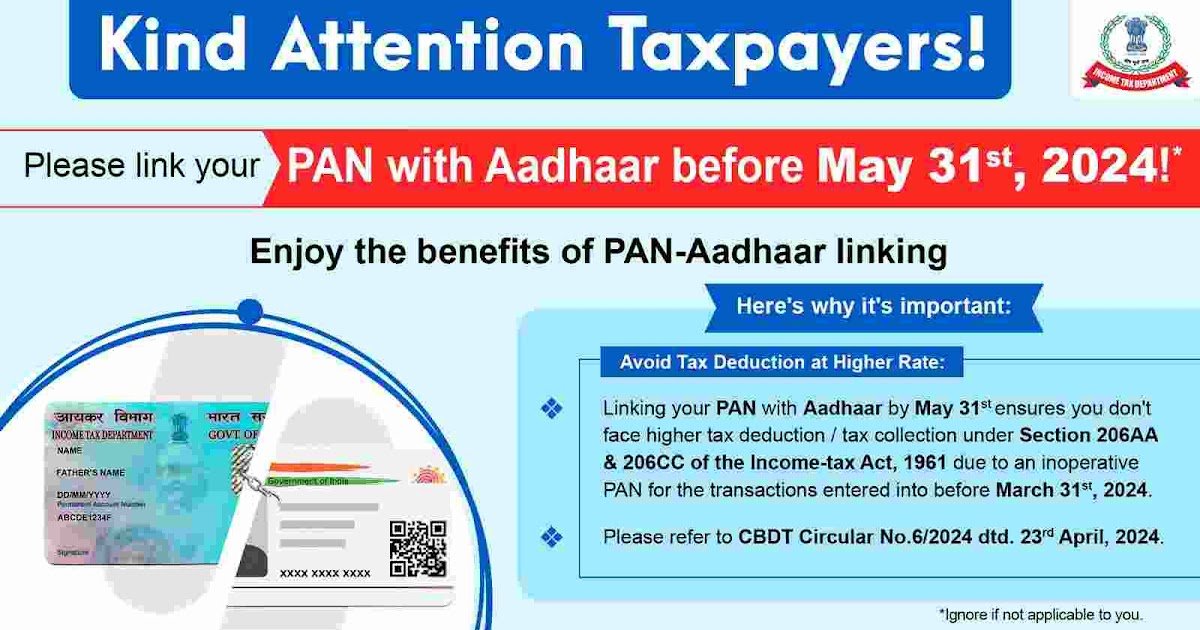

I-T Department Reminder: Link Your Permanent Account Number (PAN) with Aadhaar by May 31 to Avoid Higher TDS – Here’s How

I-T Dept Issues Reminder: Link Permanent Account Number with Aadhaar by May 31 to Avoid Higher TDS; Here’s How

Date: May 28, 2024

The Income Tax Department has issued a fresh reminder to taxpayers, urging them to link their Permanent Account Number (PAN) with Aadhaar by May 31, 2024. This move is crucial to avoid higher tax deductions at source (TDS) under Sections 206AA and 206CC of the Income Tax Act, 1961.

Why Is Linking a Permanent Account Number (PAN) with Aadhaar Important?

- Higher TDS Implications: Failure to link Permanent Account Number (PAN) with Aadhaar could significantly impact income tax return (ITR) filings. The last date to file ITR for the current financial year is July 31, 2024. If you don’t link your PAN and Aadhaar, you may face higher tax deductions.

- Section 206AA and 206CC: These sections mandate that if your PAN is not linked with Aadhaar, the tax deduction or collection at source will be at a higher rate. This can affect various financial transactions, including salary, interest income, and other payments.

How to Link Permanent Account Number (PAN) with Aadhaar?

Follow these steps to ensure a smooth linkage process:

- Online Method:

- Visit the Income Tax e-filing portal (www.incometaxindiaefiling.gov.in).

- Log in using your PAN and Aadhaar details.

- Look for the “Link Aadhaar” option.

- Enter the required information and submit the request.

- SMS Method:

- Send an SMS from your registered mobile number in the format: UIDPAN <12-digit Aadhaar> <10-character PAN> to 567678 or 56161.

- Visit PAN Service Centers or TIN Facilitation Centers:

- You can also visit these centres to link your PAN with Aadhaar in person.

Remember, linking your Permanent Account Number (PAN) with your Aadhaar by May 31 ensures that you don’t face higher tax deductions due to an inoperative Permanent Account Number (PAN) for transactions entered into before March 31, 2024.

Penalties for Non-Compliance:

- If you miss the deadline, you may face penalties and difficulties in filing your income tax returns.

- The Central Board of Direct Taxes (CBDT) has emphasized the importance of this linkage in Circular No. 6/2024, addressing issues faced by deductors/collectors due to inoperative PANs.

Don’t wait! Ensure timely compliance by linking your PAN with Aadhaar before the deadline. It’s a simple step that can save you from unnecessary hassles and higher TDS deductions.

Remember, timely action is essential to avoid any inconvenience. If you haven’t linked your PAN with Aadhaar yet, take the necessary steps now. 📝💡

For more details, you can refer to the official Income Tax Department website or consult a tax professional.

More Articles

Tata Steel Ltd Share Price: Forging Ahead with Dividends and Resilient Stock Performance

Ride into the Future with Royal Enfield’s Electrifying 2024 Lineup

Top 10 Inverter Air Conditioners in India: Unmatched Cooling and Energy Savings

Vladimir Putin AI Deepfake Film Makes Waves at Cannes, Sells Big

Air India’s New Cabin Baggage Rules: Essential Updates for Passengers

Spectacular Summer Amazon Sale: Unbeatable Discounts Await – Shop Now!

Paytm News- in Turmoil: COO Bhavesh Gupta’s Resignation Adds to the Storm – Latest Updates

REC Share Price Skyrockets: Q4 FY’24 Net Profit Soars to New Heights!

Arvind Krishna: Architecting IBM’s Future and Leading Industry Transformation

GM Breweries Ltd: Brewing Success in Every Sip, A Closer Investment Opportunity

Resurgent Yes Bank Share Price: A Financial Phoenix’s Triumphant Ascent

ICICI Bank App Glitch: ICICI Bank Data Breach Exposes 17,000 Credit Card Holders

Discover more from

Subscribe to get the latest posts sent to your email.