Paras Defence Share Price Analysis: Can This Defence-Tech Stock Soar Again or Is It Time to Book Profits?

Paras Defence Share Price Analysis

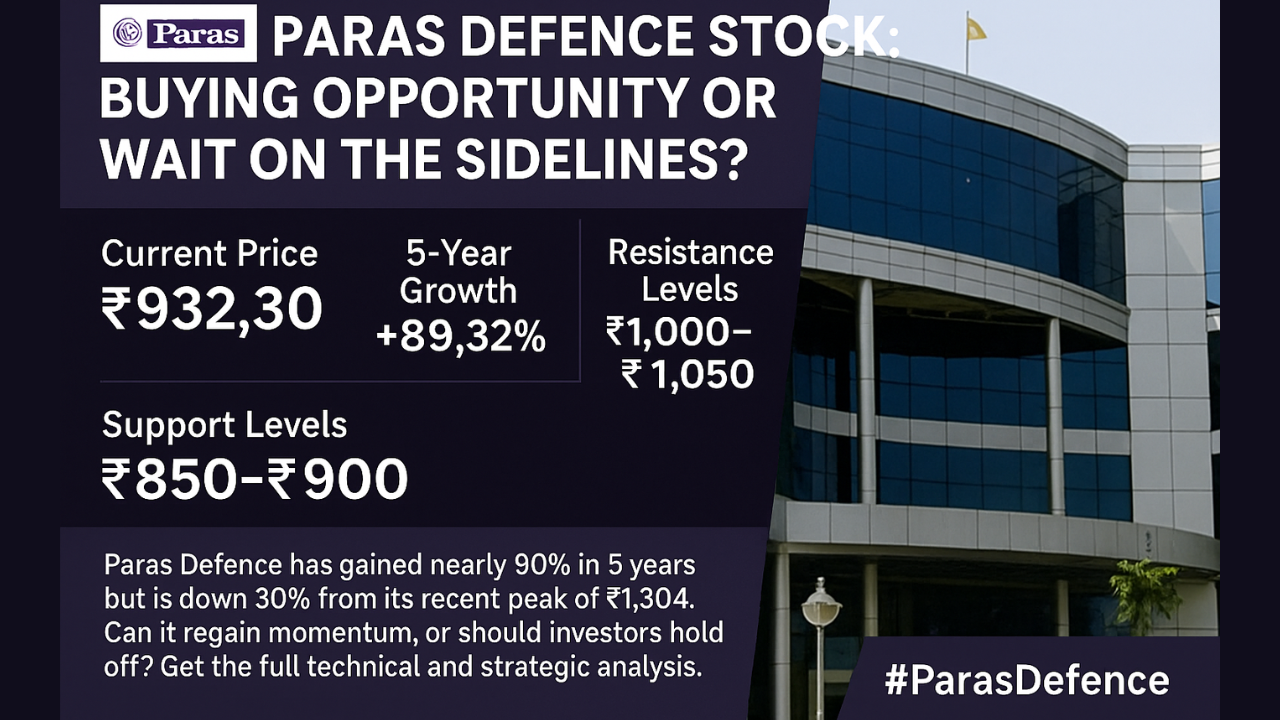

Introduction Paras Defence and Space Technologies Ltd (NSE: PARAS) has captured the attention of retail and institutional investors alike, thanks to its presence in India’s strategic defence and space sectors. With an 89.32% gain over the past five years, the stock has shown significant momentum. But recent volatility raises the question: Is it time to invest further or exercise caution?

Current Overview (as of July 4, 2025)

- Current Share Price: ₹932.30

- 5-Year Return: +89.32%

- 52-Week High/Low: ₹972.50 / ₹404.70

- Market Capitalisation: ₹3.76K Cr

- P/E Ratio: 58.20 (Indicates high valuation)

- Dividend Yield: Not available

Paras Defence share Price Trend & Technical Analysis (5-Year View)

1. Early Volatility (2021-2022): Soon after listing, the stock spiked above ₹1,000, driven by strong sentiment and buzz around India’s indigenisation push in defence. However, this was followed by a sharp correction.

2. Consolidation Phase (2022 to early 2024): For nearly two years, the share price remained in a narrow band of ₹500–₹600. This phase saw subdued investor interest due to a lack of earnings triggers or order wins.

3. Mid-2024 Breakout: The stock soared to an all-time high of ₹1,304.55 on July 26, 2024, likely due to:

- New defence contracts

- Announcements related to space missions or ISRO tie-ups

- Renewed investor interest in strategic sectors

4. Recent Correction and Recovery (Late 2024 – Mid 2025): After reaching its peak, the stock witnessed profit-booking and declined by over 30%. However, it has shown a recovery and is stabilising near the ₹900 mark.

Paras Defence share price Key Support and Resistance Levels

| Type | Price (INR) | Significance |

|---|---|---|

| Support | 850–900 | Current base support zone |

| Support | 700–750 | Historical consolidation range |

| Resistance | 1,000–1,050 | Near-term resistance zone |

| Resistance | 1,300+ | Long-term peak; psychological barrier |

Fundamental Analysis & Strategic Positioning

Strengths:

- Unique business model catering to defence and space technologies

- Strong alignment with Government of India initiatives (Make in India, Aatmanirbhar Bharat)

- Periodic boosts from government orders

Risks & Caution Points:

- The high P/E ratio of 58.20 makes the stock expensive

- Non-dividend paying stock; not attractive for income-seeking investors

- Volatile price behaviour; speculative movements

Investor Strategy Suggestions

| Investor Type | Suggestion |

| Short-Term Traders | Watch for breakout above ₹1,000 with volume confirmation |

| Long-Term Investors | Consider accumulating on dips near ₹850 if fundamentals remain strong |

| Conservative Investors | Stay cautious; high valuation and volatility suggest higher risk |

Conclusion Paras Defence and Space Technologies Ltd offers exciting growth potential in a strategic sector. However, its high valuation, erratic price swings, and dependence on government orders make it a high-risk bet. Investors should evaluate their risk tolerance and look for clearer technical confirmation before making fresh entries.

Paras Defence share price, Paras Defence stock analysis, Paras Defence NSE, defence stocks India, Paras Defence target price #ParasDefence #ParasDefenceSharePrice #NSEStocks #InvestSmart #DefenceSector #MakeInIndia #StockMarketNews #LongTermInvesting

Disclaimer: This article is for informational purposes only and should not be considered financial advice. Please consult a SEBI-registered investment advisor before making any investment decisions.

Discover more from

Subscribe to get the latest posts sent to your email.