, Glenmark Pharmaceuticals Ltd has seen a nearly 4x return, growing steadily from ~₹425 in 2020 to above ₹2,090 in July 2025. The stock remained range-bound until mid-2023 but started its aggressive rally in late 2023 as its R&D bets gained visibility and export growth picked up.

This upward trend has now culminated in a parabolic spike post the announcement of the $2 billion licensing deal with AbbVie, validating years of research investment and positioning Glenmark as a serious contender in global pharmaceutical innovation.

💊 The AbbVie Deal: A $2 Billion Pharma Re-Rating Catalyst

On July 10, 2025, Glenmark’s Swiss innovation arm, IGI Therapeutics SA, signed a landmark global licensing agreement with American biopharma giant AbbVie for its Phase 1 asset ISB 2001.

💰 Deal Highlights:

- Upfront Payment: $700 million (~₹6,000 crore)

- Milestone Payouts: Up to $1.2 billion

- Royalty: Tiered double-digit percentages on global sales

This is India’s biggest licensing deal for a molecule still in Phase 1, making it a global benchmark.

📊 What It Means:

- Glenmark’s current consolidated EBITDA is ~₹4,000 crore.

- If ISB 2001 succeeds, annual royalties could top $500 million, exceeding Glenmark’s present EBITDA.

- The implied peak global sales for the drug: $5–6 billion, per Systematix analyst Vishal Manchanda.

📉 Why This Is a Game-Changer for Glenmark

- Balance Sheet Strengthening: A large upfront payment bolsters reserves and significantly reduces debt pressure.

- Innovation Re-Rating: Glenmark is no longer just a generic pharma exporter — it’s now in the biotech big league.

- Investor Confidence Surge: The re-rating is reflected in the surge of the Glenmark share price to lifetime highs.

- Strategic Focus Shift: The company may prioritise R&D-led growth over volume-based generics going forward.

📈 Technical & Investment Outlook

Support & Resistance

- Immediate Support: ₹1,800–₹1,850

- Resistance Zone: ₹2,100–₹2,200

- Sustained closing above ₹2,100 could open the path toward ₹2,500 in the medium term.

Valuation Watch

- P/E at 56.44 implies high forward expectations.

- A significant part of the deal value is future-linked, so execution risk remains.

- Investors should track:

- Progress of ISB 2001 through clinical trials

- Use of upfront capital for debt reduction and R&D

- EBITDA improvements over the next 6–12 months

📌 Verdict: Buy, Hold, or Wait?

| Investor Type | Action Suggestion |

|---|---|

| Long-term Holders | Hold or Add on dips — Glenmark’s new trajectory is biotech-led |

| New Investors | Accumulate gradually — valuations may remain high short-term |

| Short-term Traders | Book partial profits near ₹2,100; re-enter on support retests |

📢 Conclusion

The Glenmark-AbbVie deal is more than a licensing agreement — it’s a validation of India’s pharma innovation potential. While the Glenmark share price has reacted positively in the short term, the real test will be in execution, timely commercialisation, and managing regulatory hurdles. If successful, Glenmark could emerge as India’s next big global biopharma story.

Glenmark Share Price, Glenmark AbbVie Deal, Glenmark Pharmaceuticals Stock Analysis, Glenmark ISB 2001 Drug Licensing, Indian Pharma Innovation Stocks

Recent Posts

- Bharti Airtel Share Price Analysis: Dividend Boost, Tech Moves, and Future Growth Outlook

- Nvidia Becomes First Company to Hit $4 Trillion Valuation, Cementing AI Supremacy

- Happy Guru Purnima 2025: 100+ Wishes, Images, Quotes & Messages to Celebrate and Honour the Guiding Light in Your Life

Discover more from

Subscribe to get the latest posts sent to your email.